The Hartford 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

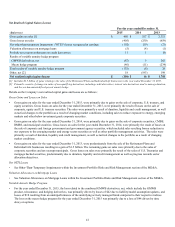

Through both facultative and treaty reinsurance agreements, the Company cedes a share of the risks it has underwritten to other

insurance companies. The Company’s net reserves for loss and loss adjustment expenses include anticipated recovery from reinsurers on

unpaid claims. The estimated amount of the anticipated recovery, or reinsurance recoverable, is net of an allowance for uncollectible

reinsurance.

Reinsurance recoverables include an estimate of the amount of gross loss and loss adjustment expense reserves that may be ceded under

the terms of the reinsurance agreements, including IBNR for unpaid losses. The Company calculates its ceded reinsurance projection

based on the terms of any applicable facultative and treaty reinsurance, often including an estimate by reinsurance agreement of how

IBNR for losses will ultimately be ceded.

The Company provides an allowance for uncollectible reinsurance, reflecting management’s best estimate of reinsurance cessions that

may be uncollectible in the future due to reinsurers’ unwillingness or inability to pay. The Company analyzes recent developments in

commutation activity between reinsurers and cedants, recent trends in arbitration and litigation outcomes in disputes between reinsurers

and cedants and the overall credit quality of the Company’s reinsurers. Where its contracts permit, the Company secures funding of

future claim obligations with various forms of collateral, including irrevocable letters of credit, secured trusts, funds held accounts and

group-wide offsets. The allowance for uncollectible reinsurance was $266 as of December 31, 2015, comprised of $46 related to

Commercial Lines and $220 related to Property & Casualty Other Operations.

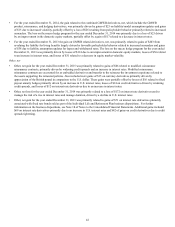

The Company’s estimate of reinsurance recoverables, net of an allowance for uncollectible reinsurance, is subject to similar risks and

uncertainties as the estimate of the gross reserve for unpaid losses and loss adjustment expenses.

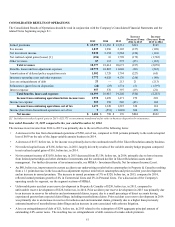

The Hartford, like other insurance companies, categorizes and tracks its insurance reserves for its segments by “line of business”.

Commercial Lines policy packages that include property and general liability coverages are generally referred to as the package line of

business. Furthermore, The Hartford regularly reviews the appropriateness of reserve levels at the line of business level, taking into

consideration the variety of trends that impact the ultimate settlement of claims for the subsets of claims in each particular line of

business. In addition, Property & Casualty Other Operations categorizes reserves as asbestos and environmental (“A&E”), whereby the

Company reviews these reserve levels by type of event, rather than by line of business. Adjustments to previously established reserves,

which may be material, are reflected in the operating results of the period in which the adjustment is determined to be necessary. In the

judgment of management, information currently available has been properly considered in the reserves established for losses and loss

adjustment expenses.

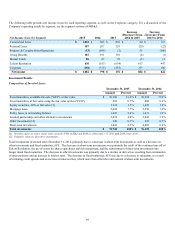

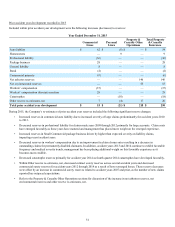

Loss and loss adjustment expense reserves by line of business as of December 31, 2015, net of reinsurance are as follows:

Commercial Lines Personal Lines Property & Casualty

Other Operations Total Property &

Casualty Insurance

Auto liability $ 701 $ 1,361 $ — $ 2,062

Auto physical damage 21 25 — 46

Homeowners’ — 414 — 414

Professional liability 508 — — 508

Package business 1,274 — — 1,274

General liability 2,431 25 — 2,456

Bond 185 — — 185

Commercial property 143 — — 143

A&E 22 1 1,959 1,982

Workers’ compensation 8,981 — — 8,981

Assumed reinsurance — — 138 138

All other non-A&E — — 754 754

Total reserves-net 14,266 1,826 2,851 18,943

Reinsurance and other recoverables 2,293 19 570 2,882

Total reserves-gross $ 16,559 $ 1,845 $ 3,421 $ 21,825