ICICI Bank 2008 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F80

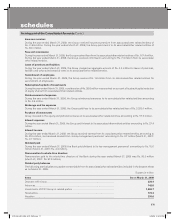

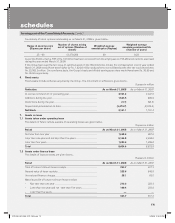

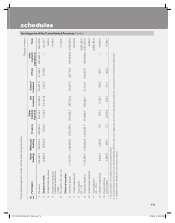

Business segments for the year ended March 31, 2007

For the year ended March 31, 2007, the primary segments were reported as follows:

1. Consumer and Commercial Banking comprising of the retail and corporate banking business of the Bank and its banking

subsidiaries i.e. ICICI Bank UK PLC., ICICI Bank Canada, ICICI Bank Eurasia LLC. and ICICI Home Finance Company

Limited.

2. Investment Banking comprising of the treasury operations of the Bank and its banking subsidiaries i.e. ICICI Bank UK PLC.,

ICICI Bank Canada and ICICI Bank Eurasia LLC., ICICI Securities Primary Dealership Limited (formerly ICICI Securities Limited),

ICICI Securities Limited (formerly ICICI Brokerage Services Limited), ICICI Securities Inc., and ICICI Securities Holdings Inc.,

ICICI Venture Funds Management Company Limited, ICICI Eco-net Internet and Technology Fund, ICICI Equity Fund, ICICI

Strategic Investments Fund, ICICI Emerging Sectors Fund and ICICI International Limited.

3. Insurance comprising of ICICI Prudential Life Insurance Company Limited and ICICI Lombard General Insurance Company

Limited.

4. Others comprising of ICICI Prudential Asset Management Company Limited, ICICI Prudential Trust Limited, ICICI Property

Trust, ICICI Investment Management Company Limited, ICICI Trusteeship Services Limited, TCW/ICICI Investment Partners

LLC., TSI Ventures (India) Private Limited.

Inter-segment transactions are generally based on transfer pricing measures as determined by the management. Income,

expenses, assets and liabilities are either specifically identified with individual segments or are allocated to segments on

a systematic basis.

The business segment results on this basis are given below.

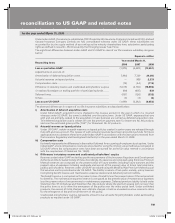

Rupees in million

Sr.

no. Particulars Consumer and

commercial

banking

Investment

Banking Insurance Others Total

1 Revenue (before extraordinary profit) 242,354.5 88,495.9 101,415.6 2,393.1 434,659.1

2 Less: Inter-segment revenue (21,021.2)

3 Total revenue (1) – (2) 413,637.9

4 Segment results 25,145.5 13,875.3 (3,917.8) 528.1 35,631.1

5 Unallocated expenses 384.0

6 Income tax expenses (net)/(net

deferred tax credit) 7,640.8

7 Net profit

(4) – (5) – (6) 27,606.3

Other information

8 Segment assets 2,253,171.9 1,455,864.0 188,501.7 (191.3) 3,897,346.3

9 Unallocated assets146,000.9

10 Total assets

(8) + (9) 3,943,347.2

11 Segment liabilities 2,705,812.3 1,051,307.62180,044.8 6,182.5 3,943,347.2

12 Unallocated liabilities —

13 Total liabilities

(11) + (12) 3,943,347.2

Note: The figures reported are net of inter-company transactions.

1. Includes tax paid in advance/tax deducted at source (net), deferred tax asset (net) and early retirement option expenses

not written off.

2. Includes share capital and reserves and surplus.

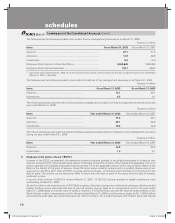

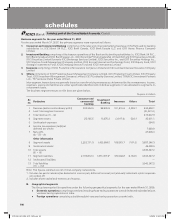

B. Geographical segments

The Group has reported its operations under the following geographical segments for the year ended March 31, 2008:

l Domestic operations comprising branches (including those having operations outside India) and subsidiaries/joint

ventures having operations in India.

l Foreign operations comprising subsidiaries/joint ventures having operations outside India.

forming part of the Consolidated Accounts (Contd.)

schedules

ICICI_BK_AR_2008_(F47_F92).indd 80ICICI_BK_AR_2008_(F47_F92).indd 80 6/20/08 3:33:03 PM6/20/08 3:33:03 PM