The Hartford 2015 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

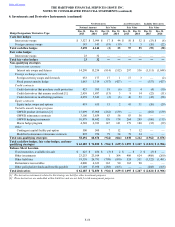

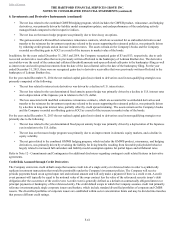

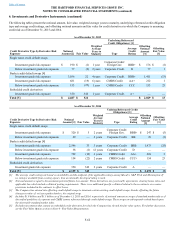

6. Investments and Derivative Instruments (continued)

F-54

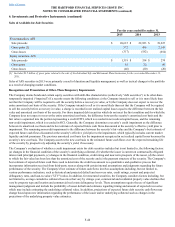

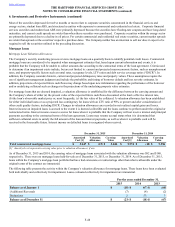

Non-qualifying Strategies

Derivative relationships that do not qualify for hedge accounting (“non-qualifying strategies”) primarily include the hedge program for

the Company's variable annuity products as well as the hedging and replication strategies that utilize credit default swaps. In addition,

hedges of interest rate, foreign currency and equity risk of certain fixed maturities, equities and liabilities do not qualify for hedge

accounting.

The non-qualifying strategies include:

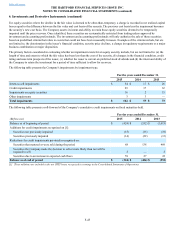

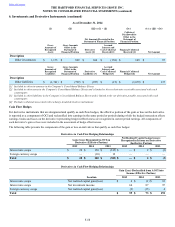

Interest Rate Swaps, Swaptions and Futures

The Company may use interest rate swaps, swaptions, and futures to manage duration between assets and liabilities in certain investment

portfolios. In addition, the Company enters into interest rate swaps to terminate existing swaps, thereby offsetting the changes in value of

the original swap. As of December 31, 2015 and 2014, the notional amount of interest rate swaps in offsetting relationships was $12.9

billion and $13.1 billion, respectively.

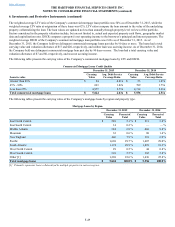

Foreign Currency Swaps and Forwards

The Company enters into foreign currency swaps and forwards to convert the foreign currency exposures of certain foreign currency-

denominated fixed maturity investments to U.S. dollars. During 2015, the Company entered into foreign currency forwards to hedge non-

U.S. dollar denominated cash and equity securities, as well as the currency impacts on changes in equity of a P&C runoff entity in the

United Kingdom.

Fixed Payout Annuity Hedge

The Company formerly offered certain variable annuity products with a guaranteed minimum income benefit ("GMIB") and continues to

reinsure certain yen denominated fixed payout annuities. The Company invests in U.S. dollar denominated assets to support the

reinsurance liability. The Company entered into pay U.S. dollar, receive yen swap contracts to hedge the currency and yen interest rate

exposure between the U.S. dollar denominated assets and the yen denominated fixed liability reinsurance payments.

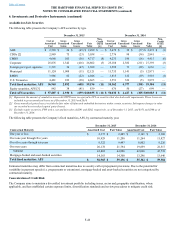

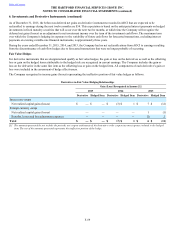

Credit Contracts

Credit default swaps are used to purchase credit protection on an individual entity or referenced index to economically hedge against

default risk and credit-related changes in value of fixed maturity securities. Credit default swaps are also used to assume credit risk

related to an individual entity or referenced index as a part of replication transactions. These contracts require the Company to pay or

receive a periodic fee in exchange for compensation from the counterparty should the referenced security issuers experience a credit

event, as defined in the contract. The Company is also exposed to credit risk related to certain structured fixed maturity securities that

have embedded credit derivatives, which reference a standard index of corporate securities. In addition, the Company enters into credit

default swaps to terminate existing credit default swaps, thereby offsetting the changes in value of the original swap going forward.

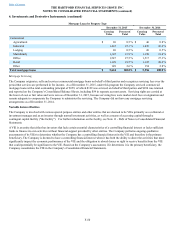

Equity Index Swaps and Options

The Company enters into total return swaps to hedge equity risk of specific common stock investments which are accounted for using

fair value option in order to align the accounting treatment within net realized capital gains (losses). The Company may also use equity

index options to hedge the impact of an adverse equity market environment on the investment portfolio. In addition, the Company

formerly offered certain equity indexed products, a portion of which contain embedded derivatives that require bifurcation. The

Company uses equity index swaps to economically hedge the equity volatility risk associated with the equity indexed products.

Commodity Contracts

During 2015, the Company purchased for $11 put option contracts on West Texas Intermediate oil futures with a strike of $35 dollars per

barrel in order to partially offset potential losses related to certain fixed maturity securities that could arise if oil prices decline

substantially. The Company has since reduced its exposure to the targeted fixed maturity securities and therefore, these options were

terminated at the end of 2015.

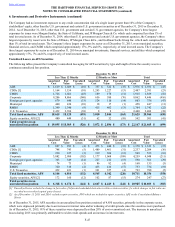

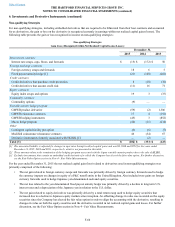

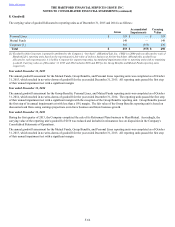

GMWB Derivatives, net

The Company formerly offered certain variable annuity products with GMWB riders. The GMWB product is a bifurcated embedded

derivative (“GMWB product derivatives”) that has a notional value equal to the GRB. The Company uses reinsurance contracts to

transfer a portion of its risk of loss due to GMWB. The reinsurance contracts covering GMWB (“GMWB reinsurance contracts”) are

accounted for as free-standing derivatives with a notional amount equal to the GRB amount.