ICICI Bank 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F29

schedules

forming part of the Accounts (Contd.)

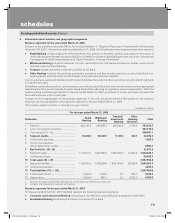

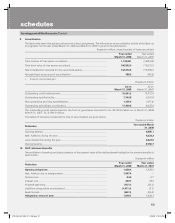

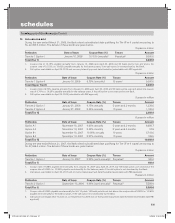

Particulars Year ended

March 31, 2008

Year ended

March 31, 2007

Opening plan assets, at fair value .................................................................... 891.7 785.3

Add: Addition due to amalgamation ................................................................... 73.1 —

Expected return on plan assets .......................................................................... 74.4 62.5

Actuarial gain/(loss) ............................................................................................. (24.8) (18.0)

Contributions ....................................................................................................... 667.6 153.7

Benefits paid ....................................................................................................... (175.3) (91.8)

Closing plan assets, at fair value ...................................................................... 1,506.7 891.7

Fair value of plan assets at the end of the year .................................................. 1,506.7 891.7

Present value of the defined benefit obligations at the end of the year ............ 1,840.4 1,142.1

Asset/(liability) .................................................................................................. (333.7) (250.4)

Cost for the year

Service cost ......................................................................................................... 292.8 221.0

Interest cost ........................................................................................................ 136.4 75.5

Expected return on plan assets .......................................................................... (74.4) (62.5)

Actuarial (gain)/loss ............................................................................................. (37.2) (45.6)

Transitional obligation/(Asset) ............................................................................. (0.2) —

Net cost .............................................................................................................. 317.4 188.4

Investment details of plan assets

Majority of the plan assets are invested in insurer managed funds and special deposit schemes.

Assumptions

Interest rate ......................................................................................................... 8.57% 8.35%

Salary escalation rate .......................................................................................... 7.00% 7.00%

Estimated rate of return on plan assets ............................................................. 8.00% 7.50%

The estimates of future salary increases, considered in actuarial valuation, take into consideration inflation, seniority,

promotion and other relevant factors.

The guidance on implementing Accounting Standard 15, Employee Benefits (revised 2005) issued by the Accounting

Standards Board (ASB) provides that exempt provident funds which require employers to meet the interest shortfall are in

effect defined benefit plans. The Bank’s actuary has informed that it is not practicable to actuarially determine the interest

shortfall obligation.

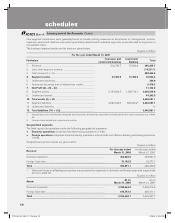

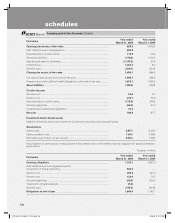

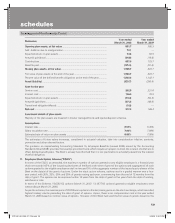

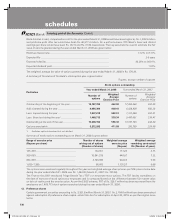

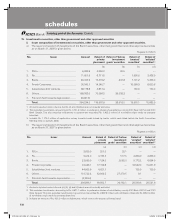

11. Employee Stock Option Scheme (“ESOS”)

In terms of the ESOS, as amended, the maximum number of options granted to any eligible employee in a financial year

shall not exceed 0.05% of the issued equity shares of the Bank at the time of grant of the options and aggregate of all such

options granted to the eligible employees shall not exceed 5% of the aggregate number of the issued equity shares of the

Bank on the date(s) of the grant of options. Under the stock option scheme, options vest in a graded manner over a four-

year period, with 20%, 20%, 30% and 30% of grants vesting each year, commencing from the end of 12 months from the

date of grant. The options can be exercised within 10 years from the date of grant or five years from the date of vesting,

whichever is later.

In terms of the Scheme, 15,638,152 options (March 31, 2007: 13,187,783 options) granted to eligible employees were

outstanding at March 31, 2008.

As per the scheme, the exercise price of ICICI Bank’s options is the last closing price on the stock exchange, which recorded

highest trading volume preceding the date of grant of options. Hence, there is no compensation cost in the year ended

March 31, 2008 based on intrinsic value of options. However, if ICICI Bank had used the fair value of options based on the

ICICI_BK_AR_2008_(F1_F46).indd 29ICICI_BK_AR_2008_(F1_F46).indd 29 6/20/08 3:25:23 PM6/20/08 3:25:23 PM