The Hartford 2015 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255

|

|

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

6. Investments and Derivative Instruments (continued)

F-49

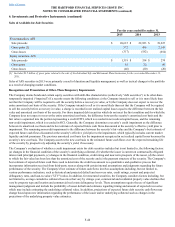

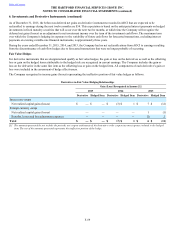

The weighted-average LTV ratio of the Company’s commercial mortgage loan portfolio was 54% as of December 31, 2015, while the

weighted-average LTV ratio at origination of these loans was 62%. LTV ratios compare the loan amount to the value of the underlying

property collateralizing the loan. The loan values are updated no less than annually through property level reviews of the portfolio.

Factors considered in the property valuation include, but are not limited to, actual and expected property cash flows, geographic market

data and capitalization rates. DSCR compares a property’s net operating income to the borrower’s principal and interest payments. The

weighted average DSCR of the Company’s commercial mortgage loan portfolio was 2.63x as of December 31, 2015. As of

December 31, 2015, the Company held two delinquent commercial mortgage loans past due by 90 days or more. The loans had a total

carrying value and valuation allowance of $17 and $20, respectively, and neither loan was accruing income. As of December 31, 2014,

the Company held one delinquent commercial mortgage loan past due by 90 days or more. The loan had a total carrying value and

valuation allowance of $7 and $0, respectively, and was not accruing income.

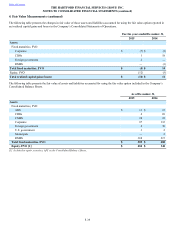

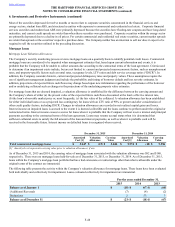

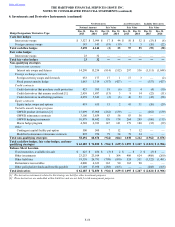

The following table presents the carrying value of the Company’s commercial mortgage loans by LTV and DSCR.

Commercial Mortgage Loans Credit Quality

December 31, 2015 December 31, 2014

Loan-to-value Carrying

Value Avg. Debt-Service

Coverage Ratio Carrying

Value Avg. Debt-Service

Coverage Ratio

Greater than 80% $ 24 0.81x $ 53 1.07x

65% - 80% 623 1.82x 789 1.75x

Less than 65% 4,977 2.75x 4,714 2.66x

Total commercial mortgage loans $ 5,624 2.63x $ 5,556 2.51x

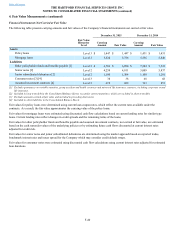

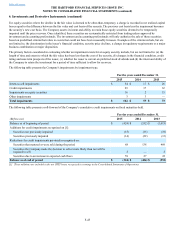

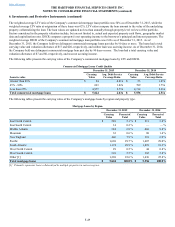

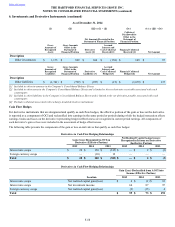

The following tables present the carrying value of the Company’s mortgage loans by region and property type.

Mortgage Loans by Region

December 31, 2015 December 31, 2014

Carrying

Value Percent of

Total Carrying

Value Percent of

Total

East North Central $ 289 5.1 % $ 211 3.8 %

East South Central 14 0.2 % — — %

Middle Atlantic 384 6.8 % 468 8.4 %

Mountain 32 0.6 % 88 1.6 %

New England 446 7.9 % 381 6.9 %

Pacific 1,669 29.7 % 1,607 29.0 %

South Atlantic 1,174 20.9 % 1,019 18.3 %

West North Central 29 0.5 % 44 0.8 %

West South Central 318 5.7 % 302 5.4 %

Other [1] 1,269 22.6 % 1,436 25.8 %

Total mortgage loans $ 5,624 100.0% $ 5,556 100.0%

[1] Primarily represents loans collateralized by multiple properties in various regions.