ICICI Bank 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

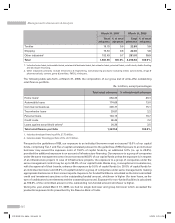

guarantees. Margins available to reimburse losses realised under guarantees amounted to Rs. 10.61 billion at

year-end fiscal 2008 and Rs. 11.93 billion at year-end fiscal 2007. Other property or security may also be available

to us to cover losses under guarantees.

We are obligated under a number of capital contracts. Capital contracts are job orders of a capital nature, which

have been committed. As of the balance sheet date, work had not been completed to this extent. Estimated amounts

of contracts remaining to be executed on capital account aggregated Rs. 17.40 billion at year-end fiscal 2008

compared to Rs. 3.43 billion at year-end fiscal 2007 primarily on account of new branches and office premises.

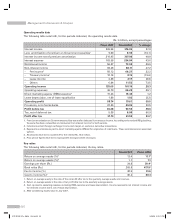

Capital Adequacy

Rs. in billion, except percentages

As per RBI guidelines

under Basel I

As per RBI

guidelines

under Basel II

March 31,

2007 March 31,

2008 March 31,

2008

Tier-1 capital 215.03 381.34 421.72

Tier-2 capital 123.93 121.21 78.86

Total capital 338.96 502.55 500.59

Credit Risk – Risk Weighted Assets (RWA) 2,579.68 2,998.08 3,173.33

Market Risk – RWA 320.25 369.46 258.74

Operational Risk – RWA — —152.50

Total risk weighted assets 2,899.93 3,367.55 3,584.57

Tier-1 capital adequacy ratio 7.42% 11.32% 11.76%

Tier-2 capital adequacy ratio 4.27% 3.60% 2.20%

Total capital adequacy ratio 11.69% 14.92% 13.97%

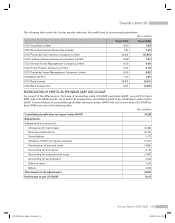

We are subject to the capital adequacy norms stipulated by RBI. As per the earlier capital adequacy guidelines

(Basel I), we were required to maintain a minimum ratio of total capital to risk adjusted assets and off-balance

sheet items of 9%, at least half of which must be Tier-1 capital. On April 27, 2007, RBI issued Prudential Guidelines

on Capital Adequacy and Market Discipline – Implementation of the New Capital Adequacy Framework, which

are applicable to all banks with international presence, from March 31, 2008. Under the new guidelines (Basel II),

which are now applicable to us, we are required to maintain a minimum ratio of total capital to risk adjusted assets

of 9%, with a minimum Tier-1 capital ratio of 6%. The other key changes under the new guidelines are:

l Investment above 30% in paid-up equity capital, of financial entities which are not consolidated for capital

adequacy (including insurance entities) and investments in other instruments eligible for regulatory capital

status in those entities have been deducted 50% from Tier-1 and 50% from Tier-2 capital, while earlier only

equity investments in subsidiaries were deducted entirely from Tier-1 capital.

l Capital charge has been introduced for operational risk.

l Under the Basel I guidelines, residential mortgages attract risk weight of 50% for loans upto Rs. 2.0 million

and 75% for loans greater than Rs. 2.0 million. Under the Basel II guidelines, residential mortgages attract a

risk weight of 50% for loans upto Rs. 2.0 million with loan-to-value ratio less than 75%, 75% for loans greater

than Rs. 2.0 million with loan-to-value ratio less than 75% and 100% for all other loans.

l Under the Basel I guidelines, claims on corporates are risk weighted at 100%, while corporate claims are risk

weighted as per the external rating of the corporate under the Basel II guidelines. Further, RBI has stipulated

that for fiscal 2009, all fresh sanctions or renewals in respect of unrated claims on corporates in excess of

Rs. 500.0 million would attract a risk weight of 150%. With effect from April 1, 2009, all fresh sanctions or

renewals in respect of unrated claims on corporates in excess of Rs. 100.0 million will attract a risk weight

of 150%.

Management’s Discussion & Analysis

56

ICICI BANK_(Fin_Matter 1-64).ind56 56ICICI BANK_(Fin_Matter 1-64).ind56 56 6/20/08 5:03:14 PM6/20/08 5:03:14 PM