ICICI Bank 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F24

schedules

forming part of the Accounts (Contd.)

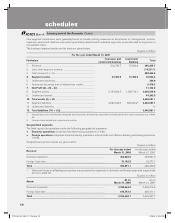

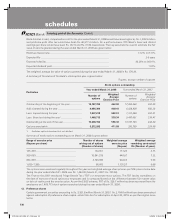

Dividend income

During the year ended March 31, 2008, the Bank received dividend from its subsidiaries amounting to Rs. 3,636.6 million

(March 31, 2007: Rs. 2,027.8 million) and from its associates/joint ventures/other related entities amounting to Rs. 8,931.4

million (March 31, 2007: Rs. 2,457.1 million).

Dividend paid

During the year ended March 31, 2008, the Bank paid dividend to its key management personnel amounting to Rs. 15.0

million (March 31, 2007: Rs. 4.4 million).

Remuneration to whole-time directors

Remuneration paid to the whole-time directors of the Bank during the year ended March 31, 2008 was Rs. 90.3 million

(March 31, 2007: Rs. 87.0 million).

Lines of credit

As on March 31, 2008, the Bank had issued lines of credit to its subsidiaries amounting to Rs. 1,003.0 million

(March 31, 2007: Rs. 2,173.5 million).

Sale of property

During the year ended March 31, 2008, the Bank sold properties to its subsidiaries amounting to Rs. 151.8 million

(March 31, 2007: Rs. 1,505.7 million).

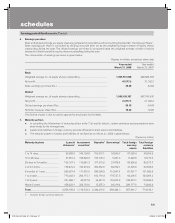

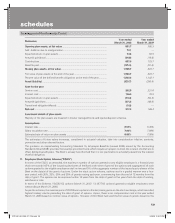

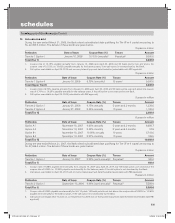

Letters of Comfort

The Bank has issued letters of comfort on behalf of its foreign subsidiaries namely, ICICI Bank UK PLC and ICICI Bank

Canada. The details of the same and their assessed financial impact are given below:

On behalf of To Purpose

ICICI Bank UK PLC Financial Services Authority,

UK (“FSA”)

To financially support ICICI Bank UK PLC to ensure that it meets

all of its financial obligations as they fall due.

ICICI Bank Canada Office of the Superintendent

of Financial Institutions,

Canada (“OSFI”)

To infuse additional capital should ICICI Bank Canada’s capital fall

below the minimum requirement and provide ICICI Bank Canada

ongoing financial, managerial and operational support.

ICICI Bank Canada Canada Deposit Insurance

Corporation (“CDIC”)

To comply with the Bank Act and the CDIC regulations or by-laws

thereunder and to indemnify CDIC against all losses, damages,

reasonable costs and expenses arising from failure of ICICI Bank

Canada in performing the same.

As per the assessment done, the financial impact of the above letters issued to overseas regulators is Nil as at March 31,

2008.

In addition to the above, the Bank has also issued letters of comfort in the nature of awareness on behalf of banking and

non-banking subsidiaries in respect of their borrowings made or proposed to be made and for other incidental business

purposes. As they are in the nature of factual statements or confirmation of facts, they do not create any financial impact

on the Bank.

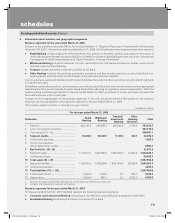

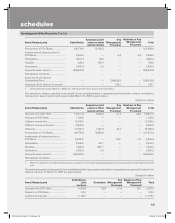

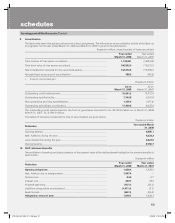

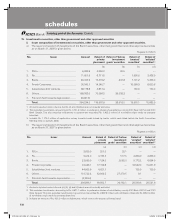

Related party balances

The balances payable to/receivable from subsidiaries/joint ventures/associates/other related entities/key management

personnel included in the balance sheet as on March 31, 2008 are given below:

Rupees in million

Items/Related party Subsidiaries Associates/joint

ventures/other

related entities

Key

Management

Personnel

Relatives of Key

Management

Personnel Total

Deposits with ICICI Bank ...................... 11,476.0 268.9 27.1 14.1 11,786.1

Deposits of ICICI Bank .......................... (17.1) — — — (17.1)

Call/term money lent ............................. 15,917.8 — — — 15,917.8

Call/term money borrowed ................... 240.7 — — — 240.7

Advances ............................................... 5,002.5 145.5 13.9 — 5,161.9

ICICI_BK_AR_2008_(F1_F46).indd 24ICICI_BK_AR_2008_(F1_F46).indd 24 6/20/08 3:25:06 PM6/20/08 3:25:06 PM