The Hartford 2015 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255

|

|

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

6. Investments and Derivative Instruments (continued)

F-45

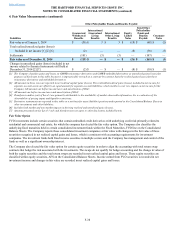

For equity securities where the decline in the fair value is deemed to be other-than-temporary, a charge is recorded in net realized capital

losses equal to the difference between the fair value and cost basis of the security. The previous cost basis less the impairment becomes

the security’s new cost basis. The Company asserts its intent and ability to retain those equity securities deemed to be temporarily

impaired until the price recovers. Once identified, these securities are systematically restricted from trading unless approved by

investment and accounting professionals. The investment and accounting professionals will only authorize the sale of these securities

based on predefined criteria that relate to events that could not have been reasonably foreseen. Examples of the criteria include, but are

not limited to, the deterioration in the issuer’s financial condition, security price declines, a change in regulatory requirements or a major

business combination or major disposition.

The primary factors considered in evaluating whether an impairment exists for an equity security include, but are not limited to: (a) the

length of time and extent to which the fair value has been less than the cost of the security, (b) changes in the financial condition, credit

rating and near-term prospects of the issuer, (c) whether the issuer is current on preferred stock dividends and (d) the intent and ability of

the Company to retain the investment for a period of time sufficient to allow for recovery.

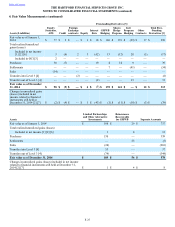

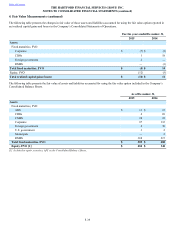

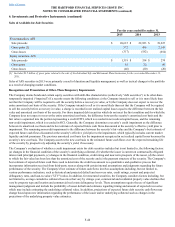

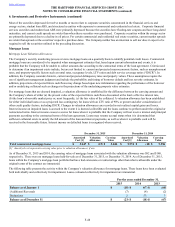

The following table presents the Company's impairments by impairment type.

For the years ended December 31,

2015 2014 2013

Intent-to-sell impairments $ 54 $ 17 $ 26

Credit impairments 29 37 32

Impairments on equity securities 16 2 15

Other impairments 3 3 —

Total impairments $ 102 $ 59 $ 73

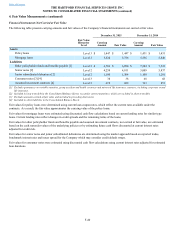

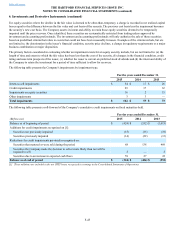

The following table presents a roll-forward of the Company’s cumulative credit impairments on fixed maturities held.

For the years ended December 31,

(Before-tax) 2015 2014 2013

Balance as of beginning of period $ (424) $ (552) $ (1,013)

Additions for credit impairments recognized on [1]:

Securities not previously impaired (15)(15) (19)

Securities previously impaired (14)(22) (13)

Reductions for credit impairments previously recognized on:

Securities that matured or were sold during the period 68 138 469

Securities the Company made the decision to sell or more likely than not will be

required to sell 2 — 2

Securities due to an increase in expected cash flows 59 27 22

Balance as of end of period $ (324) $ (424) $ (552)

[1] These additions are included in the net OTTI losses recognized in earnings in the Consolidated Statements of Operations.