ICICI Bank 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

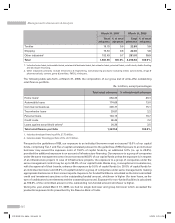

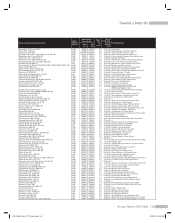

SEGMENTAL INFORMATION

Till fiscal year 2007, ICICI Bank reported segment-wise information for the following two business segments:

l ‘Consumer and Commercial Banking’, comprising retail and corporate banking operations of the Bank.

l ‘Investment Banking’ comprising treasury operations of the Bank.

RBI issued revised guidelines on segment reporting applicable from fiscal 2008. Accordingly, the Bank has

adopted a new basis of segment reporting and hence figures for previous year are not comparable. As per the

new guidelines, the business operations of the Bank have following segments:

l Retail Banking includes exposures which satisfy the four criteria of orientation, product, granularity and low value

of individual exposures for retail exposures laid down in Basel Committee on Banking Supervision document

“International Convergence of Capital Measurement and Capital Standards: A Revised Framework”.

l Wholesale Banking includes all advances to trusts, partnership firms, companies and statutory bodies which

are not included under the Retail Banking.

l Treasury includes the entire investment portfolio of the Bank.

l Other Banking includes hire purchase and leasing operations and also includes gain/loss on sale of banking

& non-banking assets and other items not attributable to any particular business segment.

Retail Banking segment reported segment revenue of Rs. 244.18 billion and profit before tax of Rs. 10.83

billion, wholesale banking segment reported segment revenue of Rs. 249.49 billion and profit before tax of

Rs. 36.24 billion, treasury banking segment reported segment revenue of Rs. 290.98 billion and profit before tax of

Rs. 5.16 billion and other banking segment reported segment revenue of Rs. 2.75 billion and profit before tax of

Rs. 0.25 billion.

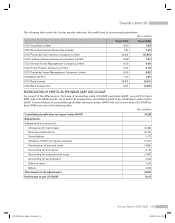

CONSOLIDATED FINANCIALS AS PER INDIAN GAAP

The consolidated profit after tax for fiscal 2008 including the results of operations of our subsidiaries and other

consolidating entities was Rs. 33.98 billion as compared to Rs. 27.61 billion for fiscal 2007.

ICICI Prudential Life Insurance Company incurred a loss of Rs.13.95 billion in fiscal 2008 mainly due to higher

business set-up costs in the initial years of rapid growth, non-amortisation of acquisition costs and reserving for

actuarial liability in line with the insurance company accounting norms. These factors have resulted in statutory

losses for the life insurance business since the company’s inception, as its business has grown rapidly year on

year. The impact on consolidated profits on account of the loss is Rs.10.31 billion.

During fiscal 2008, the financial markets globally experienced significant widening of credit spreads and tightening

of liquidity. The investment portfolio of ICICI Bank UK PLC (ICICI Bank UK) was Rs. 175.13 billion at year-end fiscal

2008 which primarily includes investments in bonds, certificate of deposits and mortgage backed securities (MBS).

In fiscal 2008, a provision for mark-to-market impact of Rs. 2.36 billion was made through the profit and loss

statement on the debt securities held by ICICI Bank UK in its trading portfolio. The investment portfolio of ICICI

Bank Canada was Rs. 58.87 billion at year-end fiscal 2008 which primarily includes investments in treasury bills,

CLNs, CDOs and asset backed commercial paper (ABCP). In fiscal 2008, a provision for mark-to-market impact

and other losses of Rs. 2.23 billion was made through the profit and loss statement on the investments, including

ABCP and credit derivatives portfolio of ICICI Bank Canada. The mark-to-market impact on investments classified as

“Available for sale securities” in UK and Canadian subsidiaries is directly reflected in the shareholders’ equity.

Consolidated assets of the Bank and its subsidiaries increased by 23.2% to Rs. 4,856.17 billion at year-end fiscal 2008

from Rs. 3,943.35 billion at year-end fiscal 2007. Consolidated advances of the Bank and its subsidiaries increased

by 18.9% to Rs. 2,514.02 billion at year-end fiscal 2008 from Rs. 2,113.99 billion at year-end fiscal 2007.

Management’s Discussion & Analysis

62

ICICI BANK_(Fin_Matter 1-64).ind62 62ICICI BANK_(Fin_Matter 1-64).ind62 62 6/20/08 5:03:16 PM6/20/08 5:03:16 PM