ICICI Bank 2008 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F111

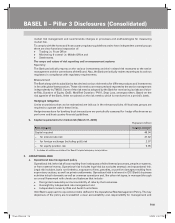

Risk measurement and reporting framework:

The various tools employed by the Bank for IRRBB have been summarised below:

Interest rate sensitivity gap report: The gap or mismatch risk as at a given date, is measured by calculating

gaps over different time intervals. Gap analysis measures mismatches between rate sensitive liabilities

(RSL) and rate sensitive assets (RSA) (including off-balance sheet positions). The report is prepared

by grouping liabilities, assets and off-balance sheet positions into time buckets according to residual

maturity or next re-pricing period, whichever is earlier. Further, the behavioral assumptions for various

categories of retail loans are employed to estimate the behavioral cash flows. The Bank also employs

behavioral assumptions to ascertain the interest rate sensitive portion of savings account balances for

the domestic operations. The difference between RSA and RSL for each time bucket signifies the gap

in that time bucket. The gap report provides a good framework for determining the earnings impact. A

similar report is generated for overseas locations. However, given that the balance sheet components of

overseas subsidiaries are distinct and may not have sufficient historical data for determining behavioral

assumptions, the groupings of assets and liabilities may differ from that of domestic operations.

EaR & mark to market (MTM): Any change in interest rate would impact Bank’s net interest income (NII)

and the value of its fixed income portfolio (price risk). The interest rate risk is measured by EaR, that is

the sensitivity of the NII to a 100 basis points adverse change in the level of interest rates. In addition,

the price risk of the MTM book is measured through the potential impact of a 100 basis points increase

on the MTM book. The MTM book, including securities held for statutory liquidity ratio requirements of

RBI, comprises all fixed income securities in available for sale and held for trading books, interest rate

swaps, and any other derivatives, which have to be marked to market. The magnitude of the impact as

a percentage of the capital gives a fair measure of the earnings risk that the Bank is exposed to.

DoE: A long-term impact of changing interest rates is on the Bank’s market value of equity as the economic

value of the Bank’s assets, liabilities and off-balance sheet positions get affected due to variation in market

interest rates. Duration is a measure of interest rate sensitivity of assets, liabilities and also equity. It

may be defined as the percentage change in the market value of an asset or liability (or equity) for a 1%

change in interest rates. The Bank measures the DoE across all locations and major currencies.

Basis risk measure: The assets and liabilities on the balance sheet are priced based on multiple benchmarks

and when interest rates fluctuate, all these various yield curves may not necessarily move in tandem

exposing the balance sheet to basis risk. The Bank measures the impact on net interest margin (NIM)

/ EaR after taking into account various possible movement in interest rates across benchmark curves.

Various scenarios of interest rate movements (across various benchmark yield curves) are identified and

the impact on the earnings and economic value of the Bank is calculated for each of these scenarios.

These scenarios take into account the magnitude as well as the timing of various interest rate movements

(across curves).

These reports are prepared on a fortnightly basis for measurement of interest rate risk. The Bank has well-

established procedures for determining and monitoring continuance and effectiveness for instruments

designated as hedges.

Hedging policy

US Dollar (USD) is the base currency for the overseas branches and subsidiaries of the Bank, apart from

the branches/subsidiaries where the currency is not convertible. Given the size of operations, the Bank

has a well diversified borrowing programme that allows it to reduce the dependence on liabilities that

carry undue risk while also allowing more efficient pricing. However at the same time, as most of the

lending is denominated in USD, the Bank usually swaps the borrowings in other currencies into USD.

Similarly assets in currencies other than USD are funded from USD resources on a swapped basis. Any

currency position on account of lending / borrowing transactions is included in the Net Overnight Open

Position (NOOP) of the Bank and monitored against the limit approved by RBI and other regulators.

BASEL II – Pillar 3 Disclosures (Consolidated)

1P-less_(Pillar).indd 1111P-less_(Pillar).indd 111 6/20/08 4:53:24 PM6/20/08 4:53:24 PM