The Hartford 2015 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115

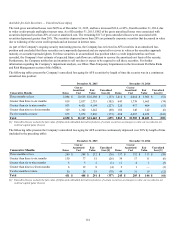

Other-Than-Temporary Impairments

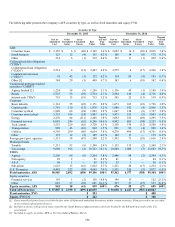

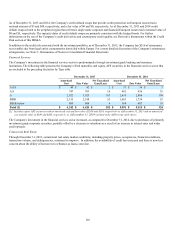

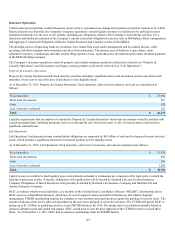

The following table presents the Company’s impairments recognized in earnings by security type.

For the years ended December 31,

2015 2014 2013

ABS $ — $ — $ 9

CRE CDOs 1 — 2

CMBS

Agency 1 — —

Bonds — 2 17

IOs 2 1 4

Corporate 71 35 20

Equity 16 11 15

Municipal 2 3 —

RMBS

Agency — 3 —

Sub-prime 1 1 6

Foreign government 5 — —

Other 3 3 —

Total $ 102 $ 59 $ 73

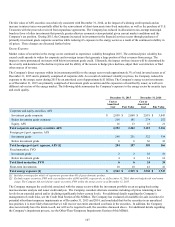

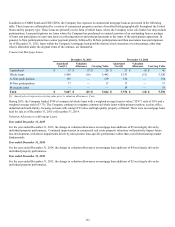

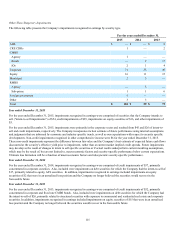

Year ended December 31, 2015

For the year ended December 31, 2015, impairments recognized in earnings were comprised of securities that the Company intends to

sell ("intent-to-sell impairments") of $54, credit impairments of $29, impairments on equity securities of $16, and other impairments of

$3.

For the year ended December 31, 2015, impairments were primarily in the corporate sector and resulted from $45 and $26 of intent-to-

sell and credit impairments, respectively. The Company incorporates its best estimate of future performance using internal assumptions

and judgments that are informed by economic and industry specific trends, as well as our expectations with respect to security specific

developments. Non-credit impairments recognized in other comprehensive income were $6 for the year ended December 31, 2015.

These non-credit impairments represent the difference between fair value and the Company’s best estimate of expected future cash flows

discounted at the security’s effective yield prior to impairment, rather than at current market implied credit spreads. Future impairments

may develop as the result of changes in intent to sell specific securities or if actual results underperform current modeling assumptions,

which may be the result of, but are not limited to, macroeconomic factors and security-specific performance below current expectations.

Ultimate loss formation will be a function of macroeconomic factors and idiosyncratic security-specific performance.

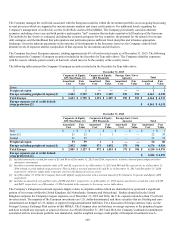

Year ended December 31, 2014

For the year ended December 31, 2014, impairments recognized in earnings were comprised of credit impairments of $37, primarily

concentrated in corporate securities. Also, included were impairments on debt securities for which the Company had the intent-to-sell of

$17, primarily related to equity, AFS securities. In addition, impairments recognized in earnings included impairments on equity

securities of $2 that were in an unrealized loss position and the Company no longer believed the securities would recover in the

foreseeable future.

Year ended December 31, 2013

For the year ended December 31, 2013, impairments recognized in earnings were comprised of credit impairments of $32, primarily

concentrated in corporate and fixed rate CMBS bonds. Also, included were impairments on debt securities for which the Company had

the intent-to-sell of $26, primarily related to structured securities with exposure to commercial and residential real estate and corporate

securities. In addition, impairments recognized in earnings included impairments on equity securities of $15 that were in an unrealized

loss position and the Company no longer believed the securities would recover in the foreseeable future.