The Hartford 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

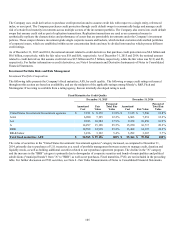

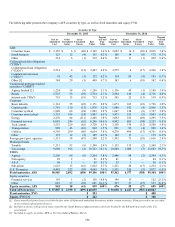

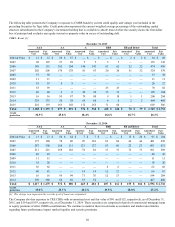

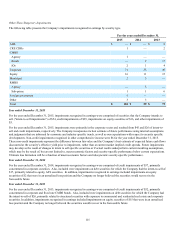

The following table presents the Company’s AFS securities by type, as well as fixed maturities and equity, FVO.

Securities by Type

December 31, 2015 December 31, 2014

Cost or

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses Fair

Value

Percent

of Total

Fair

Value

Cost or

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses Fair

Value

Percent

of Total

Fair

Value

ABS

Consumer loans $ 2,183 $ 6 $ (40) $ 2,149 3.6 % $ 2,052 $ 14 $ (28) $ 2,038 3.4 %

Small business 123 12 (4) 131 0.2 % 166 14 (8) 172 0.3 %

Other 214 6 (1) 219 0.4 % 252 11 (1) 262 0.4 %

Collateralized debt obligations

("CDOs")

Collateralized loan obligations

("CLOs") 2,514 4 (21) 2,497 4.2 % 2,279 4 (17) 2,266 3.8 %

Commercial real estate

("CREs") 91 42 (1) 132 0.2 % 114 88 (9) 193 0.3 %

Other [1] 384 29 (1) 409 0.7 % 383 6 (10) 382 0.6 %

Commercial mortgage-backed

securities ("CMBS")

Agency backed [2] 1,224 34 (8) 1,250 2.1 % 1,136 45 (1) 1,180 2.0 %

Bonds 2,725 58 (29) 2,754 4.7 % 2,594 126 (4) 2,716 4.6 %

Interest only (“IOs”) 719 13 (19) 713 1.2 % 505 25 (11) 519 0.9 %

Corporate

Basic industry 1,161 55 (45) 1,171 2.0 % 1,673 105 (22) 1,756 3.0 %

Capital goods 1,781 110 (15) 1,876 3.2 % 1,880 192 (4) 2,068 3.5 %

Consumer cyclical 1,848 68 (24) 1,892 3.2 % 1,647 128 (8) 1,767 3.0 %

Consumer non-cyclical 3,735 196 (24) 3,907 6.6 % 3,473 335 (5) 3,803 6.4 %

Energy 2,276 84 (111) 2,249 3.8 % 3,092 252 (49) 3,295 5.5 %

Financial services 6,083 246 (63) 6,266 10.6 % 4,942 405 (94) 5,253 8.8 %

Tech./comm. 3,553 229 (62) 3,720 6.3 % 3,150 370 (12) 3,508 5.9 %

Transportation 869 43 (10) 902 1.5 % 891 82 (4) 969 1.6 %

Utilities 4,395 299 (60) 4,634 7.8 % 4,278 496 (13) 4,761 8.0 %

Other 175 12 (2) 185 0.3 % 162 17 — 179 0.3 %

Foreign govt./govt. agencies 1,321 34 (47) 1,308 2.2 % 1,592 73 (29) 1,636 2.8 %

Municipal bonds

Taxable 1,315 92 (9) 1,398 2.4 % 1,135 135 (2) 1,268 2.1 %

Tax-exempt 9,809 916 (2) 10,723 18.1 % 10,600 1,006 (3) 11,603 19.5 %

RMBS

Agency 2,206 64 (6) 2,264 3.8 % 2,448 98 (2) 2,544 4.3 %

Non-agency 89 2 — 91 0.2 % 81 3 — 84 0.1 %

Alt-A 68 1 — 69 0.1 % 55 1 — 56 0.1 %

Sub-prime 1,623 15 (16) 1,622 2.7 % 1,231 20 (17) 1,234 2.1 %

U.S. Treasuries 4,481 222 (38) 4,665 7.9 % 3,551 326 (5) 3,872 6.5 %

Fixed maturities, AFS 56,965 2,892 (658) 59,196 100% 55,362 4,377 (358) 59,384 100%

Equity securities

Financial services 159 1 (2) 158 18.8 % 149 13 — 162 23.2 %

Other 683 37 (39) 681 81.2 % 527 37 (27) 537 76.8 %

Equity securities, AFS 842 38 (41) 839 100% 676 50 (27) 699 100%

Total AFS securities $ 57,807 $ 2,930 $ (699) $ 60,035 $ 56,038 $ 4,427 $ (385) $ 60,083

Fixed maturities, FVO $ 503 $ 488

Equity, FVO [3] $ 282 $ 348

[1] Gross unrealized gains (losses) exclude the fair value of bifurcated embedded derivatives within certain securities. Changes in value are recorded

in net realized capital gains (losses).

[2] Includes securities with pools of loans issued by the Small Business Administration which are backed by the full faith and credit of the U.S.

government.

[3] Included in equity securities, AFS on the Consolidated Balance Sheets.