The Hartford 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255

|

|

111

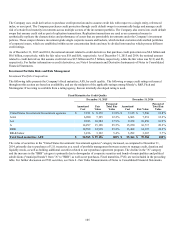

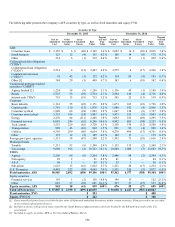

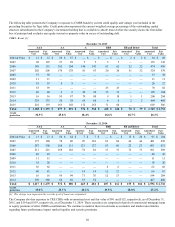

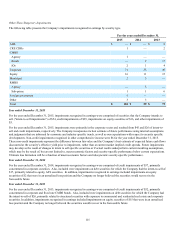

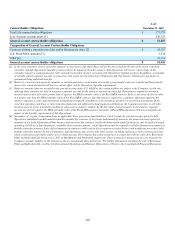

The following table presents the Company’s exposure to CMBS bonds by current credit quality and vintage year included in the

preceding Securities by Type table. Credit protection represents the current weighted average percentage of the outstanding capital

structure subordinated to the Company’s investment holding that is available to absorb losses before the security incurs the first dollar

loss of principal and excludes any equity interest or property value in excess of outstanding debt.

CMBS - Bonds [1]

December 31, 2015

AAA AA A BBB BB and Below Total

Amortized

Cost Fair

Value Amortized

Cost Fair

Value Amortized

Cost Fair

Value Amortized

Cost Fair

Value Amortized

Cost Fair

Value Amortized

Cost Fair

Value

2004 & Prior $ 12 $ 12 $ 50 $ 55 $ — $ — $ — $ — $ 2 $ 2 $ 64 $ 69

2005 98 107 27 28 5 5 5 5 — — 135 145

2006 149 151 102 104 140 141 61 62 22 22 474 480

2007 202 206 170 178 81 83 20 20 51 52 524 539

2008 37 38 — — — — — — — — 37 38

2009 11 11 — — — — — — — — 11 11

2010 18 19 8 8 — — — — — — 26 27

2011 55 59 — — — — 23 23 — — 78 82

2012 40 40 6 6 26 26 33 32 — — 105 104

2013 16 16 95 97 79 80 9 10 1 1 200 204

2014 329 335 58 58 69 68 6 6 2 2 464 469

2015 201 197 163 158 172 165 71 66 — — 607 586

Total $ 1,168 $ 1,191 $ 679 $ 692 $ 572 $ 568 $ 228 $ 224 $ 78 $ 79 $ 2,725 $ 2,754

Credit

protection 32.9% 25.8% 18.4% 16.6% 18.7% 26.3%

December 31, 2014

AAA AA A BBB BB and Below Total

Amortized

Cost Fair

Value Amortized

Cost Fair

Value Amortize

d Cost Fair

Value Amortized

Cost Fair

Value Amortized

Cost Fair

Value Amortized

Cost Fair

Value

2004 & Prior $ 13 $ 13 $ 58 $ 64 $ 7 $ 7 $ — $ — $ 15 $ 20 $ 93 $ 104

2005 175 188 78 80 99 101 83 84 46 46 481 499

2006 287 300 108 115 121 127 63 66 22 23 601 631

2007 211 221 169 182 78 82 31 31 72 73 561 589

2008 40 43 — — — — — — — — 40 43

2009 11 11 — — — — — — — — 11 11

2010 18 20 — — — — — — — — 18 20

2011 56 62 — — — — 6 6 — — 62 68

2012 40 41 — — 14 14 12 12 — — 66 67

2013 16 16 95 99 71 76 12 13 — — 194 204

2014 350 360 64 66 53 54 — — — — 467 480

Total $ 1,217 $ 1,275 $ 572 $ 606 $ 443 $ 461 $ 207 $ 212 $ 155 $ 162 $ 2,594 $ 2,716

Credit

protection 33.0% 25.7% 20.2% 19.5% 18.0% 27.2%

[1] The vintage year represents the year the pool of loans was originated.

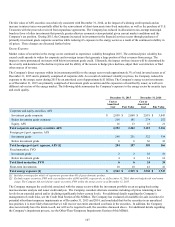

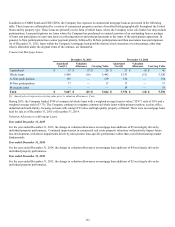

The Company also has exposure to CRE CDOs with an amortized cost and fair value of $91 and $132, respectively, as of December 31,

2015, and $114 and $193, respectively, as of December 31, 2014. These securities are comprised of pools of commercial mortgage loans

or equity positions of other CMBS securitizations. We continue to monitor these investments as economic and market uncertainties

regarding future performance impact market liquidity and security premiums.