The Hartford 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

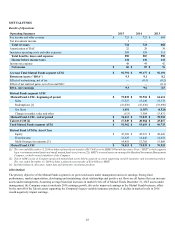

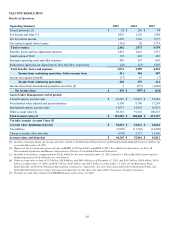

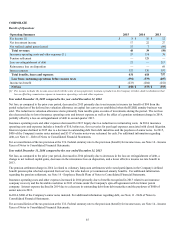

CORPORATE

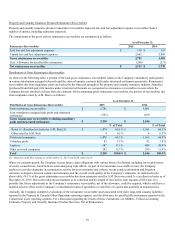

Results of Operations

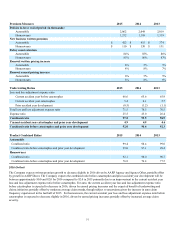

Operating Summary 2015 2014 2013

Fee income [1] $ 8 $ 10 $ 12

Net investment income 17 22 27

Net realized capital gains (losses) 15 7 (89)

Total revenues 40 39 (50)

Insurance operating costs and other expenses [1] 53 114 78

Pension settlement — 128 —

Loss on extinguishment of debt 21 — 213

Reinsurance loss on disposition — — 69

Interest expense 357 376 397

Total benefits, losses and expenses 431 618 757

Loss from continuing operations before income taxes (391)(579) (807)

Income tax benefit (233)(204) (252)

Net loss $ (158) $ (375) $ (555)

[1] Fee income includes the income associated with the sales of non-proprietary insurance products in the Company’s broker-dealer subsidiaries that

has an offsetting commission expense in insurance operating costs and other expenses.

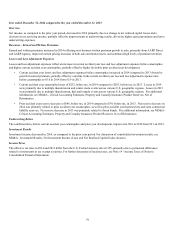

Year ended December 31, 2015 compared to the year ended December 31, 2014

Net loss, as compared to the prior year period, decreased in 2015 primarily due to an increase in income tax benefit of $94 from the

partial reduction of the deferred tax valuation allowance on capital loss carryovers established when the HLIKK annuity business was

sold. The reduction in valuation allowance stems primarily from taxable gains on sales of investments during the period. The net loss

also decreased due to lower insurance operating costs and interest expense as well as the effect of a pension settlement charge in 2014,

partially offset by a loss on extinguishment of debt in second quarter 2015.

Insurance operating costs and other expenses decreased for 2015 largely due to a reduction in restructuring costs. In 2014, insurance

operating costs and expenses includes a benefit of $10, before tax, for recoveries for past legal expenses associated with closed litigation.

Interest expense declined in 2015 due to a decrease in outstanding debt from debt maturities and the paydown of senior notes. In 2015,

$456 of the Company's senior notes matured and $317 of senior notes were redeemed for cash. For additional information regarding

debt, see Note 11 - Debt of Notes to Consolidated Financial Statements.

For a reconciliation of the tax provision at the U.S. Federal statutory rate to the provision (benefit) for income taxes, see Note 14 - Income

Taxes of Notes to Consolidated Financial Statements.

Year ended December 31, 2014 compared to the year ended December 31, 2013

Net loss, as compared to the prior year period, decreased in 2014 primarily due to decreases in the loss on extinguishment of debt, a

change to net realized capital gains, decreases in the reinsurance loss on disposition, and a lower effective income tax rate benefit in

2013.

The pension settlement charge in 2014 is related to voluntary lump-sum settlements with vested participants in the Company's defined

benefit pension plan who had separated from service, but who had not yet commenced annuity benefits. For additional information

regarding the pension settlement, see Note 16 - Employee Benefit Plans of Notes to Consolidated Financial Statements.

Insurance operating costs and other expenses increased in 2014 primarily due to benefits recognized in 2013 related to an insurance

company recovery and the favorable resolution in 2013 of items under the Company's spin-off agreement with its former parent

company. Interest expense declined in 2014 due to a decrease in outstanding debt from debt maturities and the paydown of $800 of

senior notes in 2013.

In 2014, $200 of the Company's senior notes matured. For additional information regarding debt, see Note 11 - Debt of Notes to

Consolidated Financial Statements.

For a reconciliation of the tax provision at the U.S. Federal statutory rate to the provision (benefit) for income taxes, see Note 14 - Income

Taxes of Notes to Consolidated Financial Statements.