ICICI Bank 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

March 31, 2007 to US$ 8,829 million at March 31, 2008 while total deposits grew by 84.2% from US$ 2,812 million

at March 31, 2007 to US$ 5,180 million at March 31, 2008. ICICI Bank UK’s profit after tax was US$ 38.4 million

during fiscal 2008 after taking into account investment valuation charges.

ICICI Bank Canada

ICICI Bank Canada is a full-service direct bank established in Canada as a wholly-owned subsidiary of

ICICI Bank, and offers a wide range of financial solutions to cater to personal, commercial, corporate, investment,

treasury and trade requirements. ICICI Bank Canada’s total assets increased by 92.3% from US$ 2,002 million at

March 31, 2007 to US$ 3,849 million at March 31, 2008. Total deposits increased by 77.7% from US$ 1,796 million

at March 31, 2007 to US$ 3,191 million at March 31, 2008. ICICI Bank Canada recorded a net loss of US$ 14.3

million during fiscal 2008, after taking into account investment valuation charges.

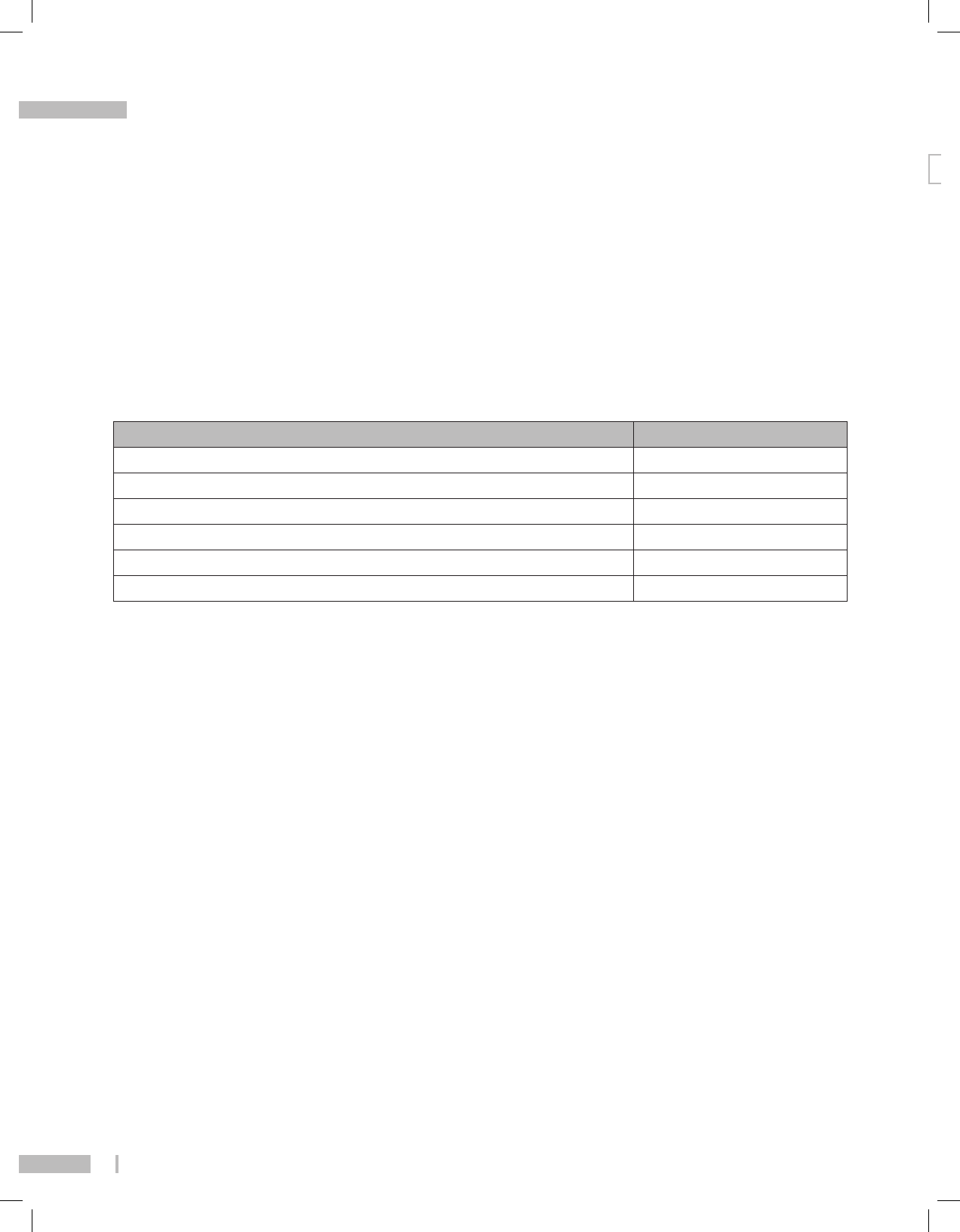

CREDIT RATINGS

ICICI Bank’s credit ratings by various credit rating agencies at March 31, 2008 are given below:

Agency Rating

Moody’s Investor Service (Moody’s) Baa21

Standard & Poor’s (S&P) BBB-1

Credit Analysis & Research Limited (CARE) CARE AAA

Investment Information and Credit Rating Agency (ICRA) AAA

CRISIL Limited AAA

Japan Credit Rating Agency (JCRA) BBB+

1. Senior foreign currency debt ratings.

PUBLIC RECOGNITION

The Bank received several awards during fiscal 2008, including the following:

l ”Best Bank in Asia” by Euromoney

l ”Best Bank in India” by Euromoney

l ”Fabulous 50 companies in Asia” by Forbes Asia

l ”Best Domestic Bank in India” by Asset Triple A

l ”Best Bank of the Year (India)” by The Banker

l ”Best Private Sector Bank” by Outlook Money NDTV Profit Awards 2007

l ”Asia’s Best Financial Borrower 2007“ by Euromoney

l ”Excellence in Remittance Business“ by Asian Banker

l ”Most Preferred Brand” for home loans, auto loans, credit cards and financial advisory services by CNBC

Awaaz

l ”Innovative Technology Award” by CIO

l ”Best Regional Private Bank” by The Banker

l ”Excellence in Financial Reporting” by Institute of Chartered Accountants of India (ICAI)

Business Overview

44

ICICI BANK_(Fin_Matter 1-64).ind44 44ICICI BANK_(Fin_Matter 1-64).ind44 44 6/20/08 5:03:10 PM6/20/08 5:03:10 PM