ICICI Bank 2008 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F91

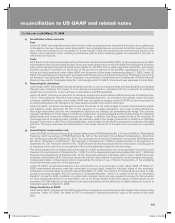

e) Amortisation of fees and costs

Fees

Under US GAAP, loan origination fees (net of certain costs) are amortised over the period of the loans as an adjustment

to the yield on the loan. However under Indian GAAP, loan origination fees are accounted for upfront except for certain

fees, which are received in lieu of sacrifice of future interest, which are amortised over the remaining period of the

facility. Loan origination costs, including commissions paid to direct marketing agents are expensed in the year in

which they are incurred.

Costs

ICICI Bank Limited had implemented an Early Retirement Option Scheme 2003 (‘ERO’) for its employees in July 2003.

All employees who had completed 40 years of age and seven years of service with the Bank (including period of service

with entities amalgamated with the Bank) were eligible for the ERO. The ex-gratia payments under ERO, termination

benefits and leave encashment in the excess of the provision made (net of tax benefits), aggregating to Rs. 1,910.0

million are being amortised under Indian GAAP over the period of five years commencing August 1, 2003. Under US

GAAP, the same has been accounted in accordance with the provisions of Statement No. 87 on “Employers’ Accounting

for Pensions” and Statement No. 88 on “Employers’ Accounting for Settlements and Curtailments of Defined Benefit

Pension Plans and for Termination Benefits”. Accordingly under US GAAP, this amount was expensed in fiscal 2004.

f) Accounting for derivatives

Under Indian GAAP, the interest rate and exchange rate risks on some on-balance sheet assets and liabilities are hedged

through swap contracts. The impact of such derivative instruments is correlated with the movement of underlying

assets and accounted for on accrual basis, in accordance with RBI guidelines.

Under US GAAP, the Group accounts for its derivative transactions in accordance with the provisions of Statement No.

133 on “Accounting for Derivative Instruments and Hedging Activities”, as amended. Accordingly certain derivative

contracts classified as hedges under Indian GAAP may not qualify as hedges under US GAAP and are accounted for

as trading derivatives with changes in fair value being recorded in the income statement.

Under US GAAP, the Group has designated certain derivatives as fair value hedges of certain interest-bearing assets

and liabilities under Statement No.133. At the inception of a hedge transaction, the Group formally documents

the hedge relationship and the risk management objective and strategy for undertaking the hedge. This process

includes identification of the hedging instrument, hedged item, risk being hedged and the methodology for assessing

effectiveness and measuring ineffectiveness of the hedge. In addition, the Group assesses both at the inception of

the hedge and on an ongoing basis, whether the derivative used in the hedging transaction is effective in offsetting

changes in fair value or cash flows of the hedged item, and whether the derivative is expected to continue to be highly

effective. The Group assesses the effectiveness of the hedge instrument at inception and continually on a quarterly

basis.

g) Accounting for compensation cost

Under US GAAP, the Financial Accounting Standards Board issued FASB Statement No. 123 (revised 2004) on “Share-Based

Payment, which is a revision of FASB Statement No. 123 on “Accounting for Stock-Based Compensation”. Statement

No. 123(R) supercedes APB Opinion No. 25 on “Accounting for Stock issued to Employees” and amends FASB Statement

No. 95 on “Statement of Cash flows”. The approach in Statement No. 123(R) is generally similar to the approach in

Statement No. 123. However, Statement No. 123(R) requires all share-based payments to employees, including grants

of employee stock options to be recognised in the income statement based on their fair values.

The Group adopted the modified prospective method in which compensation cost is recognised in the previous year

based on the requirements of Statement No. 123(R), for all the share-based payments granted after April 1, 2006 and

based on the requirements of Statement No. 123 for all awards granted to employees prior to April 1, 2006 that remain

unvested. Under Indian GAAP, the Group follows the intrinsic value method to account for its stock-based employees’

compensation plans. Compensation cost is measured by the excess, if any, of the fair market price, of the underlying

stock over the exercise price on the grant date.

Under US GAAP, compensated absences are accounted for on an accrual basis. Under Indian GAAP, till March 31,

2006 compensated absences were also accounted on accrual basis, based on the basic salary of the employee,

computed on actuarial basis. During the year ended March 31, 2007, the Institute of Chartered Accountants of India

issued Accounting Standard (‘AS’) 15 (revised) on “Employee Benefits”, which is a revision of AS-15, on “Employee

Benefits”. As per AS-15(R), in addition to certain other changes, the Group was required to account for the provision

for leave encashment based on an employees’ cost to the Group instead of the basic salary, at which leaves can be

encashed. AS-15(R) allowed an adjustment to the opening reserves for the difference in liability arising on account of

retirement benefit at March 31, 2006.

Fringe benefit tax on ESOS

Under Indian GAAP, fringe benefit tax (FBT) recovered from employees is recorded as an offset against the corresponding

expenses. Under US GAAP, the effect of FBT is considered in determining the fair value of the award on the grant

date.

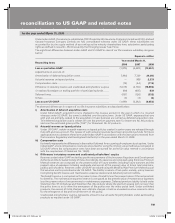

reconciliation to US GAAP and related notes

for the year ended March 31, 2008

ICICI_BK_AR_2008_(F47_F92).indd 91ICICI_BK_AR_2008_(F47_F92).indd 91 6/20/08 3:33:38 PM6/20/08 3:33:38 PM