ICICI Bank 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F23

schedules

forming part of the Accounts (Contd.)

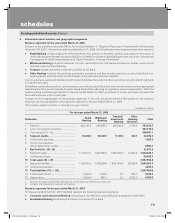

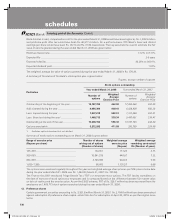

Fees and commission

During the year ended March 31, 2008, the Bank received fees from its subsidiaries amounting to Rs. 5,748.7 million

(March 31, 2007: Rs. 4,427.2 million) and Rs. 72.5 million (March 31, 2007: Rs. Nil) from its associates/joint ventures/

other related entities. During the year ended March 31, 2008, the Bank received commission from its subsidiaries of

Rs. 9.3 million (March 31, 2007: Rs. 10.7 million) and Rs. 7.4 million (March 31, 2007: Rs. Nil) from its associates/joint

ventures/other related entities on account of guarantees and letters of credit issued.

Lease of premises and facilities

During the year ended March 31, 2008, the Bank charged an aggregate amount of Rs. 982.8 million from its subsidiaries

(March 31, 2007: Rs. 711.5 million) and Rs. 3.9 million (March 31, 2007: Rs. Nil) from its associates/joint ventures/other

related entities for lease of premises, facilities and other administrative costs.

Sale of housing loan portfolio

During the year ended March 31, 2008, the Bank sold housing loan portfolio to its subsidiary amounting to Rs. 6,231.4

million (March 31, 2007: Rs. 13,171.4 million).

Secondment of employees

During the year ended March 31, 2008, the Bank received Rs. 302.8 million (March 31, 2007: Rs. 136.3 million) from

subsidiaries and Rs. 1.8 million (March 31, 2007: Rs. Nil) from associates/joint ventures/other related entities for secondment

of employees.

Purchase of investments

During the year ended March 31, 2008, the Bank purchased certain investments from its subsidiaries amounting to

Rs. 7,934.2 million (March 31, 2007: Rs. 14,186.8 million) and from its associates/joint ventures/other related entities

amounting to Rs. Nil (March 31, 2007: Rs. 944.7 million). During the year ended March 31, 2008, the Bank invested in the

equity and preference shares of its subsidiaries amounting to Rs. 43,009.2 million (March 31, 2007: Rs. 13,584.7 million)

and in its associates/joint ventures/other related entities amounting to Rs. 57.5 million (March 31, 2007: Rs. Nil).

Sale of investments

During the year ended March 31, 2008, the Bank sold certain investments to its subsidiaries amounting to Rs. 15,526.7

million (March 31, 2007: Rs. 8,569.2 million).

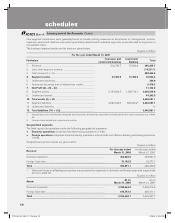

Redemption/buyback and conversion of investments

During the year ended March 31, 2008, the Bank received a consideration of Rs. 1.2 million (March 31, 2007: Rs. 663.9

million) on account of buyback/capital reduction of equity shares by subsidiaries. Units in associates/joint ventures/other

related entities amounting to Rs. 2,762.4 million (March 31, 2007: Rs. 2,795.9 million) were redeemed during the year ended

March 31, 2008.

Reimbursement of expenses

During the year ended March 31, 2008, the Bank reimbursed expenses to its subsidiaries amounting to Rs. 526.8 million

(March 31, 2007: Rs. 2,147.7 million), and to its associates/joint ventures/other related entities amounting to Rs. 0.8 million

(March 31, 2007: Rs. Nil).

Brokerage and fee expenses

During the year ended March 31, 2008, the Bank paid brokerage/fees to its subsidiaries amounting to Rs. 950.7 million

(March 31, 2007: Rs. 795.4 million), and to its associates/joint ventures/other related entities amounting to Rs. 2,354.7

million (March 31, 2007: Rs. Nil).

Custodial charges income

During the year ended March 31, 2008, the Bank charged an aggregate amount of Rs. 16.3 million (March 31, 2007: Rs. 20.4

million) from its subsidiaries and Rs. 6.8 million (March 31, 2007: Rs. 5.7 million) from its associates/joint ventures/other

related entities.

Interest expenses

During the year ended March 31, 2008, the Bank paid interest to its subsidiaries amounting to Rs. 3,311.9 million

(March 31, 2007: Rs. 513.6 million) and to its associates/joint ventures/other related entities amounting to Rs. 28.2 million

(March 31, 2007: Rs. Nil).

Interest income

During the year ended March 31, 2008, the Bank received interest from its subsidiaries amounting to Rs. 1,575.3 million

(March 31, 2007: Rs. 1,366.2 million), from its associates/joint ventures/other related entities amounting to Rs. 21.0 million

(March 31, 2007: Rs. Nil) and from its key management personnel Rs. 0.7 million (March 31, 2007: Rs. 0.7 million).

Other income

During the year ended March 31, 2008, the net gain on derivative transactions entered into with subsidiaries was Rs. 4,398.0

million (March 31, 2007: gain of Rs. 537.3 million).

ICICI_BK_AR_2008_(F1_F46).indd 23ICICI_BK_AR_2008_(F1_F46).indd 23 6/20/08 3:25:03 PM6/20/08 3:25:03 PM