The Hartford 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.86

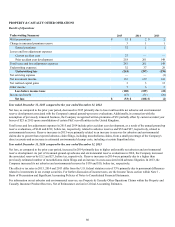

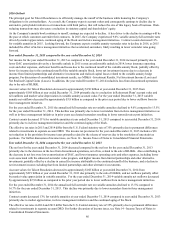

2016 Outlook

The principal goal for Talcott Resolution is to efficiently manage the runoff of the business while honoring the Company's

obligations to its contractholders. As a result, the Company expects account values and consequently earnings to decline due to

surrenders, policyholder initiatives or transactions with third parties, that will reduce the size of this legacy book of business. Risk-

reducing transactions may also cause a reduction in statutory capital and shareholders’ equity.

As the Company's annuity book continues to runoff, earnings are expected to decline. A key driver to the decline in earnings will be

the pace at which customers surrender their contracts. In 2015, the Company experienced 9.6% variable annuity full surrender rates

driven by market appreciation, continued aging of the block and in-force management initiatives. Contract counts decreased 11%

for variable annuities in 2015. Looking forward, the Company expects variable annuity surrender rates to decline in 2016, as 2015

included the effect of in-force management initiatives that accelerated surrenders, likely resulting in lower surrender rates going

forward.

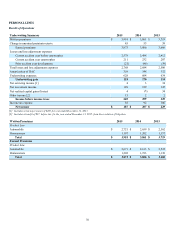

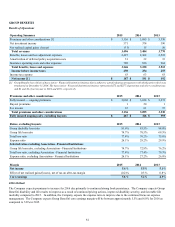

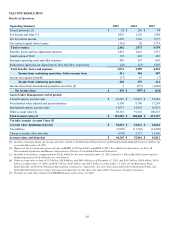

Year ended December 31, 2015 compared to the year ended December 31, 2014

Net income for the year ended December 31, 2015 as compared to the year ended December 31, 2014 increased primarily due to

lower DAC amortization driven by a favorable unlock in 2015 versus an unfavorable unlock in 2014, lower insurance operating

costs and other expenses, and lower benefits and losses due to the continued runoff of the variable annuity block, partially offset by

lower fee income due to the continued runoff of the variable annuity block, lower net investment income due to a decrease in

income from limited partnerships and alternative investments and realized capital losses related to the variable annuity hedge

program. For discussion of consolidated investment results, see MD&A - Investment Results, Net Investment Income (Loss) and

Net Realized Capital Gains (Losses). In addition, the year ended December 31, 2014 included a loss from discontinued operations

due to the sale of HLIKK.

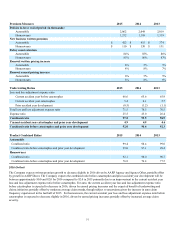

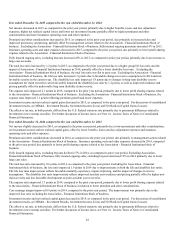

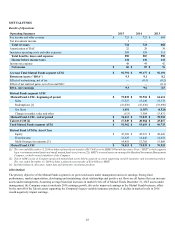

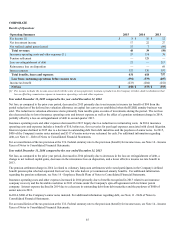

Account values for Talcott Resolution decreased to approximately $156 billion at year ended December 31, 2015 from

approximately $168 billion at year ended December 31, 2014 primarily due to a reduction in Retirement Plans' account value and

net outflows and market value depreciation in variable annuity account value. For the year ended December 31, 2015 variable

annuity net outflows decreased by approximately $3.8 billion as compared to the prior year period due to lower outflows from in-

force management initiatives.

For the year ended December 31, 2015 the annualized full surrender rate on variable annuities declined to 9.6% compared to 13.5%

for the year ended December 31, 2014. This decline was primarily due to lower surrenders from in-force management initiatives as

well as in-force management initiatives in prior years accelerated surrenders resulting in lower surrender rates post initiatives.

Contract counts decreased 11% for variable annuities at year ended December 31, 2015 compared to year ended December 31, 2014

primarily due to in-force management initiatives and the continued aging of the block.

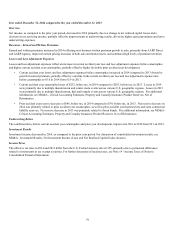

The effective tax rates in 2015 and 2014 differ from the U.S. Federal statutory rate of 35% primarily due to permanent differences

related to investments in separate account DRD. The income tax provision for the year ended December 31, 2015 includes a $36

net reduction in the provision for income taxes primarily related to the release of reserves due to the resolution of uncertain tax

positions. For further discussion of income taxes, see Note 14 - Income Taxes of Notes to Consolidated Financial Statements.

Year ended December 31, 2014 compared to the year ended December 31, 2013

The net loss for the year ended December 31, 2014 decreased compared to the net loss for the year ended December 31, 2013

primarily due to the decrease in the loss from discontinued operations, net of tax, related to the sale of HLIKK. Also contributing to

the decrease in net loss were lower amortization of DAC, and lower insurance operating costs and other expenses, including lower

costs associated with the enhanced surrender value program, and higher income from limited partnerships and other alternative

investments, partially offset by a decline in earned fee income attributable to the continued runoff of the business, and a decline in

net investment income excluding that from limited partnerships and other alternative investments.

Account values for Talcott Resolution decreased to approximately $168 billion at year ended December 31, 2014 from

approximately $219 billion at year ended December 31, 2013 due primarily to the sale of HLIKK, and net outflows partially offset

by market value appreciation in variable annuities. For the year ended December 31, 2014 variable annuity net outflows decreased

by approximately $2.9 billion as compared to the prior year period due to lower outflows from in-force management initiatives.

For the year ended December 31, 2014 the annualized full surrender rate on variable annuities declined to 13.5% compared to

16.7% for the year ended December 31, 2013. This decline was primarily due to lower surrenders from in-force management

initiatives.

Contract counts decreased 13% for variable annuities at year ended December 31, 2014 compared to year ended December 31, 2013

primarily due to market appreciation, in-force management initiatives and the continued aging of the block.

The effective tax rates in 2014 and 2013 differ from the U.S. Federal statutory rate of 35% primarily due to permanent differences

related to investments in separate account DRD. For further discussion of income taxes, see Note 14 - Income Taxes of Notes to

Consolidated Financial Statements.