ICICI Bank 2008 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

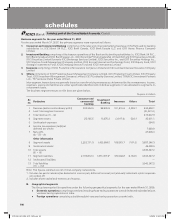

F89

Under Indian GAAP, the insurance subsidiaries (ICICI Prudential Life Insurance Company Limited and ICICI Lombard

General Insurance Company Limited) are fully consolidated whereas under US GAAP, these subsidiaries are

accounted for by the equity method of accounting as the minority shareholders have substantive participating

rights as defined in Issue No. 96-16 issued by the Emerging Issues Task Force.

The significant differences between Indian GAAP and US GAAP in case of our life insurance subsidiary are given

below:

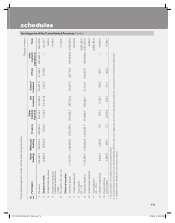

Rupees in million

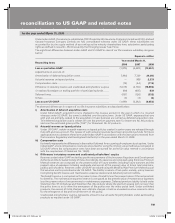

Reconciling items Year ended March 31,

2006 2007 2008

Loss as per Indian GAAP ...................................................................... (1,879) (6,489) (13,951)

Adjustments on account of:

Amortisation of deferred acquisition costs ........................................... 5,660 7,729 24,365

Actuarial reserves on lapsed policies .................................................... — 968 2,333

Compensation costs .............................................................................. (72) (44) (113)

Difference in statutory reserve and unallocated policyholders’ surplus (5,016) (4,792) (18,985)

Un-realised (loss)/gain on trading portfolio of participating funds ........ 808 (605) 833

Deferred taxes ........................................................................................ (597) (126) (532)

Others .................................................................................................... (3) (3) (3)

Loss as per US GAAP ........................................................................... (1,099) (3,362) (6,053)

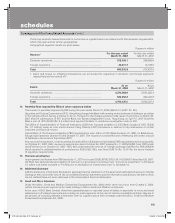

The aforesaid differences in respect of our life insurance subsidiary are described below:

i) Amortisation of deferred acquisition costs

Under Indian GAAP, acquisition cost is charged to the revenue account in the year in which it is incurred

whereas under US GAAP, the same is deferred over the policy term. Under US GAAP, expenses that vary

with and are primarily related to the acquisition of new business are carried as deferred acquisition cost.

This deferred acquisition cost is written off over the premium payment term for Statement No. 60 products

and over the estimated gross profits (“EGP”) for Statement No. 97 products.

ii) Actuarial reserves on lapsed policies

Under US GAAP, certain actuarial reserves on lapsed policies created in earlier years are released through

the profit and loss account. The release of such actuarial reserves have been accounted as funds for future

appropriations as a balance sheet item under Indian GAAP in accordance with the instructions received from

the Insurance Regulatory and Development Authority for the year ended March 31, 2008.

iii) Compensation costs

It primarily represents the differences in the method followed for accounting of employee stock options. Under

Indian GAAP, stock compensation costs are accounted for using the intrinsic value method as compared to

US GAAP where the compensation costs have been accounted for at the fair value method in accordance

with the requirement of Statement No. 123(R).

iv) Differences in statutory reserve and unallocated policyholders’ surplus

Reserves under Indian GAAP are held as per the requirements of the Insurance Regulatory and Development

Authority and the Actuarial Society of India. Accordingly, the reserves are computed using the Gross Premium

Method (reserves are computed as the present value of future benefits including future bonuses and the

present value of expenses including overheads and are net of the present value of future total premiums,

paid by policyholders). Reserves under US GAAP are valued using the Modified Net Premium Method as per

the valuation norms prescribed under US GAAP. The liability consists of two parts, namely, policy reserves

(comprising benefit reserve and maintenance expense reserve) and deferred premium liability.

The benefit reserve is computed as the present value of benefits less the present value of the net premium

for benefits. The maintenance expense reserve is computed as the present value of maintenance expenses

less the present value of net premiums for maintenance expenses. Deferred premium liability is held under

Statement No. 97 limited pay and Statement No. 60 products where the premium paying term is lower than

the policy term so as to allow the emergence of the profits over the entire policy term. Under unit-linked

products, the excess of initial charges over ultimate charges is held as unearned revenue reserve to allow

for the emergence of the profit over the term of the policy.

Unallocated policyholders’ surplus represents amount to be set aside for policyholders’ under participating

products as required under US GAAP.

reconciliation to US GAAP and related notes

for the year ended March 31, 2008

ICICI_BK_AR_2008_(F47_F92).indd 89ICICI_BK_AR_2008_(F47_F92).indd 89 6/20/08 3:33:32 PM6/20/08 3:33:32 PM