The Hartford 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.66

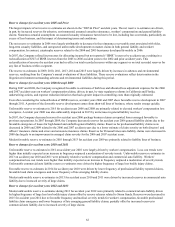

Valuation of Investments and Derivative Instruments

Fixed Maturities, AFS; Equity Securities, AFS; Equity Securities, FVO, Fixed Maturities, FVO; Equity Securities, Trading; and Short-

term Investments

The fair value of fixed maturities, equity securities, and short-term investments in an active and orderly market (i.e., not distressed or

forced liquidation) are determined by management after considering the following pricing sources: quoted prices for identical assets or

liabilities, prices from third-party services, independent broker quotations or internal matrix pricing processes. Security pricing is

applied using a “waterfall” approach whereby publicly available prices are first sought from third-party pricing services, any remaining

unpriced securities are submitted to independent brokers for prices, or lastly, securities are priced using an internal pricing matrix.

Typical inputs used by these pricing sources include, but are not limited to, benchmark yields, reported trades, broker/dealer quotes,

issuer spreads, bids, offers, and/or estimated cash flows, prepayment speeds and default rates. Most fixed maturities do not trade daily.

Based on the typical trading volumes and the lack of quoted market prices for fixed maturities, third-party pricing services utilize matrix

pricing to derive security prices. Matrix pricing relies on securities' relationships to other benchmark quoted securities, which trade

more frequently. Pricing services utilize recently reported trades of identical or similar securities making adjustments through the

reporting date based on the preceding outlined available market observable information. If there are no recently reported trades, the

third-party pricing services may develop a security price using expected future cash flows based upon collateral performance and

discounted at an estimated market rate. Both matrix pricing and discounted cash flow techniques develop prices by factoring in the time

value for cash flows and risk, including liquidity and credit.

Included in the pricing of asset-backed-securities ("ABS") and residential mortgage-backed securities ("RMBS") are estimates of the rate

of future prepayments of principal over the remaining life of the securities. Such estimates are derived based upon the characteristics of

the underlying structure and prepayment speeds previously experienced at the interest rate levels projected for the underlying collateral.

Actual prepayment experience may vary from these estimates. For further discussion, see the AFS Securities, Equity Securities, FVO

Fixed Maturities, FVO, Equity Securities, Trading, and Short-Term Investments section in Note 4 of Notes to Consolidated Financial

Statements.

The Company has analyzed the third-party pricing services' valuation methodologies and related inputs, and has also evaluated the

various types of securities in its investment portfolio to determine an appropriate fair value hierarchy level based upon trading activity

and the observability of market inputs. For further discussion of fair value measurement, see Note 4 of Notes to Consolidated Financial

Statements.

Derivative Instruments, including Embedded Derivatives within Investments

The fair value of derivative instruments is determined using pricing valuation models for over-the-counter ("OTC") derivatives that

utilize market data inputs, quoted market prices for exchanged-traded derivatives and transactions cleared through central clearing

houses ("OTC-cleared"), or independent broker quotations. Excluding embedded and reinsurance related derivatives, as of December 31,

2015 and 2014, 96% and 96%, respectively, of derivatives, based upon notional values, were priced by valuation models or quoted

market prices. The remaining derivatives were priced by broker quotations. The derivatives are valued using mid-market level inputs

that are predominantly observable in the market with the exception of the customized swap contracts that hedge GMWB liabilities.

Inputs used to value derivatives include, but are not limited to, swap interest rates, foreign currency forward and spot rates, credit

spreads and correlations, interest and equity volatility and equity index levels. For further discussion on derivative instrument valuation

methodologies, see the Derivative Instruments, including embedded derivatives within the investments section in Note 4 of Notes to

Consolidated Financial Statements. For further discussion on GMWB and other guaranteed living benefits valuation methodologies, see

the Living Benefits Required to be Fair Valued section in Note 4 of Notes to Consolidated Financial Statements.

Limited Partnerships and Other Alternative Investments

Limited partnerships and other alternative investments include hedge funds where investment company accounting has been applied to a

wholly-owned fund of funds measured at fair value. These funds are fair valued using the net asset value per share or equivalent

(“NAV”), as a practical expedient, calculated on a monthly basis and is the amount at which a unit or shareholder may redeem their

investment, if redemption is allowed. Certain impediments to redemption include, but are not limited to the following: 1) redemption

notice periods vary and may be as long as 90 days, 2) redemption may be restricted (e.g. only be allowed on a quarter-end), 3) a holding

period referred to as a lock-up may be imposed whereby an investor must hold their investment for a specified period of time before they

can make a notice for redemption, 4) gating provisions may limit all redemptions in a given period to a percentage of the entities' equity

interests, or may only allow an investor to redeem a portion of their investment at one time and 5) early redemption penalties may be

imposed that are expressed as a percentage of the amount redeemed. The Company regularly assesses impediments to redemption and

current market conditions that will restrict the redemption at the end of the notice period. For further discussion of fair value

measurement, see Note 4 of Notes to Consolidated Financial Statements. In addition, certain limited partnerships and other alternative

investments are accounted for under the equity method of accounting. For further discussion, see the Investments - Overview section of

Note 1 of Notes to the Consolidated Financial Statements.