ICICI Bank 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Directors’ Report

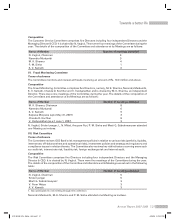

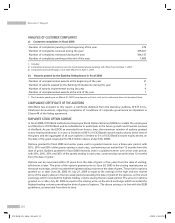

ANALYSIS OF CUSTOMER COMPLAINTS

a) Customer complaints in fiscal 2008

Number of complaints pending at the beginning of the year 579

Number of complaints received during the year1185,431

Number of complaints redressed during the year 184,147

Number of complaints pending at the end of the year 1,863

1. Includes

a) complaints received via customer service touch points (phone banking) with effect from October 1, 2007.

b) complaints received through e-mail with effect from April 1, 2007.

b) Awards passed by the Banking Ombudsman in fiscal 2008

Number of unimplemented awards at the beginning of the year 41

Number of awards passed by the Banking Ombudsman during the year 7

Number of awards implemented during the year 6

Number of unimplemented awards at the end of the year 1

1. The 4 awards pending as on March 31, 2007 have become null and void, as the customers have not accepted them.

COMPLIANCE CERTIFICATE OF THE AUDITORS

ICICI Bank has annexed to this report, a certificate obtained from the statutory auditors, B S R & Co.,

Chartered Accountants, regarding compliance of conditions of corporate governance as stipulated in

Clause 49 of the listing agreement.

EMPLOYEE STOCK OPTION SCHEME

In fiscal 2000, ICICI Bank instituted an Employee Stock Option Scheme (ESOS) to enable the employees

and Directors of ICICI Bank and its subsidiaries to participate in the future growth and financial success

of the Bank. As per the ESOS as amended from time to time, the maximum number of options granted

to any employee/director in a year is limited to 0.05% of ICICI Bank’s issued equity shares at the time of

the grant, and the aggregate of all such options is limited to 5% of ICICI Bank’s issued equity shares on

the date of the grant (equivalent to 55.6 million shares at April 26, 2008).

Options granted for fiscal 2003 and earlier years vest in a graded manner over a three-year period, with

20%, 30% and 50% of the grants vesting in each year, commencing not earlier than 12 months from the

date of grant. Options granted for fiscal 2004 onwards vest in a graded manner over a four-year period,

with 20%, 20%, 30% and 30% of the grants vesting in each year, commencing not earlier than 12 months

from the date of grant.

Options can be exercised within 10 years from the date of grant or five years from the date of vesting,

whichever is later. The price of the options granted prior to June 30, 2003 is the closing market price on

the stock exchange, which recorded the highest trading volume on the date of grant. The price for options

granted on or after June 30, 2003 till July 21, 2004 is equal to the average of the high and low market

price of the equity shares in the two week period preceding the date of grant of the options, on the stock

exchange which recorded the highest trading volume during the two week period. The price for options

granted on or after July 22, 2004 is equal to the closing price on the stock exchange which recorded the

highest trading volume preceding the date of grant of options. The above pricing is in line with the SEBI

guidelines, as amended from time to time.

30

ICICI BANK_(Fin_Matter 1-64).ind30 30ICICI BANK_(Fin_Matter 1-64).ind30 30 6/20/08 5:03:06 PM6/20/08 5:03:06 PM