The Hartford 2015 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

6. Investments and Derivative Instruments (continued)

F-60

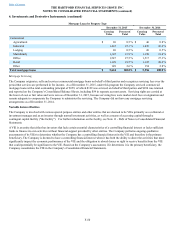

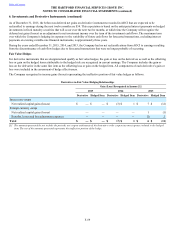

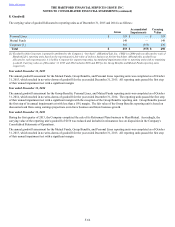

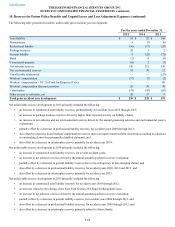

Non-qualifying Strategies

For non-qualifying strategies, including embedded derivatives that are required to be bifurcated from their host contracts and accounted

for as derivatives, the gain or loss on the derivative is recognized currently in earnings within net realized capital gains (losses). The

following table presents the gain or loss recognized in income on non-qualifying strategies:

Non-qualifying Strategies

Gain (Loss) Recognized within Net Realized Capital Gains (Losses)

December 31,

2015 2014 2013

Interest rate contracts

Interest rate swaps, caps, floors, and forwards $ (15) $ (172) $ 50

Foreign exchange contracts

Foreign currency swaps and forwards 18 6 5

Fixed payout annuity hedge [1] (21)(148) (268)

Credit contracts

Credit derivatives that purchase credit protection 8 (10) (38)

Credit derivatives that assume credit risk (11) 16 71

Equity contracts

Equity index swaps and options 19 3 (33)

Commodity contracts

Commodity options (9) — —

Variable annuity hedge program

GMWB product derivative (59)(2) 1,306

GMWB reinsurance contracts 17 4 (192)

GMWB hedging instruments (45) 3 (852)

Macro hedge program (46)(11) (234)

Other

Contingent capital facility put option (6)(6) (7)

Modified coinsurance reinsurance contracts 46 (34) 67

Derivative instruments formerly associated with HLIKK [2] — (2) —

Total [3] $ (104) $ (353) $ (125)

[1] The associated liability is adjusted for changes in spot rates through realized capital gains and was $4, $116 and $250 for the years ended

December 31, 2015, 2014 and 2013, respectively, which is not presented in this table

[2] These amounts relate to the termination of the hedging program associated with the Japan variable annuity product due to the sale of HLIKK.

[3] Excludes investments that contain an embedded credit derivative for which the Company has elected the fair value option. For further discussion,

see the Fair Value Option section in Note 4 - Fair Value Measurements.

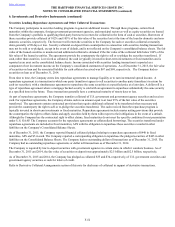

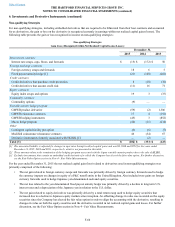

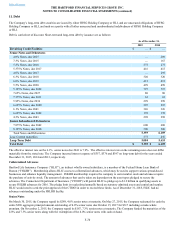

For the year ended December 31, 2015 the net realized capital gain (loss) related to derivatives used in non-qualifying strategies was

primarily comprised of the following:

• The net gain related to foreign currency swaps and forwards was primarily driven by foreign currency forwards used to hedge

the currency impacts on changes in equity of a P&C runoff entity in the United Kingdom. Also included were gains on foreign

currency forwards used to hedge Japanese yen-denominated cash and equity securities.

• The net loss related to the yen denominated fixed payout annuity hedge was primarily driven by a decline in long term U.S.

interest rates and a depreciation of the Japanese yen in relation to the U.S. dollar.

• The net gain related to equity derivatives was primarily driven by a total return swap used to hedge equity securities that

increased due to a decline in Japanese equity markets since inception. An offsetting change in value was recorded on the equity

securities since the Company has elected the fair value option in order to align the accounting with the derivative, resulting in

changes in value on both the equity securities and the derivative recorded in net realized capital gains and losses. For further

discussion, see the Fair Value Option section in Note 4 - Fair Value Measurements.