ICICI Bank 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

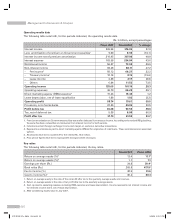

Operating results data

The following table sets forth, for the periods indicated, the operating results data.

Rs. in billion, except percentages

Fiscal 2007 Fiscal 2008 % change

Interest income 229.94 316.86 37.8

Less: amortisation of premium on Government securities19.99 8.98 (10.1)

Interest income net of premium amortisation 219.95 307.88 40.0

Interest expense 163.58 234.84 43.6

Net interest income 56.37 73.04 29.6

Non-interest income 69.28 88.11 27.2

– Fee income250.12 66.27 32.2

– Treasury income110.14 8.15 (19.6)

– Lease income 2.38 2.17 (8.8)

– Others 6.64 11.52 73.5

Operating income 125.65 161.15 28.3

Operating expenses 49.79 64.29 29.1

Direct marketing agency (DMA) expense315.24 15.43 1.2

Lease depreciation, net of lease equalisation 1.88 1.82 (3.2)

Operating profit 58.74 79.61 35.5

Provisions, net of write-backs 22.26 29.05 30.5

Profit before tax 36.48 50.56 38.6

Tax, net of deferred tax 5.38 8.98 66.9

Profit after tax 31.10 41.58 33.7

1. Premium amortisation on Government securities was earlier deducted from treasury income. According to the revised RBI guidelines,

the same has been reclassified and deducted from interest income for both periods.

2. Includes merchant foreign exchange income and margin on customer derivative transactions.

3. Represents commissions paid to direct marketing agents (DMAs) for origination of retail loans. These commissions are expensed

upfront.

4. All amounts have been rounded off to the nearest Rs. 10.0 million.

5. Prior period figures have been regrouped/re-arranged where necessary.

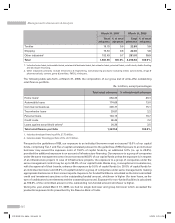

Key ratios

The following table sets forth, for the periods indicated, the key ratios.

Fiscal 2007 Fiscal 2008

Return on average equity (%)113.4 11.14

Return on average assets (%)21.1 1.1

Earnings per share (Rs.) 34.8 39.44

Book value (Rs.) 269.8 417.54

Fee to income (%) 40.5 41.6

Cost to income (%)340.2 40.4

1. Return on average equity is the ratio of the net profit after tax to the quarterly average equity and reserves.

2. Return on average assets is the ratio of net profit after tax to the quarterly average assets.

3. Cost represents operating expense excluding DMA expense and lease depreciation. Income represents net interest income and

non-interest income and is net of lease depreciation.

4. After considering equity issue in July 2007.

Management’s Discussion & Analysis

50

ICICI BANK_(Fin_Matter 1-64).ind50 50ICICI BANK_(Fin_Matter 1-64).ind50 50 6/20/08 5:03:12 PM6/20/08 5:03:12 PM