ICICI Bank 2008 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

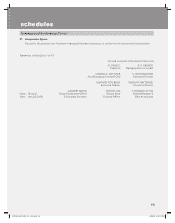

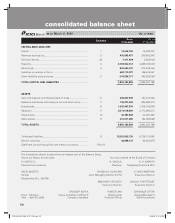

F52

Significant Accounting Policies and Notes to Accounts (refer Schedule 18 & 19).

The Schedules referred to above form an integral part of the consolidated balance sheet

As per our Report of even date For and on behalf of the Board of Directors

For BSR & Co. N. VAGHUL K. V. KAMATH

Chartered Accountants Chairman Managing Director & CEO

AKEEL MASTER CHANDA D. KOCHHAR V. VAIDYANATHAN

Partner Joint Managing Director & CFO Executive Director

Membership No.: 046768

MADHABI PURI BUCH SONJOY CHATTERJEE

Executive Director Executive Director

SANDEEP BATRA RAKESH JHA CHARANJIT ATTRA

Place : Mumbai Group Compliance Officer & Deputy Chief General Manager &

Date : April 26, 2008 Company Secretary Financial Officer Chief Accountant

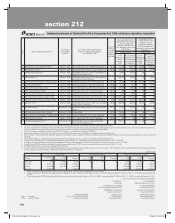

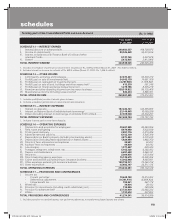

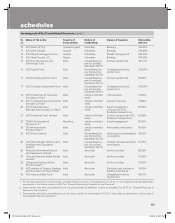

consolidated cash flow statement

for the year ended March 31, 2008

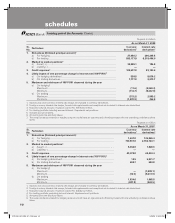

Particulars Year ended Year ended

31.03.2008 31.03.2007

(Rs. in ‘000s)

Cash flow from operating activities

Net profit before taxes ............................................................................ 45,079,134 35,247,100

Adjustments for: ....................................................................................

Depreciation and amortisation ................................................................ 8,721,642 8,346,161

Net (appreciation)/depreciation on investments..................................... 14,493,875 12,160,982

Provision in respect of non-performing assets (including prudential

provision on standard assets) ................................................................. 27,723,909 22,082,234

Provision for contingencies & others ...................................................... 1,723,502 307,652

(Profit)/loss on sale of fixed assets ......................................................... (613,379) (351,246)

97,128,683 77,792,883

Adjustments for: ....................................................................................

(Increase)/decrease in investments ........................................................ (132,276,092) (173,187,373)

(Increase)/decrease in advances ............................................................. (423,725,121) (565,891,731)

Increase/(decrease) in borrowings .......................................................... 100,659,704 96,294,679

Increase/(decrease) in deposits .............................................................. 270,566,682 761,626,500

(Increase)/decrease in other assets ........................................................ (40,067,589) (27,065,243)

Increase/(decrease) in other liabilities and provisions ............................ 173,249,913 111,407,820

(51,592,503) 203,184,652

(Payment)/refund of taxes (net) ............................................................... (23,865,900) (21,192,739)

Net cash flow from operating activities .............................................. (A) 21,670,280 259,784,796

Cash flow from investing activities ......................................................

Purchase of fixed assets ......................................................................... (13,779,728) (8,652,868)

Proceeds from sale of fixed assets ........................................................ 1,100,906 1,759,850

(Purchase)/sale of held to maturity securities ........................................ (278,393,897) (204,006,388)

Net cash generated from investing activities...................................... (B) (291,072,719) (210,899,407)

Cash flow from financing activities ......................................................

Proceeds from issue of share capital (including ESOPs) net of issue expense 197,945,383 2,055,383

Net proceeds/(repayment) of bonds (including subordinated debts) .... 138,335,874 172,962,927

Dividend and dividend tax paid ............................................................... (11,124,591) (9,072,081)

Net cash generated from financing activities...................................... (C) 325,156,666 165,946,229

Effect of exchange fluctuation on translation reserve....................... . (D) (1,721,319) (491,265)

Net cash and cash equivalents received from The Sangli Bank Limited

on amalgamation ................................................................................... (E) 2,362,563 —

Net increase/(decrease) in cash and cash equivalents ............. (A) + (B) + (C) + (D) + (E) 56,395,471 214,340,353

Cash and cash equivalents as at April 1 .............................................. 396,891,302 182,550,949

Cash and cash equivalents as at March 31 .......................................... 453,286,773 396,891,302

ICICI_BK_AR_2008_(F47_F92).indd 52ICICI_BK_AR_2008_(F47_F92).indd 52 6/20/08 3:31:30 PM6/20/08 3:31:30 PM