ICICI Bank 2008 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F105

l Underwriter: allowing un-subscribed portions of securitized debt issuances, if any to devolve on

the Bank, with the intent of selling at a later stage.

l Investor / trader / market-maker: acquiring investment grade securitized debt instruments backed

by financial assets originated by third parties for purposes of investment / trading / market-making

with the aim of developing an active secondary market in securitized debt.

l Structurer: structuring appropriately in a form and manner suitably tailored to meet investor

requirements while being compliant with extant regulations.

l Provider of liquidity facilities: addressing temporary mismatches on account of the timing

differences between the receipt of cash flows from the underlying performing assets and the

fulfillment of obligations to the beneficiaries.

l Provider of credit enhancement facilities: addressing delinquencies associated with the

underlying assets, i.e. bridging the gaps arising out of credit considerations between cash flows

received / collected from the underlying asset and the fulfillment of repayment obligations to the

beneficiaries.

l Provider of collection and processing services: collecting and/or managing receivables from

underlying obligors, contribution from the investors to securitisation transactions, making payments

to counterparties / appropriate beneficiaries, reporting the collection efficiency and other performance

parameters and providing other services relating to collections and payments as may be required

for the purpose of the transactions.

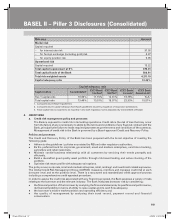

b. Summary of the Bank’s accounting policies for securitisation activities

The Bank transfers commercial and consumer loans to special purpose vehicles (SPVs) settled as

trusts through securitisation transactions. The transferred loans are de-recognised and gains/losses are

accounted for only if the Bank surrenders the rights to benefits specified in the loan contracts. Recourse

and servicing obligations are accounted for net of provisions.

In accordance with the RBI guidelines, with effect from February 1, 2006, the Bank accounts for any

loss arising from securitisation immediately at the time of sale and the profit/premium arising from

securitisation is amortised over the life of the securities issued or to be issued by the special purpose

vehicle to which the assets are sold. In the case of loans sold to an asset reconstruction company, the

gain, if any, is ignored.

