ICICI Bank 2008 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F112

The ALCO is authorised to take views on the interest rates subject to the limits approved by the Board.

The Investment Policy of the Bank stipulates the risk framework for the investment book. Currently, most

of the lending from the international branches and subsidiaries is on a floating basis, benchmarked to

USD LIBOR. The liabilities are either on a floating basis or are swapped from fixed to floating. However,

any fixed rate borrowing or lending is also within the parameters described above.

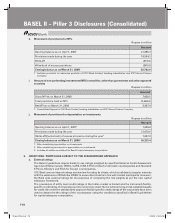

b. Level of interest rate risk

The following table sets forth, using the balance sheet as at March 31, 2008 as the base, one possible

prediction of the impact of changes in interest rates on net interest income as on March 31, 2008,

assuming a parallel shift in the yield is as follows:

Currency

Change in interest rates (in basis points)

(100) (50) 50 100

Impact on NII (Rupees in million)

INR (1,075.9) (538.0) 538.0 1,075.9

USD (75.1) (37.5) 37.5 75.1

JPY 13.4 6.7 (6.7) (13.4)

GBP (91.9) (45.9) 45.9 91.9

EURO (69.1) (34.5) 34.5 69.1

CHF (32.3) (16.3) 16.3 32.3

Others (124.4) (62.2) 62.2 124.4

Total1(1,455.3) (727.7) 727.7 1,455.3

1. Consolidated figures for ICICI Bank Limited, ICICI Bank UK PLC, ICICI Bank Canada, ICICI Bank Eurasia LLC, ICICI Home

Finance Company and ICICI Securities and its subsidiaries.

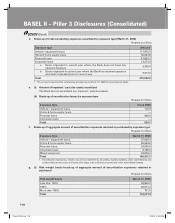

As on March 31, 2008, impact on economic value of equity is as follows:

Currency

Change in interest rates (in basis points)

(100) (50) 50 100

Impact on Economic Value1,2 (Rupees in million)

INR 16,761.1 8,380.6 (8,380.6) (16,761.1)

USD 480.7 240.4 (240.4) (480.7)

JPY 203.9 101.9 (101.9) (203.9)

GBP (68.9) (34.5) 34.5 68.9

EURO (294.5) (147.3) 147.3 294.5

CHF 46.0 23.0 (23.0) (46.0)

Others (136.3) (68.1) 68.1 136.3

Total316,992.0 8,496.0 (8,496.0) (16,992.0)

1. The economic value has been computed assuming parallel shifts in the yield curves across all currencies.

2. Annual coupon and yield of 7% across all time buckets has been assumed for the purpose of calculating modified

duration.

3. Consolidated figures for ICICI Bank Limited, ICICI Bank UK PLC, ICICI Bank Canada, ICICI Bank Eurasia LLC, ICICI Home

Finance Company and ICICI Securities and its subsidiaries.

BASEL II – Pillar 3 Disclosures (Consolidated)

1P-less_(Pillar).indd 1121P-less_(Pillar).indd 112 6/20/08 4:53:27 PM6/20/08 4:53:27 PM