The Hartford 2015 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

11. Debt (continued)

F-71

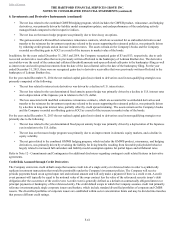

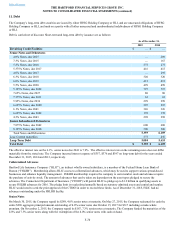

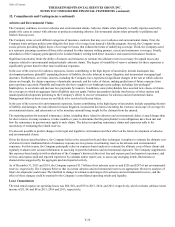

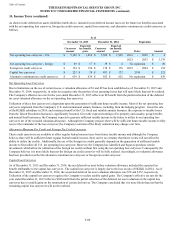

Junior Subordinated Debentures

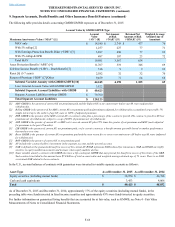

Issue Face

Value Interest Rate

[1] Call Date Interest Rate Subsequent

to Call Date [2] Final Maturity

7.875% Debentures $ 600 7.875% [2] April 15, 2022 3 Month LIBOR + 5.596% April 15, 2042

8.125% Debentures [3] $ 500 8.125% [4] June 15, 2018 3 Month LIBOR + 4.6025% June 15, 2068

[1] Interest rate in effect until call date.

[2] Payable quarterly in arrears.

[3] The 8.125% debentures have a scheduled maturity date of June 15, 2038. The Company is required to use reasonable efforts to sell certain

qualifying replacement securities in order to repay the debentures at the scheduled maturity date.

[4] Payable semi-annually in arrears.

The debentures are unsecured, subordinated and junior in right of payment and upon liquidation to all of the Company’s existing and

future senior indebtedness. In addition, the debentures are effectively subordinated to all of the Company’s subsidiaries’ existing and

future indebtedness and other liabilities, including obligations to policyholders. The debentures do not limit the Company’s or the

Company’s subsidiaries’ ability to incur additional debt, including debt that ranks senior in right of payment and upon liquidation to the

debentures.

The Company has the right to defer interest payments for up to ten consecutive years without giving rise to an event of default. Deferred

interest will continue to accrue and will accrue additional interest at the then applicable interest rate. If the Company defers interest

payments, the Company generally may not make payments on or redeem or purchase any shares of its capital stock or any of its debt

securities or guarantees that rank upon liquidation, dissolution or winding up equally with or junior to the debentures, subject to certain

limited exceptions. If the Company defers interest on the 8.125% debentures for five consecutive years or, if earlier, pays current interest

during a deferral period, the Company will be required to pay deferred interest from proceeds from the sale of certain qualifying

securities.

The 7.875% and 8.125% debentures may be redeemed in whole prior to the call date upon certain tax or rating agency events, at a price

equal to the greater of 100% of the principal amount being redeemed and the applicable make-whole amount plus any accrued and

unpaid interest. The Company may elect to redeem the 8.125% debentures in whole or part at its option prior to the call date at a price

equal to the greater of 100% of the principal amount being redeemed and the applicable make-whole amount plus any accrued and

unpaid interest. The Company may elect to redeem the 7.875% and 8.125% debentures in whole or in part on or after the call date for

the principal amount being redeemed plus accrued and unpaid interest to the date of redemption.

In connection with the offering of the 8.125% debentures, the Company entered into a replacement capital covenant ("RCC") for the

benefit of holders of one or more designated series of the Company's indebtedness, initially the Company’s 6.1% notes due 2041. Under

the terms of the RCC, if the Company redeems the 8.125% debentures at any time prior to June 15, 2048 it can only do so with the

proceeds from the sale of certain qualifying replacement securities.

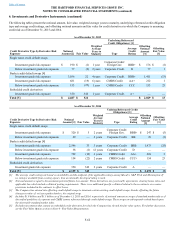

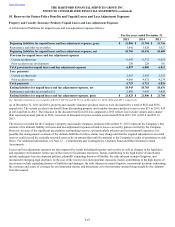

Long-Term Debt Maturities

Long-term debt maturities (at par values), as of December 31, 2015 are summarized as follows:

2016 $ 275

2017 416

2018 320

2019 413

2020 500

Thereafter 3,525

Shelf Registrations

On August 9, 2013, the Company filed with the Securities and Exchange Commission (the “SEC”) an automatic shelf registration

statement (Registration No. 333-190506) for the potential offering and sale of debt and equity securities. The registration statement

allows for the following types of securities to be offered: debt securities, junior subordinated debt securities, preferred stock, common

stock, depositary shares, warrants, stock purchase contracts, and stock purchase units. In that The Hartford is a well-known seasoned

issuer, as defined in Rule 405 under the Securities Act of 1933, the registration statement went effective immediately upon filing and The

Hartford may offer and sell an unlimited amount of securities under the registration statement during the three-year life of the

registration statement.