ICICI Bank 2008 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F57

schedules

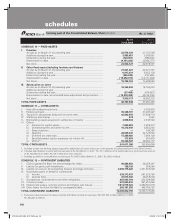

SCHEDULE 8 — INVESTMENTS

I. Investments in India (net of provisions)

i) Government securities ........................................................................ 786,560,746 696,367,000

ii) Other approved securities................................................................... 97,946 601

iii) Shares (includes equity and preference shares)1 ............................... 47,118,726 40,895,698

iv) Debentures and bonds ....................................................................... 49,447,032 45,829,459

v) Assets held to cover linked liabilities of life insurance business ...... 248,450,720 128,906,303

vi) Others (commercial paper, mutual fund units, pass through

certificates, security receipts etc.) ...................................................... 210,887,719 114,689,000

TOTAL INVESTMENTS IN INDIA ............................................................. 1,342,562,889 1,026,688,061

II. Investments outside India (net of provisions)

i) Government securities ........................................................................ 40,889,298 20,748,958

ii) Others .................................................................................................. 217,005,392 158,729,879

TOTAL INVESTMENTS OUTSIDE INDIA ................................................. 257,904,690 179,478,837

TOTAL INVESTMENTS ..................................................................................... 1,600,467,579 1,206,166,898

III. Investments in India

Gross value of investments2 ...................................................................... 1,340,676,954 1,026,171,288

Less: Aggregate of provision/depreciation/(appreciation) ........................ (1,885,935) (516,773)

Net investments ......................................................................................... 1,342,562,889 1,026,688,061

IV. Investments outside India

Gross value of investments ....................................................................... 267,772,200 179,552,465

Less: Aggregate of provision/depreciation/(appreciation) ........................ 9,867,510 73,628

Net investments ......................................................................................... 257,904,690 179,478,837

TOTAL INVESTMENTS ..................................................................................... 1,600,467,579 1,206,166,898

1. Includes investment in associate of Rs. 95.4 million (March 31, 2007 : Rs. Nil).

2, Net of appreciation of Rs. 19,534.4 million (March 31, 2007 : Rs. 13,258.4 million) on investment held to cover linked liabilities of life

insurance business.

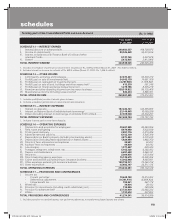

SCHEDULE 9 — ADVANCES (net of provisions)

A. i) Bills purchased and discounted .......................................................... 47,896,278 47,473,577

ii) Cash credits, overdrafts and loans repayable on demand ................. 351,458,670 334,781,882

iii) Term loans........................................................................................... 2,009,110,336 1,659,223,017

iv) Securitisation, finance lease and hire purchase receivables1 ............. 105,551,409 72,515,937

TOTAL ADVANCES ................................................................................... 2,514,016,693 213,994,413

B. i) Secured by tangible assets [includes advances against book debts] 1,928,756,159 1,602,564,461

ii) Covered by bank/government guarantees .......................................... 42,087,202 87,960,211

iii) Unsecured ........................................................................................... 543,173,332 423,469,741

TOTAL ADVANCES ................................................................................... 2,514,016,693 2,113,994,413

C. I. Advances in India

i) Priority sector .............................................................................. 606,025,758 555,491,571

ii) Public sector ................................................................................ 3,559,887 4,017,005

iii) Banks ........................................................................................... 45,947 906,063

iv) Others .......................................................................................... 1,229,874,572 1,194,443,625

TOTAL ADVANCES IN INDIA ................................................................... 1,839,506,164 1,754,858,264

II. Advances outside India

i) Due from banks ........................................................................... 53,593,670 50,979,277

ii) Due from others

a) Bills purchased and discounted .......................................... 21,006,755 24,521,767

b) Commercial loans................................................................ 324,669,709 178,608,073

c) Others .................................................................................. 275,240,395 105,027,032

TOTAL ADVANCES OUTSIDE INDIA ....................................................... 674,510,529 359,136,149

TOTAL ADVANCES ........................................................................................... 2,514,016,693 2,113,994,413

1. Includes receivables under lease amounting to Rs. 349.2 million (March 31, 2007 : Rs. 577.9 million).

(Rs. in ‘000s)

forming part of the Consolidated Balance Sheet (Contd.)

As on As on

31.03.2008 31.03.2007

ICICI_BK_AR_2008_(F47_F92).indd 57ICICI_BK_AR_2008_(F47_F92).indd 57 6/20/08 3:31:47 PM6/20/08 3:31:47 PM