ICICI Bank 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Net interest margin is expected to continue to be lower than other banks in India until we increase the proportion

of low-cost deposits and retail deposits in our total funding. The net interest margin is also impacted by the

relatively lower net interest margin earned by our overseas branches, which is offset by the higher fee income

that we are able to earn by leveraging our international presence and our ability to meet the foreign currency

borrowing requirements of Indian companies.

Non-Interest Income

Fee income

Fee income increased by 32.2% to Rs. 66.27 billion in fiscal 2008 from Rs. 50.12 billion in fiscal 2007 primarily

due to growth in fee income from structuring and advisory fees, fees from international operations, third party

distribution fees and fee income from small enterprises. Fees include merchant foreign exchange income, margin

on customer derivative transactions and loan processing fees.

Treasury income

Treasury income decreased by 19.6% to Rs. 8.15 billion in fiscal 2008 from Rs. 10.14 billion in fiscal 2007 primarily

due to mark-to-market losses/realised losses of Rs. 6.85 billion on the credit derivatives portfolio, offset, in part

by higher gains from sale of equity and fixed income investments and proprietary trading.

As at March 31, 2008, the Bank had a portfolio of Rs. 62.80 billion, including funded investments of Rs. 12.23

billion, in various credit derivative instruments including credit default swaps (CDSs), credit linked notes (CLNs)

and collateralised debt obligations (CDOs). The majority of the underlying exposure is to Indian corporates. During

fiscal 2008, global credit markets experienced significant volatility, widening of spreads, substantial risk aversion

and tight liquidity. This resulted in a mark-to-market/realised loss of Rs. 6.85 billion on the credit derivative portfolio

during the year.

Lease & other income

Lease income decreased by 8.8% to Rs. 2.17 billion in fiscal 2008 from Rs. 2.38 billion in fiscal 2007 primarily due

to decrease in leased assets to Rs. 7.97 billion at year-end fiscal 2008 compared to Rs. 10.03 billion at year-end

fiscal 2007, since the Bank is not entering into new lease transactions.

Other income increased by 73.5% to Rs. 11.52 billion in fiscal 2008 compared to Rs. 6.64 billion in fiscal 2007

primarily due to increase in income by way of dividend from subsidiary companies and distribution from venture

capital funds.

Non-interest expense

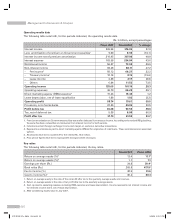

The following table sets forth, for the periods indicated, the principal components of non-interest expense.

Rs. in billion, except percentages

Fiscal 2007 Fiscal 2008 % change

Employee expenses 16.17 20.79 28.6

Depreciation on own property (including non banking assets) 3.57 3.96 10.9

Auditors’ fees and expenses 0.02 0.02 —

Other administrative expenses 30.03 39.52 31.6

Total non-interest expense (excluding lease depreciation and

direct marketing agency expenses) 49.79 64.29 29.1

Depreciation (net of lease equalisation) on leased assets 1.88 1.82 (3.2)

Direct marketing agency expenses 15.24 15.43 1.2

Total non-interest expense 66.91 81.54 21.9

1. All amounts have been rounded off to the nearest Rs. 10.0 million.

Total non-interest expense increased by 21.9% to Rs. 81.54 billion in fiscal 2008 from Rs. 66.91 billion in fiscal 2007

primarily due to a 28.6% increase in employee expenses and 31.6% increase in other administrative expenses.

Employee expenses increased by 28.6% to Rs. 20.79 billion in fiscal 2008 from Rs. 16.17 billion in fiscal 2007 primarily

due to a 22.1% increase in employee base and annual increase in salaries and other employee benefits.

Management’s Discussion & Analysis

52

ICICI BANK_(Fin_Matter 1-64).ind52 52ICICI BANK_(Fin_Matter 1-64).ind52 52 6/20/08 5:03:12 PM6/20/08 5:03:12 PM