The Hartford 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

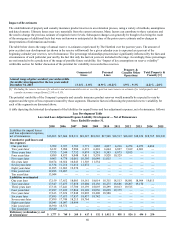

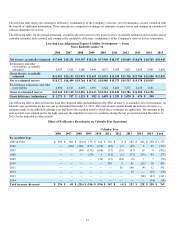

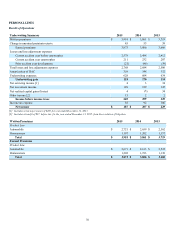

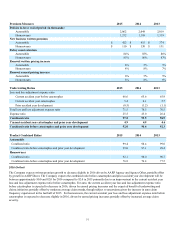

Valuation Allowance on Deferred Tax Assets

Deferred tax assets represent the tax benefit of future deductible temporary differences and tax carryforwards. Deferred tax assets are

measured using the enacted tax rates expected to be in effect when such benefits are realized if there is no change in tax law. Under U.S.

GAAP, we test the value of deferred tax assets for impairment on a quarterly basis at the entity level within each tax jurisdiction,

consistent with our filed tax returns. Deferred tax assets are reduced by a valuation allowance if, based on the weight of available

evidence, it is more likely than not that some portion, or all, of the deferred tax assets will not be realized. The determination of the

valuation allowance for our deferred tax assets requires management to make certain judgments and assumptions. In evaluating the

ability to recover deferred tax assets, we have considered all available evidence as of December 31, 2015, including past operating

results, forecasted earnings, future taxable income, and prudent and feasible tax planning strategies. In the event we determine it is more

likely than not that we will not be able to realize all or part of our deferred tax assets in the future, an increase to the valuation allowance

would be charged to earnings in the period such determination is made. Likewise, if it is later determined that it is more likely than not

that those deferred tax assets would be realized, the previously provided valuation allowance would be reversed. Our judgments and

assumptions are subject to change given the inherent uncertainty in predicting future performance and specific industry and investment

market conditions.

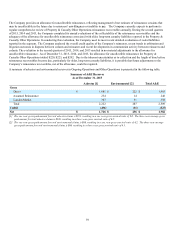

As of December 31, 2015 and 2014, the Company has recorded a deferred tax asset valuation allowance of $79 and $181, respectively,

relating primarily to U.S. capital loss carryovers. The reduction in the valuation allowance stems primarily from taxable gains on the

termination of derivatives during the period. In assessing the need for a valuation allowance, management considered future taxable

temporary difference reversals, future taxable income exclusive of reversing temporary differences and carryovers, taxable income in

open carry back years and other tax planning strategies. From time to time, tax planning strategies could include holding a portion of

debt securities with market value losses until recovery, altering the level of tax exempt securities held, making investments which have

specific tax characteristics, and business considerations such as asset-liability matching. Management views such tax planning strategies

as prudent and feasible and would implement them, if necessary, to realize the deferred tax assets.

Contingencies Relating to Corporate Litigation and Regulatory Matters

Management evaluates each contingent matter separately. A loss is recorded if probable and reasonably estimable. Management

establishes reserves for these contingencies at its “best estimate,” or, if no one number within the range of possible losses is more

probable than any other, the Company records an estimated reserve at the low end of the range of losses.

The Company has a quarterly monitoring process involving legal and accounting professionals. Legal personnel first identify

outstanding corporate litigation and regulatory matters posing a reasonable possibility of loss. These matters are then jointly reviewed by

accounting and legal personnel to evaluate the facts and changes since the last review in order to determine if a provision for loss should

be recorded or adjusted, the amount that should be recorded, and the appropriate disclosure. The outcomes of certain contingencies

currently being evaluated by the Company, which relate to corporate litigation and regulatory matters, are inherently difficult to predict,

and the reserves that have been established for the estimated settlement amounts are subject to significant changes. Management expects

that the ultimate liability, if any, with respect to such lawsuits, after consideration of provisions made for estimated losses, will not be

material to the consolidated financial condition of the Company. In view of the uncertainties regarding the outcome of these matters, as

well as the tax-deductibility of payments, it is possible that the ultimate cost to the Company of these matters could exceed the reserve

by an amount that would have a material adverse effect on the Company’s consolidated results of operations and liquidity in a particular

quarterly or annual period.