The Hartford 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255

|

|

112

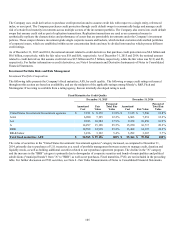

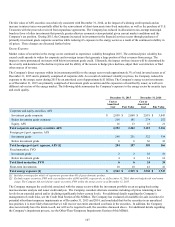

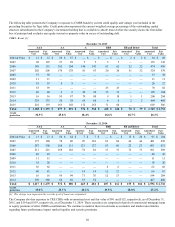

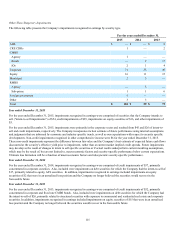

In addition to CMBS bonds and CRE CDOs, the Company has exposure to commercial mortgage loans as presented in the following

table. These loans are collateralized by a variety of commercial properties and are diversified both geographically throughout the United

States and by property type. These loans are primarily in the form of whole loans, where the Company is the sole lender, but may include

participations. Loan participations are loans where the Company has purchased or retained a portion of an outstanding loan or package

of loans and participates on a pro-rata basis in collecting interest and principal pursuant to the terms of the participation agreement. In

general, A-Note participations have senior payment priority, followed by B-Note participations and then mezzanine loan participations.

As of December 31, 2015, loans within the Company’s mortgage loan portfolio that have had extensions or restructurings, other than

what is allowable under the original terms of the contract, are immaterial.

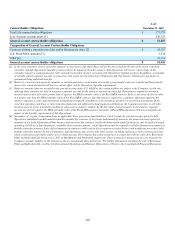

Commercial Mortgage Loans

December 31, 2015 December 31, 2014

Amortized

Cost [1] Valuation

Allowance Carrying Value Amortized

Cost [1] Valuation

Allowance Carrying Value

Agricultural $ 33 $ (7) $ 26 $ 51 $ (5) $ 46

Whole loans 5,458 (16) 5,442 5,333 (13) 5,320

A-Note participations 139 — 139 154 — 154

B-Note participations 17 — 17 17 — 17

Mezzanine loans — — — 19 — 19

Total $ 5,647 $ (23) $ 5,624 $ 5,574 $ (18) $ 5,556

[1] Amortized cost represents carrying value prior to valuation allowances, if any.

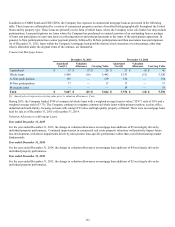

During 2015, the Company funded $744 of commercial whole loans with a weighted average loan-to-value (“LTV”) ratio of 63% and a

weighted average yield of 3.7%. The Company continues to originate commercial whole loans within primary markets, such as office,

industrial and multi-family, focusing on loans with strong LTV ratios and high quality property collateral. There were no mortgage loans

held for sale as of December 31, 2015 or December 31, 2014.

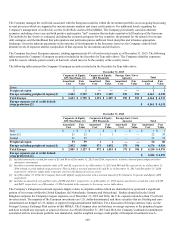

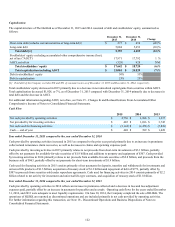

Valuation Allowances on Mortgage Loans

Year ended December 31, 2015

For the year ended December 31, 2015, the change in valuation allowances on mortgage loan additions of $5 was largely driven by

individual property performance. Continued improvement in commercial real estate property valuations will positively impact future

loss development, with future impairments driven by idiosyncratic loan-specific performance rather than overall deteriorating market

fundamentals.

Year ended December 31, 2014

For the year ended December 31, 2014, the change in valuation allowances on mortgage loan additions of $4 was largely driven by

individual property performance.

Year ended December 31, 2013

For the year ended December 31, 2013, the change in valuation allowances on mortgage loan additions of $2 was largely driven by

individual property performance.