The Hartford 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.82

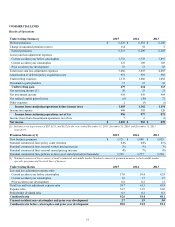

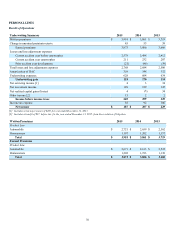

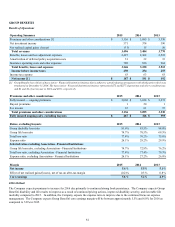

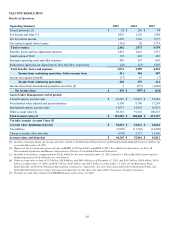

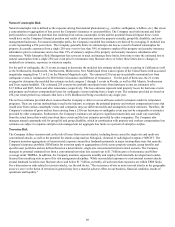

Year ended December 31, 2015 compared to the year ended December 31, 2014

Net income decreased in 2015, as compared to the prior year period, primarily due to higher benefits, losses and loss adjustment

expenses, higher net realized capital losses and lower net investment income partially offset by higher premiums and other

considerations and lower insurance operating costs and other expenses.

Premiums and other considerations increased in 2015, as compared to the prior year period, due primarily to increased sales and

improved persistency and pricing, partially offset by management actions related to the Association - Financial Institutions block of

business. Excluding the Association - Financial Institutions block of business, fully insured ongoing premiums increased 4% in 2015.

Insurance operating costs and other expenses decreased in 2015, compared to the prior year period, due primarily to lower profit sharing

expense related to the Association - Financial Institutions block of business.

Fully insured ongoing sales, excluding buyouts increased 43% in 2015, as compared to prior year period, primarily due to an increase in

large case accounts.

The total loss ratio increased by 1.2 points in 2015, as compared to the prior year period due to a higher group life loss ratio and the

impact of Association - Financial Institutions business in 2014, partially offset by a lower disability loss ratio. Excluding the

Association - Financial Institutions block of business, the total loss ratio was flat to prior year. Excluding the Association - Financial

Institutions block of business, the life loss ratio increased 1.9 points due to favorable changes in reserve assumptions in 2014 and less

favorable severity in the current year. The disability loss ratio improved 1.9 points due to changes in long term disability reserve

assumptions for claim recoveries which favorably impacted the disability loss ratio by 1.2 points, as well as improved incidence and

pricing partially offset by unfavorable long term disability claim severity.

The expense ratio improved 2.1 points in 2015, compared to the prior year period, primarily due to lower profit sharing expense related

to the Association - Financial Institutions block of business. Excluding the Association - Financial Institutions block of business, the

expense ratio improved 1.1 points reflecting premium growth and lower expenses.

Investment income and net realized capital gains decreased in 2015, as compared to the prior year period. For discussion of consolidated

investment results, see MD&A - Investment Results, Investment Income (Loss) and Net Realized Capital Gains (Losses).

The effective tax rate, in both periods, differs from the U.S. Federal statutory rate primarily due to permanent differences related to

investments in tax exempt securities. For further discussion of income taxes, see Note 14 - Income Taxes of Notes to Consolidated

Financial Statements.

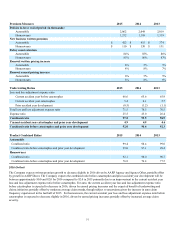

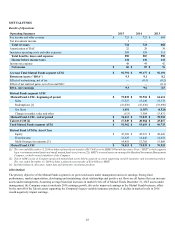

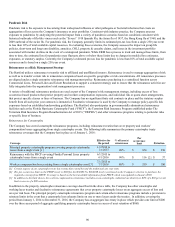

Year ended December 31, 2014 compared to the year ended December 31, 2013

Net income slightly decreased in 2014, as compared to the prior year period, primarily due to lower premiums and other considerations,

net investment income and net realized capital gains, offset by lower benefits, losses and loss adjustment expenses and insurance

operating costs and other expenses.

Premiums and other considerations decreased in 2014, as compared to the prior year period, due primarily to management actions related

to the Association - Financial Institutions block of business. Insurance operating costs and other expenses decreased in 2014, compared

to the prior year period, due primarily to lower profit sharing expense related to the Association - Financial Institutions block of

business.

Fully insured ongoing sales, excluding buyouts declined 17% in 2014, as compared to prior year period. Excluding Association -

Financial Institutions block of business, fully insured ongoing sales, excluding buyouts decreased 12% in 2014 primarily due to lower

large case sales.

The total loss ratio increased by 0.6 points in 2014, as compared to the prior year period. Excluding the Association - Financial

Institutions block of business, the loss ratio improved 1.9 points in 2014 due to improvements in both the life and disability loss ratios.

The life loss ratio improvement reflects favorable mortality experience, improved pricing, and the impact of changes in reserve

assumptions. The disability loss ratio improvement reflects improved accident year incidence and pricing partially offset by higher new

claim severity and less favorable development on prior accident year recoveries.

The expense ratio improved 1.7 points in 2014, compared to the prior year period, primarily due to lower profit sharing expense related

to the Association - Financial Institutions block of business in relation to lower premium and other considerations.

Core earnings margin improved 0.9 points in 2014, compared to the prior year period. The improvement was primarily due to the

improved loss ratio excluding the Association - Financial Institutions block of business.

Investment income and net realized capital gains decreased in 2014, as compared to the prior year period. For discussion of consolidated

investment results, see MD&A - Investment Results, Investment Income (Loss) and Net Realized Capital Gains (Losses).

The effective tax rate, in both periods, differs from the U.S. Federal statutory rate primarily due to permanent differences related to

investments in tax exempt securities. For further discussion of income taxes, see Note 14 - Income Taxes of Notes to Consolidated

Financial Statements.