The Hartford 2015 Annual Report Download - page 227

Download and view the complete annual report

Please find page 227 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

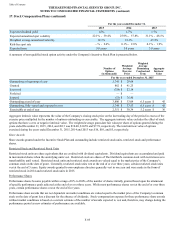

17. Stock Compensation Plans (continued)

F-96

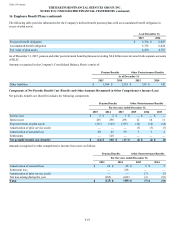

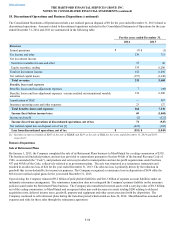

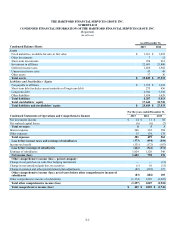

Other performance share awards or portions thereof have a market condition based upon the Company's total shareholder return relative

to a group of peer companies within a three year period. Stock compensation expense for these performance share awards is based on

the number of awards expected to vest as estimated at the grant date and therefore does not change for changes in estimated

performance. The Company uses a risk neutral Monte-Carlo valuation model that incorporates time to maturity, implied volatilities of

the Company and the peer companies, and correlations between the Company and the peer companies and interest rates. The range for

assumptions of inputs are disclosed below.

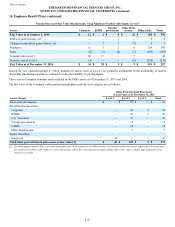

For the years ended December 31,

2015 2014 2013

Volatility of common stock 21.4% 31.6% 42.8%

Average volatility of peer companies 14.0% - 24.0% 17.0% - 29.0% 20.0% - 36.0%

Average correlation coefficient of peer companies 54.0% 62.0% 76.0%

Risk-free spot rate 1.1% 0.7% 0.4%

Term 3.0 years 3.0 years 3.0 years

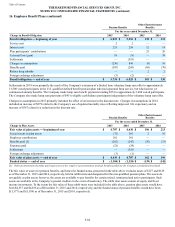

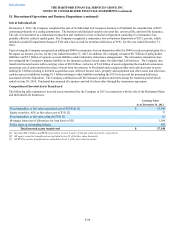

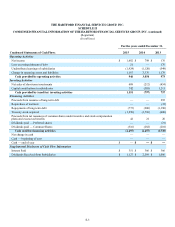

Total Share Awards

A summary of non-vested share award activity under the Company's Incentive Stock Plan is presented below.

Restricted Stock and

Restricted Stock Units Performance Shares

Number of

Shares

(in thousands)

Weighted-Average

Grant-Date

Fair Value

Number of

Shares

(in thousands)

Weighted-Average

Grant date

Fair Value

Non-vested shares For the year ended December 31, 2015

Non-vested at beginning of year 7,232 $ 26.59 1,063 $ 30.55

Granted 1,603 $ 42.25 398 $ 42.40

Performance based adjustment 407 $ 24.15

Vested (2,708) $ 20.95 (814) $ 24.15

Forfeited (259) $ 36.90 (279) $ 33.47

Non-vested at end of year 5,868 $ 33.12 775 $ 37.35

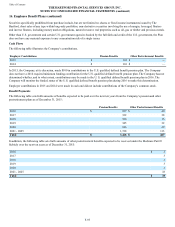

The weighted average grant-date fair value per share of restricted stock units and restricted stock granted during the years ended

December 31, 2015, 2014, and 2013 was $42.25, $35.74 and $27.72, respectively. The weighted average grant-date fair value per share

of performance shares granted during the years ended December 31, 2015, 2014, and 2013 was $42.40, $36.45 and $27.92, respectively.

The total fair value of shares vested during the years ended December 31, 2015, 2014 and 2013 was $144, $75 and $42, respectively,

based on actual or estimated performance factors. The Company did not make cash payments in settlement of stock compensation during

the years ended December 31, 2015, 2014 and 2013.

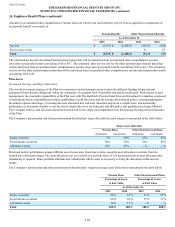

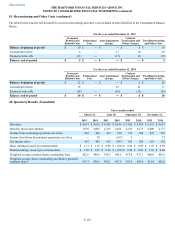

Subsidiary Stock Plan

In 2013 the Company established a subsidiary stock-based compensation plan similar to The Hartford Incentive Stock Plan except that it

awards non-public subsidiary stock as compensation. The Company recognized stock-based compensation plans expense of $7, $4 and

$1 in the years ended December 31, 2015, 2014 and 2013, respectively, for the subsidiary stock plan. Upon employee vesting of

subsidiary stock, the Company will recognize a noncontrolling equity interest. Employees will be restricted from selling vested

subsidiary stock to other than the Company and the Company will have discretion on the amount of stock to repurchase. Therefore the

subsidiary stock is classified as equity because it is not mandatorily redeemable.

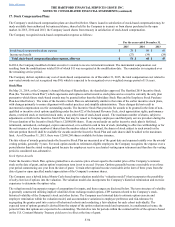

Employee Stock Purchase Plan

The Company sponsors The Hartford Employee Stock Purchase Plan (“ESPP”). Under this plan, eligible employees of The Hartford

purchase common stock of the Company at a discount rate of 5% of the market price per share on the last trading day of the offering

period. Accordingly, the plan is a noncompensatory plan. Employees purchase a variable number of shares of stock through payroll

deductions elected as of the beginning of the offering period. The Company may sell up to 15,400,000 shares of stock to eligible

employees under the ESPP. As of December 31, 2015, there were 4,944,278 shares available for future issuance. During the years ended

December 31, 2015, 2014 and 2013, 249,344 shares, 258,609 shares, and 321,723 shares were sold, respectively. The weighted average

per share fair value of the discount under the ESPP was $2.15, $1.70 and $1.00 during the years ended December 31, 2015, 2014 and

2013, respectively. The fair value is estimated based on the 5% discount off the market price per share on the last trading day of the

offering period.