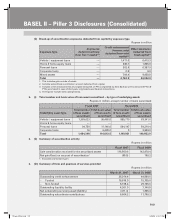

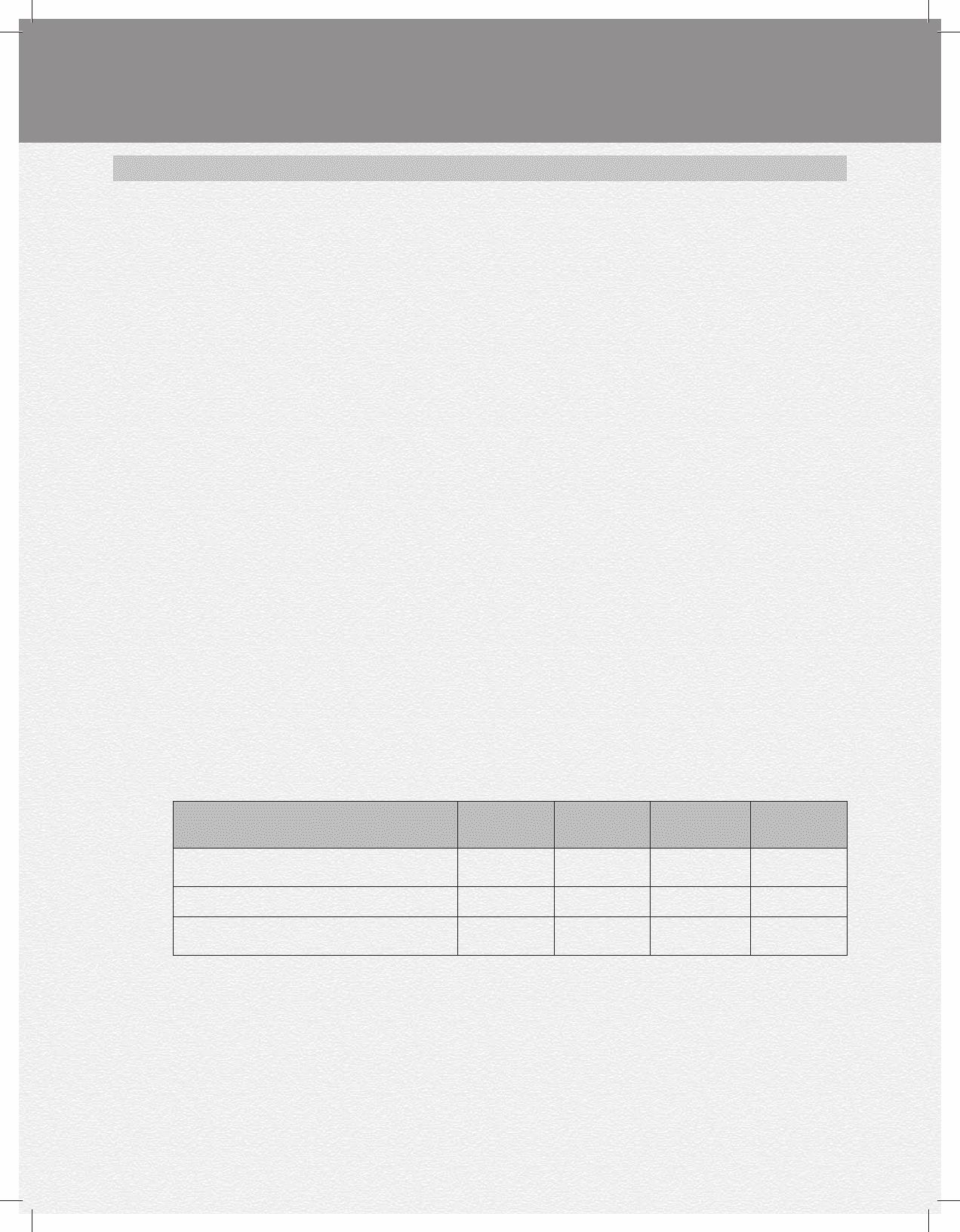

Key assumptions in measuring the fair value of retained interests at the date of sale or securitisation

during the year ended March 31, 2008 and also for subsequent measurement of retained interests as

on March 31, 2008 are given in the table below.

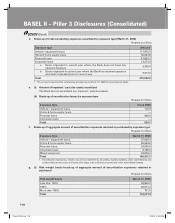

Auto

loans Personal

loans Two wheeler

loans Mortgage

loans

Discount rate 7.0% to

15.8% 7.0% to

25.6% 7.0% to

18.8% 7.0% to

10.2%

Constant prepayment rate (per annum) 15.0% 42.0% 12.0% 10.0%

Anticipated net credit losses (per annum) 0.5% to

0.8% 3.0% to

5.7% 2.0% to

3.6% 0.2% to

0.3%

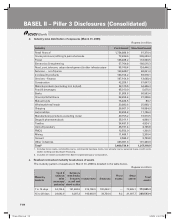

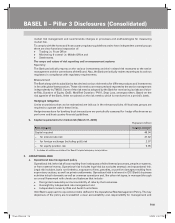

c. Rating of securitisation exposures

Ratings obtained from domestic accredited rating agencies like CARE, CRISIL, ICRA and Fitch (India) are

used for securisation exposures. Presently, the type of securitisation exposures, for which these ratings

are used, are:

l Securitized debt instruments / Pass through certificates (PTCs)

l Second loss credit enhancement facility and

l Liquidity facility.

BASEL II – Pillar 3 Disclosures (Consolidated)

1P-less_(Pillar).indd 1051P-less_(Pillar).indd 105 6/20/08 4:53:03 PM6/20/08 4:53:03 PM