ICICI Bank 2008 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F81

The Group conducts transactions with its customers on a global basis in accordance with their business requirements,

which may span across various geographies.

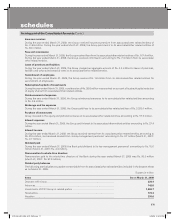

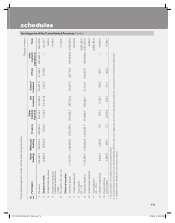

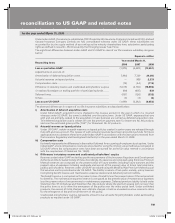

Geographical segment results are given below.

Rupees in million

Revenue1For the year ended

March 31, 2008 For the year ended

March 31, 2007

Domestic operations .......................................................................... 572,499.1 399,509.0

Foreign operations ............................................................................. 28,031.7 14,128.9

Total 600,530.8 413,637.9

1. Gains and losses on offsetting transactions are accounted for separately in domestic and foreign segments

respectively and not netted off.

Rupees in million

Assets As on

March 31, 2008 As on

March 31, 2007

Domestic operations .......................................................................... 4,270,982.8 3,641,022.4

Foreign operations ............................................................................. 525,452.2 302,324.8

Total 4,796,435.0 3,943,347.2

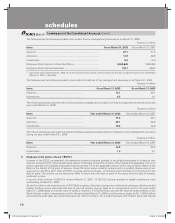

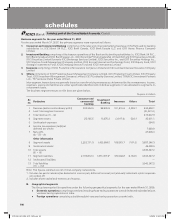

14. Penalties/fines imposed by RBI and other regulatory bodies

There were no penalties imposed by RBI during the year ended March 31, 2008 (March 31, 2007: Rs. Nil).

Securities and Futures Commission (SFC), Hong Kong charged the Bank with carrying on the business of dealing in securities

in Hong Kong without having a license to do so. Pursuant to the charges preferred vide issue of summons on March 30,

2007 and the submissions of SFC and the Bank, the Eastern Magistrate’s Court, Hong Kong, on April 10, 2007 fined the

Bank a sum of HKD 40,000 (Rs. 0.2 million) and required the Bank to reimburse investigation costs to SFC.

The Office of Superintendent of Financial Institutions (OSFI) has imposed penalties on ICICI Bank Canada of CAD 18,250

(Rs. 0.7 million) under its Late and Erroneous Filing Penalty (LEFP) framework in relation to late submission of certain

corporate and financial returns.

Central Bank of the Russian Federation (CBR) inspected the main office of ICICI Bank Eurasia LLC. (IBEL) in Balabanovo,

Kaluga region between October 15 and October 17, 2007. The inspection covered the area of reflecting the correct amount

of liabilities in the books in September 2007.

As a result of the inspection, it was found that the main office in Balabanovo had violated CBR requirements and consequently,

on October 31, 2007, IBEL received a prescription dated October 26, 2007 bearing No. 11-40DSP/5294 from CBR which

specified that as on October 01, 2007, IBEL had understated the amount of foreign exchange liabilities by RUB 288,000

which resulted in underestimation of provisions by RUB 9,000. IBEL was fined RUB 10 (Rs. 15.97) for the above violation

of regulatory requirements.

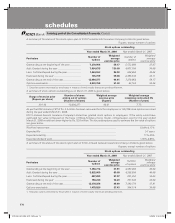

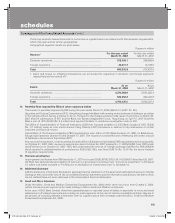

15. Premium amortisation

As per general clarification from RBI dated July 11, 2007 on circular DBOD.BP.BC.87/21.04.141/2006-07 dated April 20, 2007,

the Bank has deducted the amortisation of premium on government securities from “Income on investment” in Schedule

13, which was earlier included in “Profit/(Loss) on revaluation of investments (net)” in Schedule 14.

16. Additional disclosure

Additional statutory information disclosed in separate financial statements of the parent and subsidiaries having no material

bearing on the true and fair view of the consolidated financial statements and the information pertaining to the items which

are not material have not been disclosed in the consolidated financial statements.

17. Small and Micro Industries

Under the Micro, Small and Medium Enterprises Development Act, 2006 which came into force from October 2, 2006,

certain disclosures are required to be made relating to Micro, Small and Medium enterprises.

In the case of ICICI Bank Limited, there have generally been no reported cases of delays in payments to micro and small

enterprises or of interest payments due to delays in such payments. In the case of certain consolidated entities, they are in

the process of compiling relevant information from its suppliers about their coverage under the Micro, Small and Medium

Enterprises Development Act, 2006.

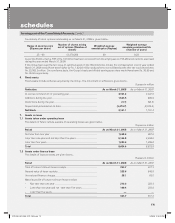

forming part of the Consolidated Accounts (Contd.)

schedules

ICICI_BK_AR_2008_(F47_F92).indd 81ICICI_BK_AR_2008_(F47_F92).indd 81 6/20/08 3:33:06 PM6/20/08 3:33:06 PM