ICICI Bank 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F21

schedules

forming part of the Accounts (Contd.)

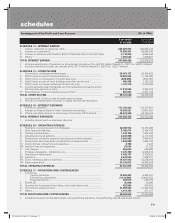

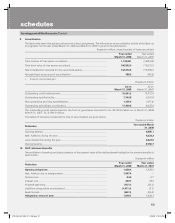

6. Earnings per share

Basic and diluted earnings per equity share are computed in accordance with Accounting Standard 20, “Earnings per Share”.

Basic earnings per share is computed by dividing net profit after tax by the weighted average number of equity shares

outstanding during the year. The diluted earnings per share is computed using the weighted average number of equity

shares and dilutive potential equity shares outstanding during the year.

The computation of earnings per share is given below:

Rupees in million, except per share data

Year ended

March 31, 2008

Year ended

March 31, 2007

Basic

Weighted average no. of equity shares outstanding.......................................... 1,055,591,068 892,820,768

Net profit ............................................................................................................. 41,577.3 31,102.2

Basic earnings per share (Rs.) ........................................................................... 39.39 34.84

Diluted

Weighted average no. of equity shares outstanding.......................................... 1,062,103,167 897,743,476

Net profit ............................................................................................................. 41,577.3 31,102.2

Diluted earnings per share (Rs.) .......................................................................... 39.15 34.64

Nominal value per share (Rs.) ............................................................................. 10.00 10.00

The dilutive impact is due to options granted to employees by the Bank.

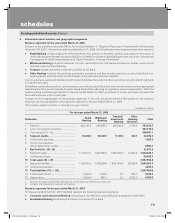

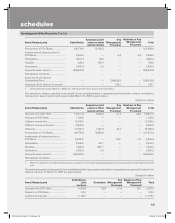

7. Maturity pattern

l In compiling the information of maturity pattern (refer 7 (a) and (b) below), certain estimates and assumptions have

been made by the management.

l Assets and liabilities in foreign currency exclude off-balance sheet assets and liabilities.

a) The maturity pattern of assets and liabilities of the Bank as on March 31, 2008 is given below:

Rupees in million

Maturity buckets Loans &

Advances1

Investment

securities1

Deposits1Borrowings1Total foreign

currency

assets

Total foreign

currency

liabilities

1 to 14 days ............................... 93,299.9 144,138.8 150,415.1 18,949.7 67,356.4 49,954.8

15 to 28 days ............................. 27,857.4 102,926.6 105,105.3 5,407.0 11,229.6 12,310.0

29 days to 3 months ................. 155,107.3 110,681.3 377,315.6 37,476.4 64,606.8 60,017.7

3 to 6 months ............................ 156,415.2 106,274.8 353,452.6 98,782.1 31,405.6 82,855.8

6 months to 1 year .................... 260,207.4 171,675.0 596,599.9 112,847.4 61,401.7 121,563.8

1 to 3 years ................................ 773,243.4 208,115.1 812,119.4 176,727.5 66,300.5 143,269.2

3 to 5 years ................................ 331,808.1 46,577.8 34,047.3 176,974.8 125,974.1 170,063.8

Above 5 years ............................ 458,222.1 224,154.0 15,255.3 29,319.4 229,717.0 74,283.0

Total .......................................... 2,256,160.8 1,114,543.4 2,444,310.5 656,484.3 657,991.7 714,318.1

1. Includes foreign currency balances.

ICICI_BK_AR_2008_(F1_F46).indd 21ICICI_BK_AR_2008_(F1_F46).indd 21 6/20/08 3:24:57 PM6/20/08 3:24:57 PM