ICICI Bank 2008 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2008 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F102

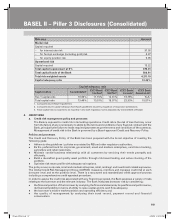

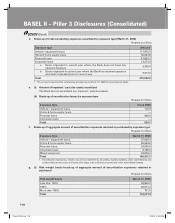

h. Movement of provisions for NPL

Rupees in million

Amount

Opening balance as on April 1, 2007 21,085.3

Provisions made during the year 19,594.2

Write-off (372.5)

Write-back of excess provisions (545.0)

Closing balance as on March 31, 2008139,762.0

1. Includes provision on advances portfolio of ICICI Bank Limited, banking subsidiaries and ICICI Home Finance

Company.

i. Amount of non-performing investments (NPI) in securities, other than government and other approved

securities

Rupees in million

Amount1

Gross NPI as on March 31, 2008 7,058.5

Total provisions held on NPI (3,660.6)

Net NPI as on March 31, 2008 3,397.9

1. Consolidated figures for ICICI Bank Limited, banking subsidiaries and ICICI Home Finance Company.

j. Movement of provisions for depreciation on investments

Rupees in million

Amount

Opening balance as on April 1, 200711,625.8

Provisions made during the year 12,678.6

(Write-off)/(write back) of excess provisions during the year21,927.0

Closing balance as on March 31, 2008316,231.4

1. After considering appreciation on investments.

2. After considering movement in appreciation on investments.

3. Includes all entities considered for Basel II capital adequacy computation.

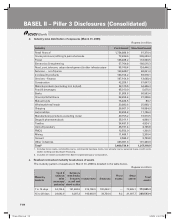

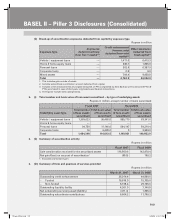

5. CREDIT RISK: PORTFOLIOS SUBJECT TO THE STANDARDISED APPROACH

a. External ratings

The Basel II guidelines require banks to use ratings assigned by specified External Credit Assessment

Agencies (ECAIs) namely CRISIL, CARE, ICRA & Fitch (India) for domestic counterparties and Standard

& Poors, Moody’s and Fitch for foreign counterparties.

ICICI Bank uses an internal ratings mechanism for rating its clients, which is validated at regular intervals

with the assistance of ECAIs like CRISIL to ensure the model is in line with market participants. However,

the Bank uses external ratings for the purposes of computing the risk weights as per the new capital

adequacy framework.

The prevalence of entity level credit ratings in the Indian market is limited and the instrument/facility-

specific credit rating of corporates is more commonly used. Hence while arriving at risk-weighted assets

for credit risk under the standardized approach facility-specific credit ratings of the corporates have been

used to determine the ratings of the counterparty using the conditions specified in Basel II guidelines

for capital adequacy computation.

BASEL II – Pillar 3 Disclosures (Consolidated)

1P-less_(Pillar).indd 1021P-less_(Pillar).indd 102 6/20/08 4:52:53 PM6/20/08 4:52:53 PM