The Hartford 2015 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

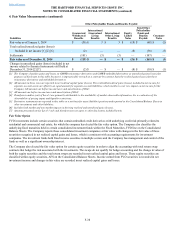

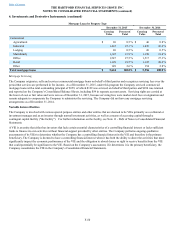

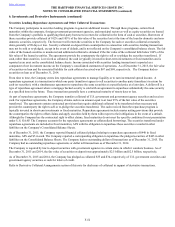

6. Investments and Derivative Instruments (continued)

F-48

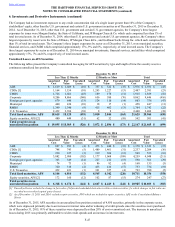

Most of the securities depressed for twelve months or more relate to corporate securities concentrated in the financial services and

energy sectors, student loan ABS, and structured securities with exposure to commercial and residential real estate. Corporate financial

services securities and student loan ABS were primarily depressed because the securities have floating-rate coupons and have long-dated

maturities, and current credit spreads are wider than when these securities were purchased. Corporate securities within the energy sector

are primarily depressed due to a decline in oil prices. For certain commercial and residential real estate securities, current market spreads

are wider than spreads at the securities' respective purchase dates. The Company neither has an intention to sell nor does it expect to be

required to sell the securities outlined in the preceding discussion.

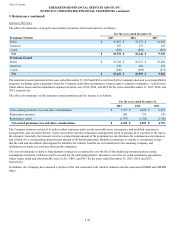

Mortgage Loans

Mortgage Loan Valuation Allowances

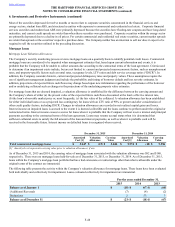

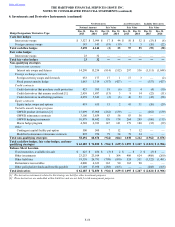

The Company’s security monitoring process reviews mortgage loans on a quarterly basis to identify potential credit losses. Commercial

mortgage loans are considered to be impaired when management estimates that, based upon current information and events, it is

probable that the Company will be unable to collect amounts due according to the contractual terms of the loan agreement. Criteria used

to determine if an impairment exists include, but are not limited to: current and projected macroeconomic factors, such as unemployment

rates, and property-specific factors such as rental rates, occupancy levels, LTV ratios and debt service coverage ratios (“DSCR”). In

addition, the Company considers historic, current and projected delinquency rates and property values. These assumptions require the

use of significant management judgment and include the probability and timing of borrower default and loss severity estimates. In

addition, projections of expected future cash flows may change based upon new information regarding the performance of the borrower

and/or underlying collateral such as changes in the projections of the underlying property value estimates.

For mortgage loans that are deemed impaired, a valuation allowance is established for the difference between the carrying amount and

the Company’s share of either (a) the present value of the expected future cash flows discounted at the loan’s effective interest rate,

(b) the loan’s observable market price or, most frequently, (c) the fair value of the collateral. A valuation allowance has been established

for either individual loans or as a projected loss contingency for loans with an LTV ratio of 90% or greater and after consideration of

other credit quality factors, including DSCR. Changes in valuation allowances are recorded in net realized capital gains and losses.

Interest income on impaired loans is accrued to the extent it is deemed collectible and the loans continue to perform under the original or

restructured terms. Interest income ceases to accrue for loans when it is probable that the Company will not receive interest and principal

payments according to the contractual terms of the loan agreement. Loans may resume accrual status when it is determined that

sufficient collateral exists to satisfy the full amount of the loan and interest payments, as well as when it is probable cash will be

received in the foreseeable future. Interest income on defaulted loans is recognized when received.

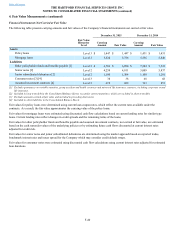

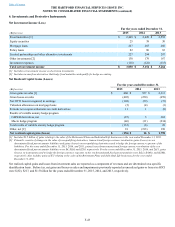

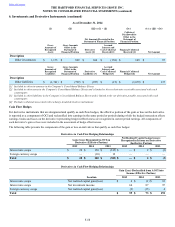

December 31, 2015 December 31, 2014

Amortized

Cost [1] Valuation

Allowance Carrying

Value Amortized

Cost [1] Valuation

Allowance Carrying

Value

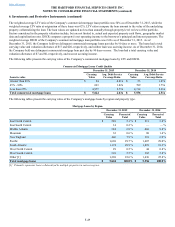

Total commercial mortgage loans $ 5,647 $ (23) $ 5,624 $ 5,574 $ (18) $ 5,556

[1] Amortized cost represents carrying value prior to valuation allowances, if any.

As of December 31, 2015 and 2014, the carrying value of mortgage loans associated with the valuation allowance was $82 and $140,

respectively. There were no mortgage loans held-for-sale as of December 31, 2015, or December 31, 2014. As of December 31, 2015,

loans within the Company’s mortgage loan portfolio that have had extensions or restructurings other than what is allowable under the

original terms of the contract are immaterial.

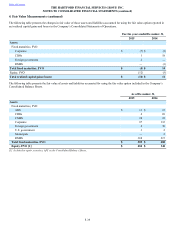

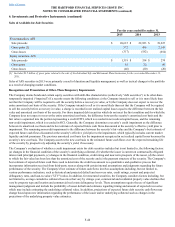

The following table presents the activity within the Company’s valuation allowance for mortgage loans. These loans have been evaluated

both individually and collectively for impairment. Loans evaluated collectively for impairment are immaterial.

For the years ended December 31,

2015 2014 2013

Balance as of January 1 $ (18) $ (67) $ (68)

(Additions)/Reversals (7)(4) (2)

Deductions 2 53 3

Balance as of December 31 $ (23) $ (18) $ (67)