ICICI Bank 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F19

schedules

forming part of the Accounts (Contd.)

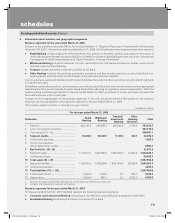

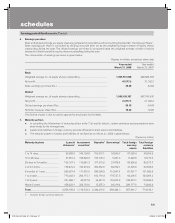

5. Information about business and geographical segments

Business segments for the year ended March 31, 2008

Pursuant to the guidelines issued by RBI on Accounting Standard - 17 (Segment Reporting) - Enhancement of Disclosures

dated April 18, 2007, effective from period ending March 31, 2008, the following business segments have been reported.

l Retail Banking includes exposures which satisfy the four criteria of orientation, product, granularity and low value of

individual exposures for retail exposures laid down in Basel Committee on Banking Supervision document “International

Convergence of Capital Measurement and Capital Standards: A Revised Framework”.

l Wholesale Banking includes all advances to trusts, partnership firms, companies and statutory bodies, which are not

included under the Retail Banking.

l Treasury includes the entire investment portfolio of the Bank.

l Other Banking includes hire purchase and leasing operations and also includes gain/loss on sale of banking & non-

banking assets and other items not attributable to any particular business segment.

Income, expenses, assets and liabilities are either specifically identified with individual segments or are allocated to segments

on a systematic basis.

All liabilities are transfer priced to a central treasury unit, which pools all funds and lends to the business units at appropriate

rates based on the relevant maturity of assets being funded after adjusting for regulatory reserve requirements. While the

transfer pricing methodology followed for the year ended March 31, 2007 was based on similar principles, the same has

been refined further in the current year.

Pursuant to the reorganisation of the business segments in line with the aforementioned RBI guidelines, the business

segments are not comparable to the segments reported for the year ended March 31, 2007.

The business segment results on this basis are given below:

Rupees in million

For the year ended March 31, 2008

Particulars Retail

Banking Wholesale

Banking

Treasury/

Investment

Banking

Other

Banking

Business Total

1 Revenue ..................................................... 244,185.4 249,493.5 290,982.6 2,749.2 787,410.7

2 Less: Inter-segment revenue ..................... 391,419.6

3 Total revenue (1) – (2) ................................. 395,991.1

4 Segment results ........................................ 10,838.4 36,240.6 5,159.2 252.1 52,490.3

5 Unallocated expenses ................................ 1,929.3

6 Income tax expenses

(net of deferred tax credit) ......................... 8,983.7

7 Net Profit (4) – (5) – (6) ............................. 41,577.3

8 Segment assets ......................................... 1,112,510.1 1,263,992.0 1,540,852.6 27,053.4 3,944,408.1

9 Unallocated assets1 .................................... 53,542.7

10 Total assets (8) + (9) ................................ 3,997,950.8

11 Segment liabilities ...................................... 1,152,965.5 1,378,224.6 1,442,104.8220,360.4 3,993,655.3

12 Unallocated liabilities ................................. 4,295.5

13 Total liabilities (11) + (12) ........................ 3,997,950.8

14 Capital expenditure .................................... 6,430.8 1,364.6 8.5 504.5 8,308.4

15 Depreciation ............................................... 2,836.8 889.1 5.3 2,052.3 5,783.5

1. Includes tax paid in advance/tax deducted at source (net) and deferred tax asset (net).

2. Includes share capital and reserves and surplus.

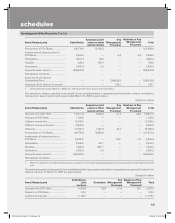

Business segments for the year ended March 31, 2007

For the year ended March 31, 2007 the Bank reported the following business segments:

l Consumer and Commercial Banking comprising of the retail and corporate banking operations of the Bank.

l Investment Banking comprising the treasury operations of the Bank.

ICICI_BK_AR_2008_(F1_F46).indd 19ICICI_BK_AR_2008_(F1_F46).indd 19 6/20/08 3:24:51 PM6/20/08 3:24:51 PM