The Hartford 2015 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

6. Investments and Derivative Instruments (continued)

F-55

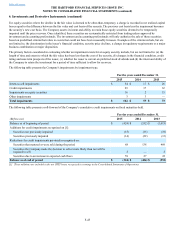

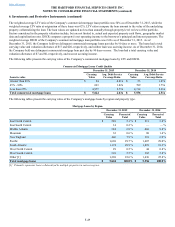

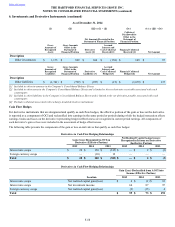

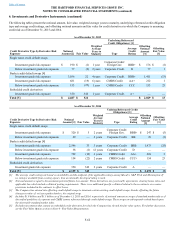

The Company utilizes derivatives (“GMWB hedging instruments”) as part of an actively managed program designed to hedge a portion

of the capital market risk exposures of the non-reinsured GMWB riders due to changes in interest rates, equity market levels, and equity

volatility. These derivatives include customized swaps, interest rate swaps and futures, and equity swaps, options and futures, on certain

indices including the S&P 500 index, EAFE index and NASDAQ index. The following table presents notional and fair value for GMWB

hedging instruments.

Notional Amount Fair Value

December 31,

2015 December 31,

2014 December 31,

2015 December 31,

2014

Customized swaps $ 5,877 $ 7,041 $ 131 $ 124

Equity swaps, options, and futures 1,362 3,761 2 39

Interest rate swaps and futures 3,740 3,640 25 11

Total $ 10,979 $ 14,442 $ 158 $ 174

Macro Hedge Program

The Company utilizes equity options, swaps, futures, and foreign currency options to partially hedge against a decline in the equity

markets and the resulting statutory surplus and capital impact primarily arising from the guaranteed minimum death benefit ("GMDB")

and GMWB obligations. The following table presents notional and fair value for the macro hedge program.

Notional Amount Fair Value

December 31,

2015 December 31,

2014 December 31,

2015 December 31,

2014

Equity swaps, options, and futures $ 4,548 $ 5,983 $ 147 $ 141

Foreign currency options — 400 — —

Total $ 4,548 $ 6,383 $ 147 $ 141

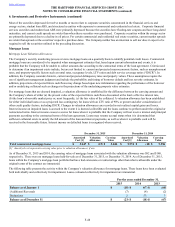

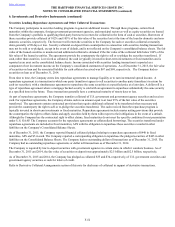

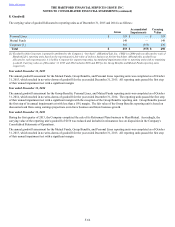

Contingent Capital Facility Put Option

The Company entered into a put option agreement that provides the Company the right to require a third-party trust to purchase, at any

time, The Hartford’s junior subordinated notes in a maximum aggregate principal amount of $500. Under the put option agreement, The

Hartford will pay premiums on a periodic basis and will reimburse the trust for certain fees and ordinary expenses.

Modified Coinsurance Reinsurance Contracts

As of December 31, 2015 and 2014, the Company had approximately $895 and $1.0 billion, respectively, of invested assets supporting

other policyholder funds and benefits payable reinsured under a modified coinsurance arrangement in connection with the sale of the

Individual Life business, which was structured as a reinsurance transaction. The assets are primarily held in a trust established by the

Company. The Company pays or receives cash quarterly to settle the results of the reinsured business, including the investment results.

As a result of this modified coinsurance arrangement, the Company has an embedded derivative that transfers to the reinsurer certain

unrealized changes in fair value due to interest rate and credit risks of these assets. The notional amount of the embedded derivative

reinsurance contracts are the invested assets that are carried at fair value supporting the reinsured reserves.

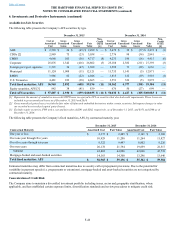

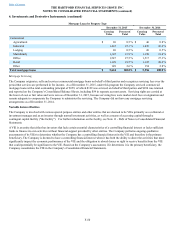

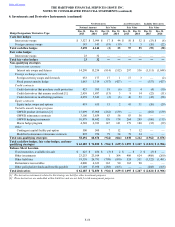

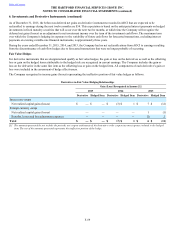

Derivative Balance Sheet Classification

The following table summarizes the balance sheet classification of the Company’s derivative related net fair value amounts as well as the

gross asset and liability fair value amounts. For reporting purposes, the Company has elected to offset within total assets or total

liabilities based upon the net of the fair value amounts, income accruals, and related cash collateral receivables and payables of OTC

derivative instruments executed in a legal entity and with the same counterparty under a master netting agreement, which provides the

Company with the legal right of offset. The Company has also elected to offset within total assets or total liabilities based upon the net of

the fair value amounts, income accruals and related cash collateral receivables and payables of OTC-cleared derivative instruments

based on clearing house agreements. The following fair value amounts do not include income accruals or related cash collateral

receivables and payables, which are netted with derivative fair value amounts to determine balance sheet presentation. Derivative fair

value reported as liabilities after taking into account the master netting agreements was $1.1 billion as of December 31, 2015 and 2014.

Derivatives in the Company’s separate accounts, where the associated gains and losses accrue directly to policyholders, are not included

in the table below. The Company’s derivative instruments are held for risk management purposes, unless otherwise noted in the

following table. The notional amount of derivative contracts represents the basis upon which pay or receive amounts are calculated and

is presented in the table to quantify the volume of the Company’s derivative activity. Notional amounts are not necessarily reflective of

credit risk. The following tables exclude investments that contain an embedded credit derivative for which the Company has elected the

fair value option. For further discussion, see the Fair Value Option section in Note 4 - Fair Value Measurements of Notes to the

Consolidated Financial Statements.