ICICI Bank 2008 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F33

schedules

forming part of the Accounts (Contd.)

Rupees in million

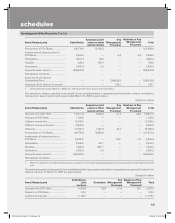

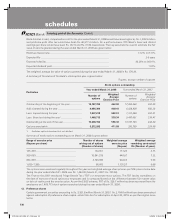

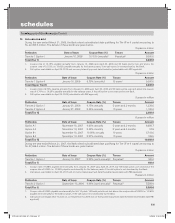

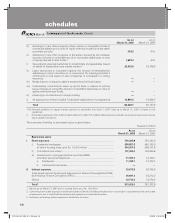

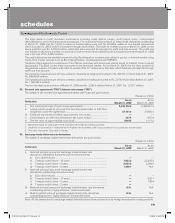

Particulars Date of Issue Coupon Rate (%) Tenure Amount

Tranche 2 Option I July 17, 2006 9.50% annual115 years210,000.0

Total (Upper Tier II) 10,000.0

1. Coupon rate of 9.50% for first 10 years. For next 5 years, 50 basis points over and above coupon rate of 9.50% i.e. 10.00%, if the call

option is not exercised by the Bank.

2. Call option after 10 years, i.e. on July 17, 2016 (exercisable with RBI approval).

Rupees in million

Particulars Date of Issue Coupon Rate (%) Tenure Amount

Tranche 1 Option I July 11, 2006 9.00% annual 10 years 20,000.0

Total (Tier II) 20,000.0

Rupees in million

Particulars Date of Issue Coupon Rate (%) Tenure Amount

Tranche 5 Option I June 22, 2006 8.95% annual115 years22,552.0

Total (Upper Tier II) 2,552.0

1. Coupon rate of 8.95% for first 10 years. For next 5 years, 50 basis points over and above the coupon rate of 8.95% i.e. 9.45% if the call

option is not exercised by the Bank.

2. Call option after 10 years, i.e. on June 22, 2016 (exercisable with RBI approval).

Rupees in million

Particulars Date of Issue Coupon Rate (%) Tenure Amount

Tranche 4 Option I May 19, 2006 8.50% annual 10 years 230.0

Tranche 4 Option II May 19, 2006 8.60% annual 12 years 140.0

Tranche 4 Option III May 19, 2006 8.40% annual 5 years and 11 months 350.0

Total (Tier II) 720.0

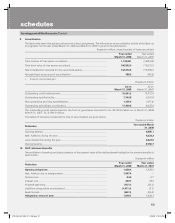

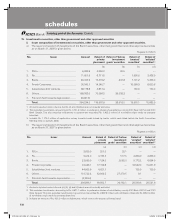

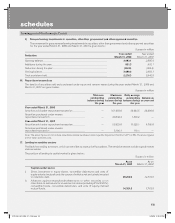

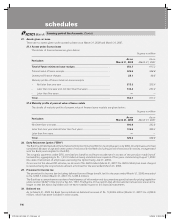

14. Investments

The details of investments and the movement of provisions held towards depreciation of investments of the Bank as on

March 31, 2008 and March 31, 2007 are given below:

Rupees in million

Particulars As on

March 31, 2008

As on

March 31, 2007

1. Value of Investments

(i) Gross value of investments

a) In India ........................................................................................... 1,056,883.5 873,108.3

b) Outside India ................................................................................. 64,358.5 45,052.7

(ii) Provision for depreciation

a) In India ........................................................................................... (5,719.8) (5,568.1)

b) Outside India ................................................................................. (978.7) (14.5)

(iii) Net value of investments

a) In India ........................................................................................... 1,051,163.7 867,540.2

b) Outside India ................................................................................. 63,379.8 45,038.2

2. Movement of provisions held towards depreciation on investments

(i) Opening balance ................................................................................... 5,582.6 5,066.4

(ii) Add: Provisions made during the year ................................................. 2,622.7 948.9

(iii) Less: Write-off/write back of excess provisions during the year ......... (1,506.8) (432.7)

(iv) Closing balance ..................................................................................... 6,698.5 5,582.6

ICICI_BK_AR_2008_(F1_F46).indd 33ICICI_BK_AR_2008_(F1_F46).indd 33 6/20/08 3:25:36 PM6/20/08 3:25:36 PM