ICICI Bank 2008 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

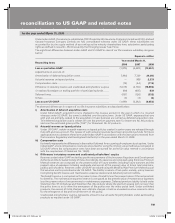

F96

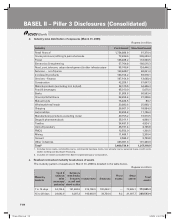

c. Amount of Tier-2 capital (March 31, 2008)

Rupees in billion

Tier-2 capital elements Amount

General provisions & loss reserves 15.69

Upper Tier-2 instruments 30.53

Lower Tier-2 capital instruments 104.10

Gross Tier-2 capital 150.32

Deductions :

Investments in paid-up equity of financial subsidiaries/associates 17.49

Securitisation exposure including credit enhancement 14.71

Other deductions 0.28

Net Tier-2 capital 117.85

d. Debt capital instruments eligible for inclusion in Tier-1 and Tier-2 capital

Rupees in billion

Tier-1 Upper Tier-2 Lower Tier-2

Total amount outstanding at March 31, 2008 26.57 30.53 131.47

Amount raised during current financial year 5.00 5.00 13.40

Amount eligible to be reckoned as capital funds 26.57 30.53 104.10

e. Total eligible capital (March 31, 2008)

Rupees in billion

Amount

Eligible Tier-1 capital 448.96

Eligible Tier-2 capital 117.85

Total eligible capital 566.81

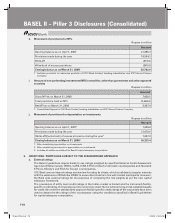

3. CAPITAL ADEQUACY

a. Capital assessment

ICICI Bank is subjected to the capital adequacy guidelines stipulated by RBI which are based on the

framework of the Basel Committee on Banking Supervision. As per the capital adequacy guidelines

under Basel I, the Bank is required to maintain a minimum ratio of total capital to risk weighted assets

(CRAR) of 9.0%, at least half of which is required to be Tier-1 capital. In April 2007, RBI issued the final

guidelines on Basel II. As per Basel II guidelines, applicable from March 31, 2008, ICICI Bank is required

to maintain a minimum CRAR of 9.0%, with minimum Tier I capital ratio of 6%. ICICI Bank is required

to maintain capital at the level required by Basel I or Basel II, whichever is higher. The minimum

capital required to be maintained by ICICI Bank as per Basel II guidelines is higher than that under

Basel I guidelines. Assessment of the Bank’s capital requirements is carried out on a periodic basis.

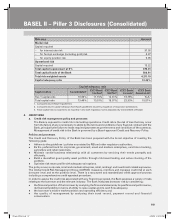

b. Capital requirements for various risk areas (March 31, 2008)

Rupees in billion

Risk area Amount

Credit risk

Capital required

– Portfolio subject to standardized approach 311.96

– Securitisation exposure 1.89

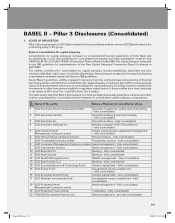

BASEL II – Pillar 3 Disclosures (Consolidated)

1P-less_(Pillar).indd 961P-less_(Pillar).indd 96 6/20/08 4:52:32 PM6/20/08 4:52:32 PM