The Hartford 2015 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.126

Patient Protection and Affordable Care Act of 2010 (the "Affordable Care Act")

On March 23, 2010, the President signed the Affordable Care Act. While many of the key provisions of the Affordable Care Act have

become effective, there remains uncertainty with its implementation. Federal agencies continue rulemaking for certain provisions, along

with the law being subject to legal and legislative challenges. In addition, certain provisions of the Affordable Care Act have been

amended or delayed, such as the employer mandate which will continue to be phased in during 2016. The impact of the Affordable Care

Act to The Hartford as an employer is consistent with other large employers. The Hartford’s core business does not involve the issuance

of health insurance and we do not issue any products that insure customers under the Affordable Care Act’s individual mandate. To date,

there have been certain limited impacts to The Hartford's group benefits businesses including additional opportunities to market our

group benefits products and services through private exchanges. While we have not observed any material impacts on the Company’s

workers’ compensation business or group benefits business, we continue to monitor the impact of the Affordable Care Act on consumer,

broker and medical provider behavior for leading indicators of changes in medical costs or loss payments primarily on the Company's

workers' compensation and disability liabilities.

Social Security Disability Insurance ("SSDI")

On November 2, 2015, the President signed the Bipartisan Budget Act of 2015 (the "Budget Act"), which, among other things, ensures

solvency of the SSDI program through 2022. Prior to the Budget Act's enactment, the SSDI program was projected to become insolvent

in 2016, which would have had an impact on the group disability and workers' compensation markets, including reserve impacts and

increases in the cost of benefits.

Budget of the United States Government

On February 9, 2016, the Obama Administration released its “Fiscal Year 2017, Budget of the U.S. Government” (the “Budget”). The

Budget includes proposals that if enacted, would affect the taxation of life insurance companies and certain life insurance products. In

particular, the proposals would change the method used to determine the amount of dividend income received by a life insurance

company on assets held in separate accounts used to support products, including variable life insurance and variable annuity contracts,

which are eligible for the dividends received deduction (“DRD”). The DRD reduces the amount of dividend income subject to tax and is

a significant component of the difference between the Company's actual tax expense and expected amount determined using the federal

statutory tax rate of 35%. If this proposal were enacted, the Company's actual tax expense could increase, reducing earnings.

United States Department of Labor Proposed Rule

In April, 2015, the U.S. Department of Labor (DOL) issued a proposed regulation that would, if finalized in its current form, expand the

range of activities that would be considered to be fiduciary investment advice under the Employee Retirement Income Security Act of

1974 (“ERISA”) and the Internal Revenue Code. On January 28, 2016, the DOL submitted its final version of the proposed fiduciary

rule to the Office of Management and Budget for review. In its proposed form, the rule could have an adverse impact on our current

offerings of certain insurance products and investment products, along with contracts in our run-off lines of business. If enacted in its

current form, the proposed rule could impact the way we provide investment-related information and support to financial advisors, plan

sponsors, plan participants, plan beneficiaries and Individual Retirement Account (IRA) owners. Because we cannot predict the exact

nature and extent of changes that may be made to the proposed rule when finalized, the potential effect on our businesses is

undeterminable at this time.

Guaranty Fund and Other Insurance-related Assessments

For a discussion regarding Guaranty Fund and Other Insurance-related Assessments, see Note 12 Commitments and Contingencies of

Notes to Consolidated Financial Statements.

IMPACT OF NEW ACCOUNTING STANDARDS

For a discussion of accounting standards, see Note 1 Basis of Presentation and Significant Accounting Policies of Notes to Consolidated

Financial Statements.

Item 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The information required by this item is set forth in the Enterprise Risk Management section of Item 7, Management’s Discussion and

Analysis of Financial Condition and Results of Operations and is incorporated herein by reference.

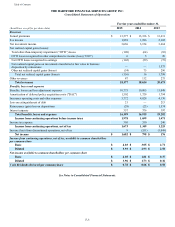

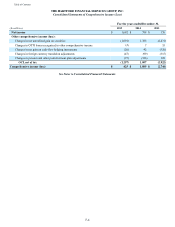

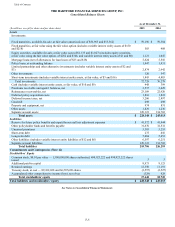

Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

See Index to Consolidated Financial Statements and Schedules elsewhere herein.

Item 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

None.