ICICI Bank 2008 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F38

schedules

forming part of the Accounts (Contd.)

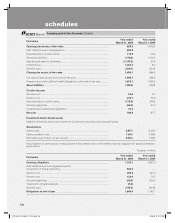

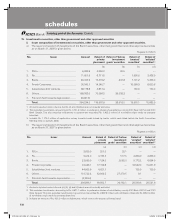

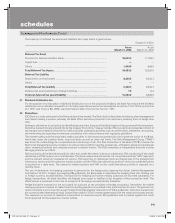

21. Financial assets transferred during the year to securitisation company (SC)/reconstruction company (RC)

The Bank has transferred certain assets to Asset Reconstruction Company (India) Limited (ARCIL) in terms of the guidelines

issued by RBI governing such transfer. For the purpose of the valuation of the underlying security receipts issued by the

underlying trusts managed by ARCIL, the security receipts are valued at their respective NAVs as advised by the ARCIL. The

details of the assets transferred during the year ended March 31, 2008 and March 31, 2007 are given in the table below:

Rupees in million, except no. of accounts

Year ended

March 31, 2008 Year ended

March 31, 2007

A. No. of accounts ............................................................................................. 18,480 19

B. Aggregate value (net of provisions) of accounts sold to SC/RC .................. 9,344.5 8,169.6

C. Aggregate consideration ............................................................................... 9,408.2 8,024.7

D. Additional consideration realised in respect of accounts

transferred in earlier years1 ........................................................................... ——

E. Aggregate gain/(loss) over net book value ................................................... 63.7 (144.9)

1. During the year ended March 31, 2008, ARCIL fully redeemed security receipts of Nil trusts. The Bank realised Rs. Nil over the

gross book value in respect of these trusts (March 31, 2007: Rs. 849.0 million). The Bank also realised an additional amount of Rs. Nil

over the gross book value in respect of security receipts already redeemed. Further, the Bank has realised an additional amount of

Rs. 7.7 million (March 31, 2007: Rs. 43.5 million) over the gross book value in respect of security receipts not fully redeemed as on

March 31, 2008. During the year ended March 31, 2008 security receipts of net book value amounting to Rs. 4,777.9 million were sold

to ARCIL at a sale consideration of Rs. 4,820.0 million. The net loss on this transaction was Rs. 100.6 million and provision release was

Rs. 142.7 million.

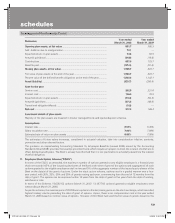

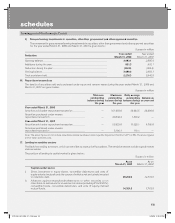

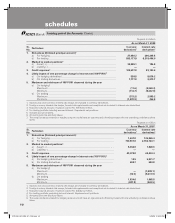

22. Provisions on standard assets

During the year ended March 31, 2007, RBI increased the requirement of general provisioning to 2% on standard loans

relating to personal loans, loans and advances qualifying as capital market exposure, credit card receivables, advances to

non-deposit taking systemically important non-banking financial companies (NBFCs) and commercial real estate loans. On

standard loans for residential housing beyond Rs. 2.0 million, the provisioning requirement was increased to 1% from the

earlier level of 0.4%. In accordance with the revised RBI guidelines, a general provision of Rs. 1,590.0 million has been

made during the year ended March 31, 2008 (March 31, 2007: Rs. 7,310.0 million). The provision on standard assets held

by the Bank in accordance with RBI guidelines was Rs. 14,550.3 million (including Rs. 12.0 million transferred on account

of merger of the Sangli Bank Limited effective April 19, 2007) at March 31, 2008 (March 31, 2007: Rs. 12,948.3 million).

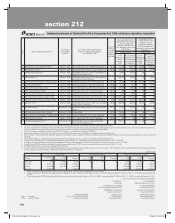

23. Provisions and contingencies

The break-up of ‘Provisions and contingencies’ included in the profit and loss account is given below:

Rupees in million

Year ended

March 31, 2008

Year ended

March 31, 2007

Provisions for depreciation of investments ........................................................ 622.6 419.4

Provision towards non-performing assets .......................................................... 25,419.9 14,283.0

Provision towards standard assets ..................................................................... 1,590.0 7,310.0

Provision towards income tax1 ........................................................................... 8,953.7 5,348.2

Provision towards wealth tax .............................................................................. 30.0 30.0

Other provision and contingencies ..................................................................... 1,413.3 251.3

1. Includes fringe benefit tax amounting to Rs. 392.0 million and creation of net deferred tax asset amounting to Rs. (7,133.6) million.

ICICI_BK_AR_2008_(F1_F46).indd 38ICICI_BK_AR_2008_(F1_F46).indd 38 6/20/08 3:25:53 PM6/20/08 3:25:53 PM