ICICI Bank 2008 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F104

The Bank extends unsecured facilities to high rated clients and for certain products such as derivatives,

credit cards and personal loans. The limits structure with respect to unsecured facilities has been approved

by the Board of Directors.

The decision on the type and quantum of collateral for each transaction is taken by the credit approving

authority as per the credit approval authorisation approved by the Board of Directors. For facilities

provided as per approved product policies (retail products, loan against shares etc.), collateral is taken

in line with the policy.

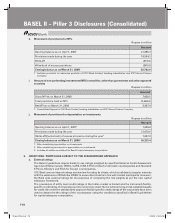

Types of eligible financial collateral

The Bank recognizes only specified types of financial collateral to be eligible for providing capital relief

in line with Basel II guidelines towards credit risk mitigation. This includes cash (deposited with the

Bank), gold (including bullion and jewellery, subject to collateralized jewellery being benchmarked to

99.99% purity), securities issued by Central and State Governments, Indira Vikas Patra, Kisan Vikas

Patra, National Savings Certificates, life insurance policies with a declared surrender value issued by an

insurance company which is regulated by the insurance sector regulator, certain debt securities rated

by a recognized credit rating agency, mutual fund units where daily Net Asset Value (NAV) is available in

public domain and the mutual fund is limited to investing in the instruments listed above and guarantees

from certain specified entities.

Credit concentration risk

Credit concentration risk arises mainly on account of concentration of exposures under various categories

viz. industry, products, geography, underlying collateral nature, single/group borrower exposures etc.

Within corporate portfolio, as a prudential measure aimed at better risk management and avoidance of

concentration of risks, the RBI has prescribed regulatory limits on banks’ maximum exposure to single

borrowers and group borrowers. In order to restrict the concentration risk arising out of longer tenure

exposure within the prudential limits set by RBI, the Board of ICICI Bank has approved prescribed sub-

limits for the maximum exposure the Bank can have to a borrower group.

Within the various limits are stipulated in the credit policy to address concentration risk. Limits have been

stipulated on single borrower, group, industry, longer tenure exposure to a group. Exposure of top 10

borrowers and borrower groups for the consolidated Bank are reported to the Committee of Directors

on a quarterly basis.

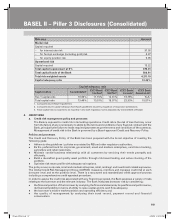

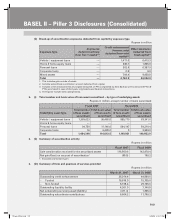

b. Portfolio covered by eligible financial collateral

The table below details the total exposure that is covered by eligible financial collateral as at March 31,

2008.

Rupees in million

Exposures covered by financial collateral Amount1

Exposure before use of credit risk mitigation techniques 105,242.2

Exposure after use of credit risk mitigation techniques 83,676.5

1. Includes all entities considered for Basel II capital adequacy computation.

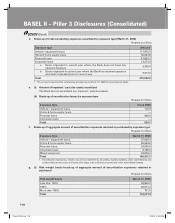

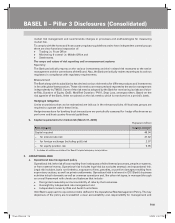

7. SECURITISATION

a. Securitisation objectives and policies

Objectives

The Bank’s primary objective of securitization activities is to increase the efficiency of capital and enhance

the return on capital employed by diversifying sources of funding.

Roles played by the Bank

In securitization transactions backed by assets either originated by the Bank or third parties, the Bank

plays the following major roles:

BASEL II – Pillar 3 Disclosures (Consolidated)

1P-less_(Pillar).indd 1041P-less_(Pillar).indd 104 6/20/08 4:53:00 PM6/20/08 4:53:00 PM