ICICI Bank 2008 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

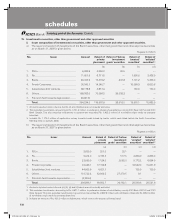

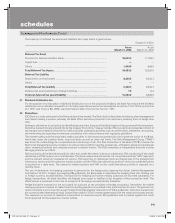

F42

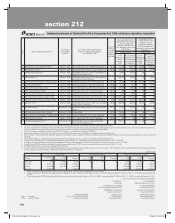

Rupees in million

As on March 31, 2008

Sr.

No. Particulars Currency

derivatives1

Interest rate

derivatives2

1. Derivatives (Notional principal amount)3

a) For hedging ..................................................................................................... 27,056.3 206,265.5

b) For trading ....................................................................................................... 993,177.9 6,318,496.0

2. Marked to market positions4

a) Asset (+) ......................................................................................................... 30,085.1 184.5

b) Liability (-) ........................................................................................................ ——

3. Credit exposure5 .................................................................................................... 109,607.8 83,103.4

4. Likely impact of one percentage change in interest rate (100*PV01)6

a) On hedging derivatives7 .................................................................................. 559.5 8,879.2

b) On trading derivatives ..................................................................................... 1,777.8 2,270.7

5. Maximum and minimum of 100*PV01 observed during the year

a) On hedging7

Maximum ........................................................................................................ (11.6) (4,268.4)

Minimum ......................................................................................................... (714.7) (9,467.8)

b) On trading .......................................................................................................

Maximum ........................................................................................................ (313.2) 2,809.2

Minimum ......................................................................................................... (1,870.9) 464.9

1. Options and cross currency interest rate swaps are included in currency derivatives.

2. Foreign currency interest rate swaps, forward rate agreements and swaptions are included in interest rate derivatives.

3. Excludes notional amount of options sold for Rs. 597,333.2 million.

4. For trading portfolio including accrued interest. Represents net positions.

5. Includes accrued interest.

6. Amounts given are absolute values.

7. The swap contracts entered for hedging purpose would have an opposite and offsetting impact with the underlying on-balance sheet

items.

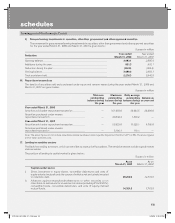

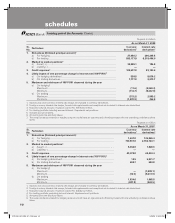

Rupees in million

As on March 31, 2007

Sr.

No Particulars Currency

derivatives1

Interest rate

derivatives2

1. Derivatives (Notional principal amount)3

a) For hedging ................................................................................................. 1,441.0 145,066.4

b) For trading ................................................................................................... 730,931.6 2,794,743.1

2. Marked to market positions4

a) Asset (+) ..................................................................................................... 5,044.8 1,828.6

b) Liability (-) .................................................................................................... ——

3. Credit exposure ................................................................................................. 40,376.0 42,433.4

4. Likely impact of one percentage change in interest rate (100*PV01)5

a) On hedging derivatives6 .............................................................................. 12.5 5,031.7

b) On trading derivatives ................................................................................. 683.7 684.8

5. Maximum and minimum of 100*PV01 observed during the year

a) On hedging6

Maximum .................................................................................................... — (1,098.1)

Minimum ..................................................................................................... (14.5) (5,031.9)

b) On trading

Maximum .................................................................................................... 1,934.0 1,965.5

Minimum ..................................................................................................... (847.8) (369.5)

1. Options and cross currency interest rate swaps are included in currency derivatives.

2. Foreign currency interest rate swaps, forward rate agreements and swaptions are included in interest rate derivatives.

3. Excludes notional amount of options sold for Rs. 444,221.2 million.

4. For trading portfolio excluding accrued interest. Represents net positions.

5. Amounts given are absolute values.

6. The swap contracts entered for hedging purpose would have an opposite and offsetting impact with the underlying on-balance sheet

items.

schedules

forming part of the Accounts (Contd.)

ICICI_BK_AR_2008_(F1_F46).indd 42ICICI_BK_AR_2008_(F1_F46).indd 42 6/20/08 3:26:05 PM6/20/08 3:26:05 PM