ICICI Bank 2008 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

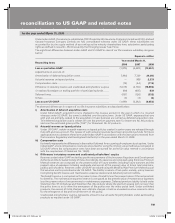

F86

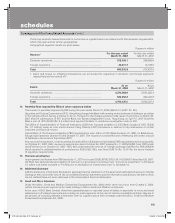

a) Allowance for loan losses

The differences in the allowance for loan losses between Indian GAAP and US GAAP are primarily on account of:

i) Differences in the discount rates and cash flows used for computing allowances created on restructured assets

including allowances on certain loans transferred to an asset reconstruction company not accounted for as sale

under US GAAP. The loss on assets transferred to an asset reconstruction company are included under allowance

for loan losses under US GAAP whereas under Indian GAAP, these are netted off from the security receipts received

as consideration for sale as the transfer of these loans is treated as a sale under Indian GAAP.

ii) Allowance for loan losses created on other impaired loans made in accordance with Statement No. 5

on “Accounting for Contingencies” and Statement No. 114 on “Accounting by Creditors for Impairment of a Loan”

issued by the Financial Accounting Standard Board (‘FASB’) under US GAAP and prescriptive provisioning on

non-performing loans as per Reserve Bank of India (“RBI”) guidelines under Indian GAAP.

iii) Allowance made for credit losses on the performing portfolios based on the estimated probable losses inherent

in the portfolio under US GAAP and prescriptive provisioning norms for standard assets as per RBI norms under

Indian GAAP.

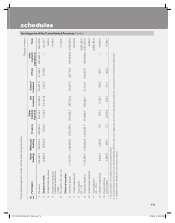

The guidelines on provisioning for loan losses under Indian GAAP are as follows:

Classification Provisioning

Standard loans As per the RBI guidelines issued in September 2005, banks were required to make a

general provision at 0.4% on standard loans (excluding loans to the agricultural sector

and to small and medium enterprises at 0.25%).

In May 2006, the general provisioning requirement for personal loans, loans and advances

qualifying as capital market exposure, residential housing loans beyond Rs. 2.0 million

and commercial real estate was further increased to 1.0% from 0.4%. In January 2007,

the general provisioning requirement for personal loans, credit card receivables, loans

and advances qualifying as capital market exposure, commercial real estate and advances

to non-deposit taking systematically important non-banking financial companies (NBFCs)

was increased to 2%.

Sub-standard assets A loan is classified as sub-standard if interest payments or installments have remained

overdue for more than 90 days. A provision of 10% is required for all sub-standard loans.

An additional provision of 10% is required for accounts that are ab-initio unsecured.

Doubtful assets A loan is classified as a doubtful loan, if it has remained as sub-standard for more than

a year.

A 100% provision/write-off is required in respect of the unsecured portion of the doubtful

loans. Until year-end fiscal 2004, a 20% to 50% provision was required for the secured

portion as follows:

Up to one year: 20% provision;

One to three years: 30% provision; and

More than three years: 50% provision.

Effective quarter ended June 30, 2004 a 100% provision is required for loans classified as

doubtful for more than three years on or after April 1, 2004. In respect of assets classified

as doubtful for more than three years up to March 31, 2004, 60% to 100% provision on

the secured portion is required as follows:

By March 31, 2005: 60% provision;

By March 31, 2006: 75% provision; and

By March 31, 2007: 100% provision.

Loss assets The entire loan is required to be written off or provided for.

Restructured loans A provision equal to the difference between the present value of the future interest as

per the original loan agreement and the present value of the future interest on the basis

of rescheduled terms at the time of restructuring is required to be made.

Under US GAAP, the impaired loans portfolio is classified into restructured loans and other impaired loans. Restructured

loans represent loans whose terms relating to interest and installment payments have been modified and qualify as

troubled debt restructurings as defined in Statement No. 15 on “Accounting by Debtors and Creditors for Troubled

Debt Restructurings”. Other impaired loans represent loans other than restructured loans, which qualify for impairment

as per Statement No. 114.

reconciliation to US GAAP and related notes

for the year ended March 31, 2008

ICICI_BK_AR_2008_(F47_F92).indd 86ICICI_BK_AR_2008_(F47_F92).indd 86 6/20/08 3:33:22 PM6/20/08 3:33:22 PM