ICICI Bank 2008 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F70

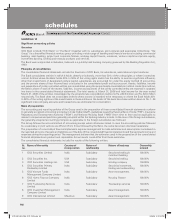

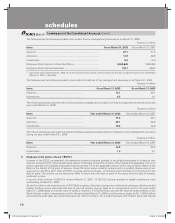

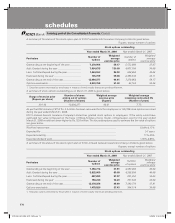

Rupees in million, except number of shares

Details No. of equity

shares

Amount of

securities

premium

Aggregate

proceeds

Equity shares of Rs. 10 each at a premium of Rs. 930 per share .............. 61,923,519 57,588.9 58,208.1

Equity shares of Rs. 10 each at a premium of Rs. 880 per share1 ............ 32,912,238 28,962.7 29,291.9

Equity shares of Rs. 10 each at a premium of

Rs. 930 per share issued under green-shoe options .................................. 13,762,869 12,799.5 12,937.1

49,949,238 American Depository Share (“ADSs”) at a price

of US$ 49.25 per ADSs 1,2,3 .......................................................................... 99,898,476 98,237.4 99,236.4

Total 208,497,102 197,588.5 199,673.5

1. Includes 6,497,462 ADSs issued on exercise of the green-shoe option.

2. 1 ADS = 2 equity shares of Rs.10 each.

3. Converted at US$ 1 = Rs. 40.34, being noon buying rate on the date of allotment.

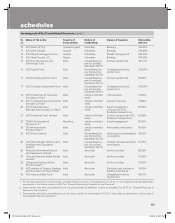

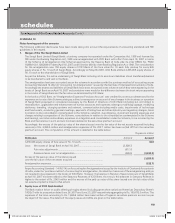

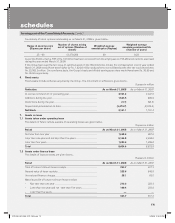

3. Earnings per share (“EPS”)

Basic and diluted earnings per equity share are computed in accordance with Accounting Standard 20, “Earnings per Share”.

Basic earnings per share is computed by dividing net profit after tax by the weighted average number of equity shares

outstanding during the year. The diluted earnings per share is computed using the weighted average number of equity

shares and dilutive potential equity shares outstanding during the year.

The computation of earnings per share is given below.

Rupees in million, except per share data

Year ended

March 31, 2008

Year ended

March 31, 2007

Basic

Weighted average no. of equity shares outstanding.......................................... 1,055,591,068 892,820,768

Net profit ............................................................................................................. 33,982.3 27,606.3

Basic earnings per share (Rs.) ........................................................................... 32.19 30.92

Diluted

Weighted average no. of equity shares outstanding.......................................... 1,062,103,167 897,743,476

Net profit ............................................................................................................. 33,982.3 27,606.3

Diluted earnings per share (Rs.) ......................................................................... 32.00 30.75

Normal value per share (Rs.) ............................................................................... 10.00 10.00

The dilutive impact is mainly due to options granted to employees by the Bank.

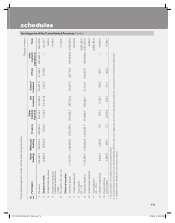

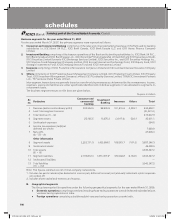

4. Related party transactions

The Group has transactions with its related parties and key management personnel.

Associates/other related entities

Financial Information Network & Operations Limited, I-Process Services (India) Private Limited, I-Solutions Providers (India)

Private Limited, NIIT Institute of Finance, Banking and Insurance Training Limited, ICICI Venture Value Fund, Comm Trade

Services Limited, Loyalty Solutions & Research Limited, Café Network Limited, Traveljini.com Limited and Firstsource

Solutions Limited (Bank’s holding is 24.97% as on March 31, 2008).

With respect to entities, which have been identified as related parties from the financial year ended March 31, 2008, previous

year’s comparative figures have not been reported.

Key management personnel include whole-time directors. The following are the significant transactions of the Group with

its associates/other related entities and key management personnel.

forming part of the Consolidated Accounts (Contd.)

schedules

ICICI_BK_AR_2008_(F47_F92).indd 70ICICI_BK_AR_2008_(F47_F92).indd 70 6/20/08 3:32:30 PM6/20/08 3:32:30 PM