The Hartford 2015 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

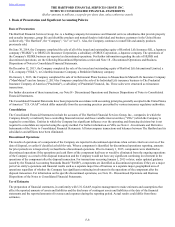

1. Basis of Presentation and Significant Accounting Policies (continued)

F-11

Investments

Overview

The Company’s investments in fixed maturities include bonds, structured securities, redeemable preferred stock and commercial paper.

Most of these investments, along with certain equity securities, which include common and non-redeemable preferred stocks, are

classified as available-for-sale ("AFS") and are carried at fair value. The after-tax difference between fair value and cost or amortized

cost is reflected in stockholders’ equity as a component of Accumulated Other Comprehensive Income (Loss) (“AOCI”), after

adjustments for the effect of deducting certain life and annuity deferred policy acquisition costs and reserve adjustments. Also included

in equity securities, AFS are certain equity securities for which the Company elected the fair value option. These equity securities are

carried at fair value with changes in value recorded in realized capital gains and losses on the Company's Consolidated Statements of

Operations. Fixed maturities for which the Company elected the fair value option are classified as FVO and are carried at fair value with

changes in value recorded in realized capital gains and losses. Policy loans are carried at outstanding balance. Mortgage loans are

recorded at the outstanding principal balance adjusted for amortization of premiums or discounts and net of valuation allowances. Short-

term investments are carried at amortized cost, which approximates fair value. Limited partnerships and other alternative investments are

reported at their carrying value and accounted for under the equity method with the Company’s share of earnings included in net

investment income. Recognition of income related to limited partnerships and other alternative investments is delayed due to the

availability of the related financial information, as private equity and other funds are generally on a three-month delay and hedge funds

on a one-month delay. Accordingly, income for the years ended December 31, 2015, 2014, and 2013 may not include the full impact of

current year changes in valuation of the underlying assets and liabilities of the funds, which are generally obtained from the limited

partnerships and other alternative investments’ general partners. In addition, for investments in a wholly-owned hedge fund of funds,

the Company recognizes changes in the fair value of the underlying funds in net investment income, which is consistent with accounting

requirements for investment companies. Other investments primarily consist of derivative instruments which are carried at fair value.

Net Realized Capital Gains and Losses

Net realized capital gains and losses from investment sales are reported as a component of revenues and are determined on a specific

identification basis. Net realized capital gains and losses also result from fair value changes in fixed maturities and equity securities

FVO, and derivatives contracts (both free-standing and embedded) that do not qualify, or are not designated, as a hedge for accounting

purposes, ineffectiveness on derivatives that qualify for hedge accounting treatment, and the change in value of derivatives in certain

fair-value hedge relationships and their associated hedged asset. Impairments and mortgage loan valuation allowances are recognized as

net realized capital losses in accordance with the Company’s impairment and mortgage loan valuation allowance policies as discussed in

Note 6 - Investments and Derivative Instruments of Notes to Consolidated Financial Statements. Foreign currency transaction

remeasurements are also included in net realized capital gains and losses.

Net Investment Income

Interest income from fixed maturities and mortgage loans is recognized when earned on the constant effective yield method based on

estimated timing of cash flows. The amortization of premium and accretion of discount for fixed maturities also takes into consideration

call and maturity dates that produce the lowest yield. For securitized financial assets subject to prepayment risk, yields are recalculated

and adjusted periodically to reflect historical and/or estimated future repayments using the retrospective method; however, if these

investments are impaired, any yield adjustments are made using the prospective method. Prepayment fees and make-whole payments on

fixed maturities and mortgage loans are recorded in net investment income when earned. For equity securities, dividends will be

recognized as investment income on the ex-dividend date. Limited partnerships and other alternative investments primarily use the

equity method of accounting to recognize the Company’s share of earnings; however, for a portion of those investments, the Company

uses investment fund accounting applied to a wholly-owned fund of funds. For impaired debt securities, the Company accretes the new

cost basis to the estimated future cash flows over the expected remaining life of the security by prospectively adjusting the security’s

yield, if necessary. The Company’s non-income producing investments were not material for the years ended December 31, 2015, 2014

and 2013.

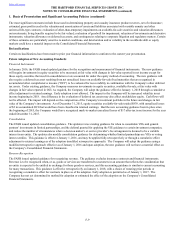

Derivative Instruments

Overview

The Company utilizes a variety of over-the-counter ("OTC") derivative investments, including transactions cleared through a central

clearing house ("OTC-cleared"), and exchange-traded derivative instruments as part of its overall risk management strategy. The types

of instruments may include swaps, caps, floors, forwards, futures and options to achieve one of four Company-approved objectives: to

hedge risk arising from interest rate, equity market, commodity market, credit spread and issuer default, price or currency exchange rate

risk or volatility; to manage liquidity; to control transaction costs; or to enter into synthetic replication transactions.