ICICI Bank 2008 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Towards a better life

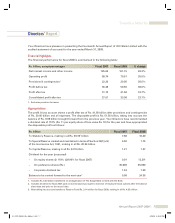

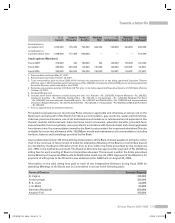

ISSUANCE OF EQUITY CAPITAL

In fiscal 2008, ICICI Bank successfully concluded a capital raising exercise, raising a total of about

Rs. 200.00 billion through a simultaneous public issue in India and issue of American Depositary Shares

(ADS) in the United States. The public issue in India was subscribed 11.5 times and the ADS issue was

subscribed over 5 times. The domestic issue was priced at Rs. 940, representing a premium of 3.6%

to the average closing price from the announcement to the pricing date and the ADS was priced at

USD 49.25, representing a premium of 6.6% over the domestic issue price.

SUBSIDIARY COMPANIES

At March 31, 2008, ICICI Bank had 17 subsidiaries as listed below:

Domestic Subsidiaries International Subsidiaries

ICICI Securities Limited ICICI Bank UK PLC

ICICI Securities Primary Dealership Limited ICICI Bank Canada

ICICI Prudential Life Insurance Company Limited ICICI Wealth Management Inc.1

ICICI Lombard General Insurance Company Limited ICICI Bank Eurasia Limited Liability Company

ICICI Prudential Asset Management Company Limited ICICI Securities Holdings Inc.2

ICICI Prudential Trust Limited ICICI Securities Inc.3

ICICI Venture Funds Management Company Limited ICICI International Limited

ICICI Home Finance Company Limited

ICICI Investment Management Company Limited

ICICI Trusteeship Services Limited

1. Subsidiary of ICICI Bank Canada.

2. Subsidiary of ICICI Securities Limited.

3. Subsidiary of ICICI Securities Holdings Inc.

As approved by the Central Government vide letter dated May 15, 2008 under Section 212(8) of the

Companies Act, 1956, copies of the balance sheet, profit & loss account, report of the board of directors

and report of the auditors of each of the subsidiary companies have not been attached to the accounts

of the Bank for fiscal 2008. The Bank will make available these documents/details upon request by any

Member of the Bank. These documents/details will be available on the Bank’s website www.icicibank.com

and will also be available for inspection by any Member of the Bank at its Registered Office and Corporate

Chanda D. Kochhar

Joint Managing Director & CFO

“We believe that the Indian economy as well as the international markets offer long-term

growth opportunities and we have built a strong foundation in each of these areas. Our fund

raising measures and strengthened capital base have significantly enhanced our ability to

capitalise on various opportunities. We would remain focused and flexible as we attune our

business strategy to the evolving environment. We will continue to leverage our domestic

market leadership and global presence, as well as further enhance our risk management

capabilities and compliance framework, to drive growth”

Annual Report 2007-2008 9

01_ICICI_BANK_(Fin_Matter_1-64).9 901_ICICI_BANK_(Fin_Matter_1-64).9 9 6/20/08 6:42:45 PM6/20/08 6:42:45 PM