The Hartford 2015 Annual Report Download - page 209

Download and view the complete annual report

Please find page 209 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

13. Equity (continued)

F-78

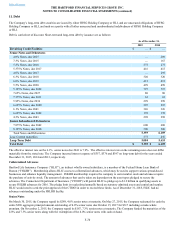

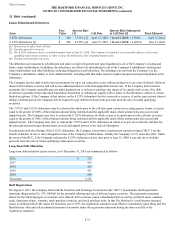

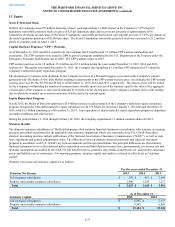

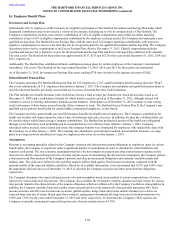

Regulatory Capital Requirements

The Company's U.S. insurance companies' states of domicile impose risk-based capital (“RBC”) requirements. The requirements

provide a means of measuring the minimum amount of statutory capital appropriate for an insurance company to support its overall

business operations based on its size and risk profile. Regulatory compliance is determined by a ratio of a company's total adjusted

capital (“TAC”) to its authorized control level RBC (“ACL RBC”). Companies below specific trigger points or ratios are classified

within certain levels, each of which requires specified corrective action. The minimum level of TAC before corrective action

commences (“Company Action Level”) is two times the ACL RBC. The adequacy of a company's capital is determined by the ratio of a

company's TAC to its Company Action Level, known as the "RBC ratio". All of the Company's operating insurance subsidiaries had

RBC ratios in excess of the minimum levels required by the applicable insurance regulations. On an aggregate basis, the Company's

U.S. property and casualty insurance companies' RBC ratio was in excess of 200% of its Company Action Level as of December 31,

2015 and 2014. The RBC ratios for the Company's principal life insurance operating subsidiaries were all in excess of 400% of their

Company Action Levels as of December 31, 2015 and 2014. The reporting of RBC ratios is not intended for the purpose of ranking any

insurance company, or for use in connection with any marketing, advertising, or promotional activities.

Similar to the RBC ratios that are employed by U.S. insurance regulators, regulatory authorities in the international jurisdictions in

which the Company operates generally establish minimum solvency requirements for insurance companies. All of the Company's

international insurance subsidiaries have solvency margins in excess of the minimum levels required by the applicable regulatory

authorities.

Dividend Restrictions

Dividends to the HFSG Holding Company from its insurance subsidiaries are restricted by insurance regulation. The payment of

dividends by Connecticut-domiciled insurers is limited under the insurance holding company laws of Connecticut. These laws require

notice to and approval by the state insurance commissioner for the declaration or payment of any dividend, which, together with other

dividends or distributions made within the preceding twelve months, exceeds the greater of (i) 10% of the insurer’s policyholder surplus

as of December 31 of the preceding year or (ii) net income (or net gain from operations, if such company is a life insurance company)

for the twelve-month period ending on the thirty-first day of December last preceding, in each case determined under statutory insurance

accounting principles. In addition, if any dividend of a Connecticut-domiciled insurer exceeds the insurer’s earned surplus, it requires the

prior approval of the Connecticut Insurance Commissioner. The insurance holding company laws of the other jurisdictions in which The

Hartford’s insurance subsidiaries are incorporated (or deemed commercially domiciled) generally contain similar (although in certain

instances somewhat more restrictive) limitations on the payment of dividends. Dividends paid to HFSG Holding Company by its life

insurance subsidiaries are further dependent on cash requirements of HLI and other factors. In addition to statutory limitations on paying

dividends, the Company also takes other items into consideration when determining dividends from subsidiaries. These considerations

include, but are not limited to, expected earnings and capitalization of the subsidiary, regulatory capital requirements and liquidity

requirements of the individual operating company.

During 2015, HFSG Holding Company received approximately $900 of dividends from its property and casualty insurance subsidiaries

including approximately $200 which was subsequently contributed to a U.K subsidiary to effect the consolidation of certain property and

casualty run-off entities in the U.K. In addition to the property-casualty insurance subsidiaries dividends, HFSG Holding Company

received approximately $1.1 billion through a series of transactions with HLI’s life insurance subsidiaries.

In 2016, The Company’s property and casualty insurance subsidiaries are permitted to pay up to a maximum of approximately $1.6

billion in dividends to HFSG Holding Company without prior approval from the applicable insurance commissioner. In 2016, HFSG

Holding Company anticipates receiving net dividends of approximately $800 from its property-casualty insurance subsidiaries.

In 2016, Hartford Life and Accident Insurance Company ("HLA") is permitted to pay up to a maximum of $165 in dividends without

prior approval from the insurance commissioner. In 2016, HFSG Holding Company anticipates receiving dividends of approximately

$240 from HLA, subject to regulatory approval.

On January 29, 2016 HLIC paid an extraordinary dividend of $500, based on approval received from the CTDOI. As a result of this

dividend, HLIC has no ordinary dividend capacity for the remainder of 2016. HFSG Holding Company anticipates receiving an

additional $250 of extraordinary dividends from HLIC during 2016, subject to regulatory approval.

There are no current restrictions on the HFSG Holding Company's ability to pay dividends to its shareholders.

Restricted Net Assets

The Company's insurance subsidiaries had net assets of $19 billion, determined in accordance with U.S. GAAP, that were restricted from

payment to the HFSG Holding Company, without prior regulatory approval at December 31, 2015.